Mega-cap growth stocks continue to dominate the broader market and contribute the bulk of gains in major indexes like the S&P 500 and Nasdaq Composite. But the sheer value of some of the largest companies might surprise you.

The “Magnificent Seven” is a term coined to describe seven industry-leading tech-focused companies that make up a whopping 35.5% of the S&P 500. These companies include Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla.

Image source: Getty Images.

The Duality of Influence

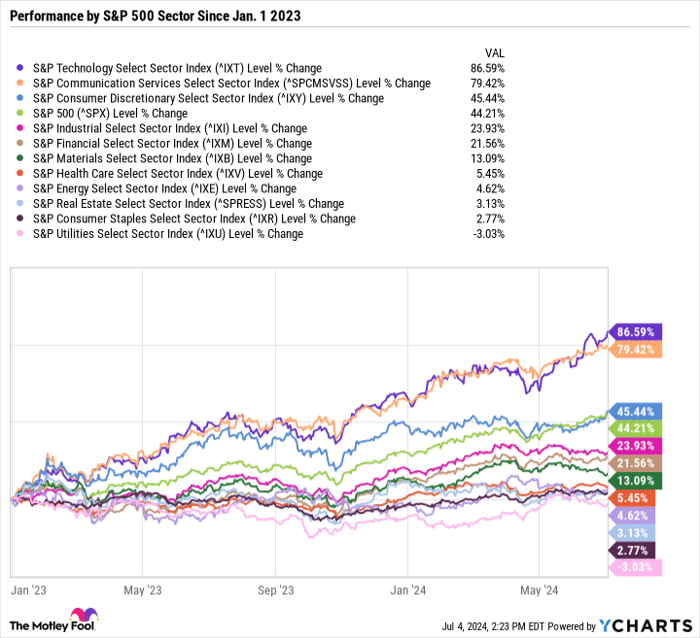

The S&P 500 has surged over 44% since the end of 2022, primarily driven by the outperformance of sectors encompassing the Magnificent Seven, while other sectors lag behind.

These mega-cap stocks wield such power that a significant downturn in them could cascade into a market correction. Their staggering influence isn’t just about their presence in the S&P 500; it extends to driving substantial gains and potentially volatile sell-offs.

Navigating High Expectations

Understanding the S&P 500’s evolving composition is crucial for investors, given its proclivity for transformations based on economic shifts and investor sentiment. With the index at a lofty price-to-earnings ratio of nearly 29, concerns about an overheated market persist.

Despite the daunting metrics, history shows that investing in high markets, even at pinnacle levels, has been rewarding. The premise of high valuations rests on future earnings growth, a paradigm shift from a bygone era where past earnings dictated market worth.

The investment landscape now hinges more on a company’s future trajectory than its present status. Mega-cap growth stocks, while seemingly overpriced, have delivered on earnings growth, further justifying their premium valuation. If these growth expectations falter, a notable market correction could ensue.

Crafting Your Ideal Portfolio

Given the rich valuations of the S&P 500 and its meager 1.3% dividend yield, investors gravitating towards value and income strategies may find solace in integrating quality dividend stocks and ETFs into their portfolio.

Companies like Coca-Cola and PepsiCo present as compelling options with discounts to the S&P 500, robust dividend histories, and attractive yields exceeding 3%.

The SPDR Dow Jones Industrial Average ETF mirrors the index’s performance and provides a balanced approach for investors eyeing stability and income.

The Hidden Gem of Value in Blue Chip Stocks

Riding the Wave of Blue Chip Stocks

For investors seeking the stability of blue-chip stocks with a keen eye for value, there is a treasure trove of opportunities waiting to be unearthed. By delving into the realm of low-cost Vanguard Exchange-Traded Funds (ETFs), a lifetime stream of passive income can be secured.

Key examples of these value-laden Vanguard ETFs include the Vanguard High Dividend Yield ETF (NYSEMKT: VYM), Vanguard Consumer Staples ETF (NYSEMKT: VDC), and the Vanguard Utilities ETF (NYSEMKT: VPU). Targeting lower-growth, higher-yield sectors can act as a counterbalance in a portfolio heavily tilted towards high-flying growth stocks.

Navigating the Shifting Tides

Initial impressions might paint a picture of an overvalued market, given the inflated P/E ratio metrics of the S&P 500. However, this inflation is largely attributed to the dominating presence of surging mega-cap growth stocks within the index.

Despite this facade, numerous niches within the market are brimming with high-quality value and income stocks waiting to be discovered. It is an opportune moment for investors to recalibrate their portfolios by conducting a thorough review and revamping their watch lists. This ensures that passive-income objectives can be met while aligning investments with individual risk tolerances.

Seizing the Second Shot at Prosperity

Have you ever felt like you missed the boat when it came to investing in the next big success stories? If so, then this could be your moment to shine.

In rare instances, our team of experts unveils a “Double Down” stock recommendation for companies poised for significant growth. If you fear that the opportunity has passed you by, now is the prime opportunity to seize the moment before it slips away. The track record speaks for itself:

- Amazon: An investment of $1,000 back in 2010 on our recommendation would have turned into $22,525!

- Apple: A $1,000 investment in 2008 based on our guidance would be worth $42,768 today!

- Netflix: If you had invested $1,000 following our 2004 recommendation, you would be sitting on $372,462!

Presently, “Double Down” alerts are being issued for three exceptional companies with immense potential, marking a unique opportunity that may not knock on your door again soon.