The Federal Reserve’s Inflation Gauge & IBM’s Transformation

The latest core personal consumption expenditures (PCE) price index report revealed softer-than-expected numbers, with the annual rate coming in at 2.9% and the month-to-month increase at 0.2%, strengthening the case for a soft landing facilitated by the Fed. However, consumer savings rates are declining, a critical indicator for a favorable market climate. Nonetheless, the path to 2% inflation remains feasible.

IBM’s AI-Driven Surge

IBM’s recent 13% surge after surpassing earnings expectations underscores the company’s profound transformation driven by Artificial Intelligence. It has been redirecting its focus towards AI software and made substantial acquisitions to solidify its position in the AI market. Eric Fry’s keen insight into IBM’s transition resulted in tremendous gains for his Speculator subscribers, with IBM trades yielding returns of 300% and 450% within a year.

The AI Investment Wave

The surge in AI demand in 2023 marked the initial rush of corporate early adopters embracing transformative AI technology. This sets the stage for an imminent deluge of investment opportunities, promising significant returns in the AI sector. The live event hosted by Eric on Tuesday spotlighted the semiconductor sector as a prime hunting ground for AI winners.

The Crucial Pivotal “AI Wars of 2024”

The escalating U.S.-China technological supremacy struggle, aptly termed the “AI Wars of 2024,” heralds a new era of international technological competition. At its core is the quest for advanced AI capabilities to secure global leadership. Semiconductors play a pivotal role in this rivalry, as they are the bedrock of AI-powered devices and technologies.

The Upcoming Game-Changer: CHIPS Act

Under the CHIPS And Science Act Of 2022, the construction of microprocessor manufacturing facilities in the United States will be actively encouraged through federal aid. The act aims to reduce the nation’s reliance on overseas chip supply chains and boost domestic science and technology research. With $53 billion allocated for local chip manufacturing, investors are urged to swiftly identify the right stocks before the February 1st deadline, as per Eric’s recent presentation.

Eric’s Strategic Move with Intel

Eric, in a bold strategic move, has recommended Intel as a live trade in his Speculator portfolio, leveraging the CHIPS Act’s potential benefits. Despite impressive triple-digit gains, a new Intel trade was recommended, citing the colossal opportunity presented by the CHIPS Act. Eric envisions substantial growth in profits over the upcoming year.

The Significance of Intel’s Renaissance & Potential Semiconductor Gains

The Case for Doubling Down on Intel

Given the current downtrend, it’s time to double down on Intel. The rationale is simple – Intel’s trade is gaining momentum throughout 2024 and into 2025, presenting an opportunity for readers to benefit from its renaissance. Additionally, the stock might see a potential spike with major funding from the CHIPS Act.

Intel’s Current Status and Prospects

Intel’s recent 11% dip due to Q1 guidance disappointment is an advantageous entry point. Despite the pullback, the company is restructuring itself into a next-gen chip powerhouse. Therefore, the current dip offers a discounted entry price for longer-term investors.

The AI Boom and Semiconductor Companies

While Eric’s semiconductor recommendations diversify AI plays, focusing on Intel and other semiconductor companies showcases the vast potential for investment gains in the sector.

Contextualizing the Future with the Past

Reflecting on the tech industry’s expansion over the last decade, it’s evident that semiconductor chips are the backbone of technological advancements. Considering the emerging AI adoption curve, the demand for semiconductor chips is expected to substantially grow over the next decade.

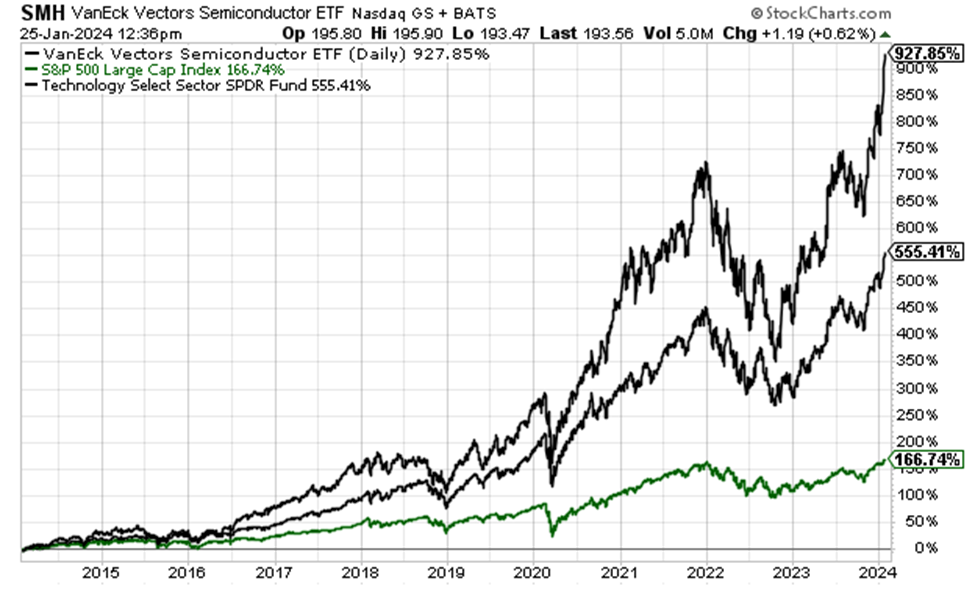

Examining the performance of semiconductor stocks over the past decade, it becomes apparent that the sector has outperformed the S&P and the SPDR Technology Select Sector ETF XLK, signaling significant potential for growth.

Superior Semiconductor Returns

Over the last 10 years, the VanEck Vectors Semiconductor ETF SMH surged by 928%, eclipsing XLK’s performance by almost double. This substantial growth underlines the potential of semiconductor stocks.

Source: StockCharts.com

Enter the Semiconductor Stocks

Considering the exponential growth in demand for semiconductor chips in the next decade, long-term investors should capitalize on top-tier semiconductor stocks. It’s clear from history and the introduction of AI that these stocks are poised for dramatic growth.

The AI Wars have just begun, promising substantial wealth creation. Despite potential volatility, history and the rise of AI indicate a compelling future for semiconductor stocks.

Today’s insight is a mere scratch on the surface of the AI Wars. Nonetheless, ignoring this opportunity is unwise. Have a good evening.