Bitcoin has experienced a tumultuous journey since its inception over a decade ago, garnering a fervent following and reaching unprecedented heights. In 2024, the cryptocurrency giant is once again on the cusp of surpassing its record high, captivating investors and enthusiasts alike.

The Genesis of Bitcoin

Birthed in response to the 2008 financial crisis, Bitcoin has weathered extreme fluctuations, soaring to a peak of US$19,650 in 2017 before languishing beneath the US$10,000 mark for years. Introduced in an enigmatic white paper in late 2008 by the pseudonymous Satoshi Nakamoto, Bitcoin aimed to disrupt the existing monetary paradigm by offering a transparent, censorship-resistant peer-to-peer payment system.

The aftermath of the 2008 economic collapse, considered the most severe crisis since the Great Depression, ignited a global financial downturn, wiping out USD 7.4 trillion in the US stock market and causing a staggering USD 2 trillion contraction in the global economy.

Bitcoin’s Finite Supply and Mining Mechanism

Unlike traditional currencies that can be inflated ad infinitum, Bitcoin has a fixed supply of 21 million coins, of which approximately 19.1 million are in circulation, with less than 2 million yet to be mined. This scarcity is a fundamental feature of Bitcoin’s design, intended to combat inflation.

Miners generate new Bitcoins by validating transactions on the blockchain, with around 900 new coins entering circulation daily. Bitcoin’s protocol mandates halving events every four years, with the latest occurring in May 2020 and the forthcoming one slated for April 2024. Halvings not only curb inflation but also bolster Bitcoin’s value by stimulating demand-supply dynamics.

Bitcoin’s Rollercoaster Ride Amidst COVID-19 Challenges

Bitcoin embarked on a steady price surge from 2016, culminating in an all-time high of US$68,649.05 in November 2021, before retracing slightly to close the year at US$47,897.16. The cryptocurrency faced intense volatility, enduring a rollercoaster journey of highs and lows.

The onset of the COVID-19 pandemic in 2020 tested Bitcoin’s resilience, prompting a 30 percent drop in March before staging a remarkable recovery by year-end. Throughout the year, Bitcoin emerged as a digital safe-haven asset, appealing particularly to Millennials and Generation Z investors.

The Road to Recovery and Price Catalysts

The cryptocurrency market witnessed a resurgence in 2021, driven by a surge in risk appetite among investors and notable corporate adoptions, such as Tesla’s landmark US$1.5 billion Bitcoin purchase. Tesla’s announcement of accepting Bitcoin as payment for its electric vehicles further fueled Bitcoin’s meteoric rise.

Despite enduring skepticism and bouts of volatility, Bitcoin’s resilience in the face of economic uncertainties has solidified its position as a critical player in the global financial landscape.

Insightful Analysis on Bitcoin’s Market Performance

The Ever-Changing Landscape of Bitcoin and Cryptocurrencies

Controversies and debates have long surrounded the world of Bitcoin. At one moment, the electric car maker announced a due diligence process on the renewable energy used in the cryptocurrency mining industry. Yet, in a swift about-face reminiscent of a rollercoaster ride, the same fuel for speculation now appears to be back on the table per Musk’s nod in September 2023. The whirlwind epitomizes the fluid nature of the crypto realm, akin to taming a wild stallion in a raging storm.

The Meteoric Rise and Fall of NFTs

Like a phoenix rising from the ashes, Bitcoin rode on the coattails of the tumultuous pandemic era, soaring to new heights fueled by investors diversifying their portfolios. The success story of the pioneering cryptocurrency in 2020 and 2021 became the catalyst for the meteoric rise of non-fungible tokens (NFTs), a digital phenomenon taking the art world by storm.

Despite a subsequent dip in the NFT market valuation, akin to the ebb and flow of ocean tides, the space has recently blossomed once more to a staggering US$58.71 billion, proving the resilience and adaptability of the digital assets market.

The Whirlwind Journey of Bitcoin’s Price Volatility

The journey of Bitcoin’s price reads like a Shakespearean tragedy, filled with dramatic twists and turns. The crypto coin’s undulating volatility, a double-edged sword of fortune and misfortune, plunged below US$20,000 in 2022, akin to a skydiver free-falling without a parachute. Yet, against all odds, Bitcoin staged a grand comeback, showcasing its unwavering persistence and potential for a powerful resurgence.

The year 2023 marked the price resurgence for Bitcoin, with milestones such as breaching US$30,000 amid legal battles and regulatory challenges, painting a picture of resilience and fortitude in the face of adversity.

The Ongoing Evolution of Bitcoin’s Market Performance

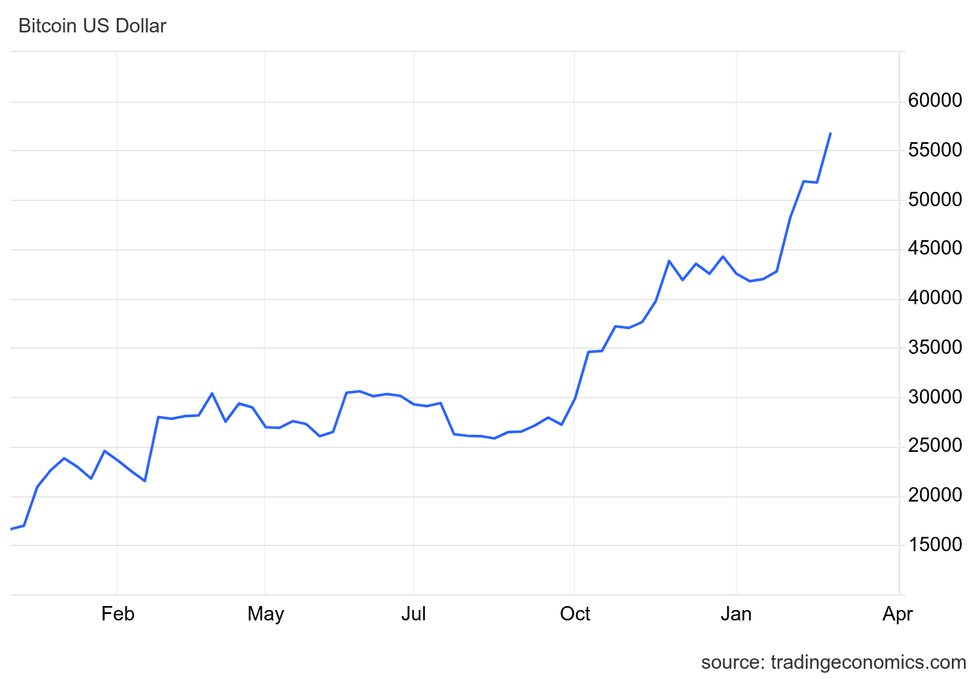

Chart via TradingEconomics.com.

Entering the climax of the year, Bitcoin’s price enjoyed a resurgence, buoyed by increased institutional interest and prospects of regulatory approvals. This surge in investment heralded a new chapter for cryptocurrencies amid an evolving financial landscape, paving the way for a brighter future for digital assets.

The approval of spot Bitcoin ETFs served as a seismic shift, propelling Bitcoin’s value to new heights and sparking renewed interest in the digital currency space, setting the stage for an exhilarating journey ahead.

A Glimpse into the Intricacies of Cryptocurrency Investment

FAQs for investing in Bitcoin

Unraveling the Mysteries of Blockchain Technology

At the heart of the crypto universe lies the blockchain, a decentralized ledger symbolizing both transparency and security in digital transactions. This revolutionary technology is reshaping industries, from finance to healthcare, offering a glimpse into a future governed by innovation and trust.

The Art of Acquiring Bitcoin

The journey to Bitcoin ownership is akin to embarking on a treasure hunt; traversing exchange platforms and crypto apps is like navigating uncharted waters in search of digital riches. With names like Coinbase Global and Binance leading the charge, acquiring Bitcoin has become a modern-day adventure in the world of cryptocurrencies.

The Cryptocurrency Craze: Bitcoin and the Banking Industry

Cryptocurrencies have disrupted the traditional banking landscape, enticing a younger demographic seeking alternatives to conventional financial systems. The allure of digital assets lies in their decentralized nature, offering privacy and independence from central authorities. Moreover, crypto transactions boast swiftness and lower fees compared to traditional banking routes.

Banks are taking notice of the rising popularity of cryptocurrencies as assets like Bitcoin gain mainstream acceptance. Numerous financial institutions have begun investing in cryptocurrencies and blockchain enterprises, signaling a shift in the financial landscape.

Bitcoin’s Resilience Amidst Banking Crisis

The recent banking crisis in the US sparked an influx of worried investors turning to Bitcoin as a safe haven asset. Escalating with the failures of Silicon Valley Bank and Signature Bank, fears mounted as the industry grappled with uncertainty. UBS’s acquisition of Credit Suisse further exacerbated concerns within the banking sector.

While the banking crisis appears to have faded from the economic limelight, its lingering effects persist, especially in the regional banking realm. Bitcoin, emerging in the aftermath of the 2008 financial meltdown, has historically responded to narrative shifts and sentiment fluctuations. The cryptocurrency’s trajectory remains unpredictable amidst regulatory changes and its characteristic volatility.

The Genesis of Bitcoin: A Journey from Penny Stocks

The earliest Bitcoin transaction on record, excluding those involving the founder, took place in late 2009 when 5,050 Bitcoins exchanged hands for a meager US$5.02 via PayPal. This pegged the value of one Bitcoin at approximately US$0.001, a mere fraction of a cent.

Bitcoin: Investment Frenzy or Risky Business?

Bitcoin’s resurgence in value in 2024 has reignited interest in the cryptocurrency, known for its inherent volatility. While lucrative opportunities have historically abounded in the crypto space, substantial risks accompany potential gains. Prudent investors may seek safer ventures amidst Bitcoin’s fluctuating landscape.

Cathie Wood’s Bold Prognostication for Bitcoin

Renowned investor Cathie Wood of ARK Invest remains steadfast in her advocacy for Bitcoin, envisioning a bullish future for the digital coin. Wood’s projections place Bitcoin’s base-case price target at US$600,000 by 2030, with an optimistic scenario exceeding US$1 million.

Bitcoin Holdings: Unveiling Satoshi Nakamoto and Elon Musk

The enigmatic Satoshi Nakamoto, Bitcoin’s elusive creator, purportedly commands the largest share of the cryptocurrency, with analyses hinting at a substantial ownership stake in the near 19.5 million Bitcoins in existence.

Tesla and Twitter magnate Elon Musk’s association with Bitcoin and Dogecoin has been well-documented, influencing the trajectories of both cryptocurrencies through his social media presence and corporate decisions. While Musk’s personal investments in Bitcoin, Dogecoin, and Ether remain undisclosed, his involvement in funding Dogecoin in the shadows has elicited curiosity, mirroring the intricate web of crypto investments.

Warren Buffett’s Bitcoin Aversion

Contrary to tech titans like Musk, legendary investor Warren Buffett remains steadfast in his skepticism towards cryptocurrencies. Buffett’s vocal disapproval of Bitcoin as a speculative token devoid of intrinsic value reflects his conservative investment philosophy, diverging sharply from the crypto enthusiasts’ fervor.

This comprehensive analysis sheds light on Bitcoin’s evolution amidst the financial tumult, emphasizing the contrasting views of prominent figures in the finance sector.

Disclaimer: This article offers insights into the cryptocurrency landscape and does not constitute financial advice.