In the midst of market uncertainties, a glance at ride-sharing giants, Lyft and Uber Technologies, might offer investors a compelling buy-the-dip opportunity. Both companies have witnessed a remarkable surge in their stock prices, with a commendable +20% growth in 2024.

Image Source: Zacks Investment Research

Growth Trajectories

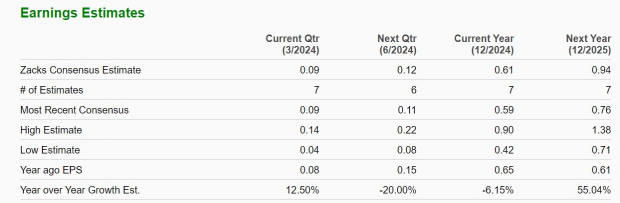

Focusing on its core ride-hailing business in the U.S. and Canada, Lyft is projected to witness a 16% increase in total sales in fiscal 2024, followed by an additional 13% enhancement in FY25, reaching $5.81 billion. Although annual earnings are forecasted to dip to $0.61 per share in FY24, a rebound to $0.94 per share is anticipated in FY25, marking a robust 55% growth.

Image Source: Zacks Investment Research

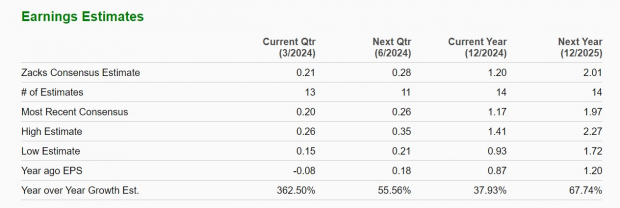

On the other hand, Uber has been expanding its services internationally, including in Canada, Europe, Latin America, and the Middle East. With sales expected to rise by 16% in FY24 and further by 16% in FY25 to $50.49 billion, Uber’s EPS is projected to surge by 38% to $1.20 per share in FY24 from $0.87 per share in 2023. Looking ahead, annual earnings are forecasted to skyrocket by 68% next year, amounting to $2.01 per share.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

While the tremendous stock performance of Lyft and Uber can be attributed to their remarkable growth and path to profitability, the real indicator of potential upside lies in positive earnings estimate revisions. In this regard, Uber shines brightly.

Image Source: Zacks Investment Research

In contrast, estimates for Lyft’s EPS in FY24 and FY25 have seen declines of -3% and -11% in the past 60 days, respectively.

Image Source: Zacks Investment Research

Bottom Line

With their promising growth trajectories, Lyft and Uber’s stocks emerge as enticing options for a buy-the-dip strategy. However, Uber’s stock bears a Zacks Rank #1 (Strong Buy), indicating potential for further upside, fueled by the upward trend in earnings estimates. In contrast, Lyft shares currently hold a Zacks Rank #3 (Hold).

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”