The Wall Street Tug of War: Deciphering Newmont’s Stock Outlook

Investors frequently ponder over buying, selling, or holding a stock, often swayed by the recommendations of financial analysts. These seasoned Wall Street analysts influence market sentiment with their rating adjustments. But just how pivotal are these brokerage recommendations in the grand scheme of things?

Before diving into the reliability of brokerage advices and strategies for leveraging them, let’s peek into the sentiments of Wall Street maestros concerning Newmont Corporation (NEM).

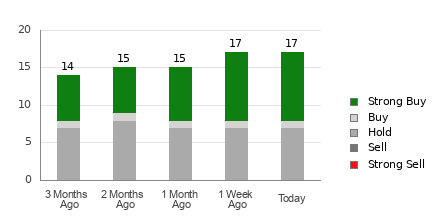

Newmont currently boasts an impressive Average Brokerage Recommendation (ABR) of 1.88, falling within the 1 to 5 scale (ranging from Strong Buy to Strong Sell). The ABR, sourced from endorsements (Buy, Hold, Sell, etc.) by 17 brokerage firms, suggests a stance between Strong Buy and Buy in the investment realm.

Among these 17 reviews sculpting the current ABR, the lion’s share comprises nine Strong Buy recommendations and a single Buy tip. Together, Strong Buy and Buy ratings command a solid 58.8% of the total recommendations.

Shifting Winds of Brokerage Recommendations for NEM

Delve into the price target & stock forecast for Newmont here>>>

While the ABR nudges towards acquiring Newmont shares, prudent investors know the limits of solely relying on this metric. Various studies unveil the modest success of brokerage recommendations in steering investors toward stocks with the highest price escalation potential.

Curious about the why behind this scenario? The lucrative interests of brokerage firms in stocks they track often sway their analysts to paint a rosier picture. Our investigations unravel that for every “Strong Sell,” brokerage houses generously sprinkle five “Strong Buy” recommendations.

Consequently, their motivations don’t consistently match those of the average investor, seldom providing a clear roadmap of a stock’s future trajectory. Thus, this data is best utilized for either validating individual research or as a complementary compass that has demonstrated prowess in prognosticating stock price movements.

Zacks Rank, our unique stock evaluation tool with a robust externally validated history, slots equities into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a reliable barometer for a stock’s forthcoming price performance. Hence, cross-referencing the ABR with the Zacks Rank may yield a fruitful investment choice.

Beware: Zacks Rank Is a Distinct Metric from ABR

Though both ABR and Zacks Rank are confined to a numerical domain of 1-5, they are distinct measurements.

ABR hinges solely on brokerage counsel and is typically denoted with decimals (such as 1.28). In contrast, Zacks Rank stands as a quantitative model enabling investors to leverage earnings estimate revisions. It is tableaued in whole figures from 1 to 5.

Historically, analysts on brokerage payrolls have veered towards inherent optimism in their veredicts. With ratings skewed favorably relative to their actual research, attributable to their employers’ interests, they often lead astray rather than steer accurately.

Conversely, Zacks Rank takes root in earnings estimate revisions. Recent stock price shifts closely track movements in earnings estimate trends, bolstered by empirical data.

Moreover, the varied Zacks Rank gradations find application across all stocks furnished with current-year earnings estimates by brokerage analysts. This mechanism ensures an equitable distribution among the quintet ranks at all times.

A glaring dichotomy surfaces between ABR and Zacks Rank concerning real-time relevance. While the ABR might lag in currency, the swift reprisals of brokerage analysts to business dynamics via earnings estimate updates promptly reflect in the Zacks Rank, consistently offering timely insights into future stock prices.

Is Newmont’s Future Valiant?

Newmont’s earnings estimate revisions paint a promising picture, with the Zacks Consensus Estimate for the current year witnessing an 8.1% upsurge in the past month, climbing to $2.64.

The upbeat outlook among analysts, mirrored by a unanimous zeal in lifting EPS estimates skyward, could herald a bullish phase for the stock in the near term.

Bolstered by the notable leap in the consensus estimate alongside other decisive factors tied to earnings projections, Newmont clinches a Zacks Rank #2 (Buy). Unearth the full array of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, the Buy-swayed ABR for Newmont may stand tall as a guiding light for investors.

Unveiling Zacks’ “Best Double Your Money Bet”

Among a myriad of stocks, five Zacks gurus have each selected a gem expected to double or more in a span of months. From this elite quintet, Director of Research Sheraz Mian singles out one poised for the most explosive upsurge.

An under-the-radar chemistry enterprise, climbing 65% in the past year while sporting an enticing valuation, stands as the prime candidate. Fueled by unceasing demand, robust 2022 earnings forecasts, and a $1.5 billion stock buyback program, retail investors could plunge in at any juncture.

This contender could rival or surpass the trajectories of past Zacks’ Stunners that sky-rocketed; such as Boston Beer Company leaping +143.0% within a mere 9 months and NVIDIA’s stellar +175.9% surge in a year.

Free: Discover Our Premier Pick and 4 Runners Up >>

Free Stock Analysis Report for Newmont Corporation (NEM)

Access the full article on Zacks.com here.