UPS Disappoints in Q2

The bellwether United Parcel Service (UPS) sent shockwaves through the transportation sector on July 23 with underwhelming results. While the company marked a return to volume growth in the U.S. after nine consecutive quarters, its inability to execute on cost-cutting measures and volume expansion efforts posed a significant challenge. Despite this, UPS reported earnings per share of $1.79, missing the Zacks Consensus Estimate and reflecting a 29.5% decline from the previous year. Revenues also fell short, dropping 1% year over year to $21.8 billion.

The lackluster performance can be attributed to higher labor costs amidst weak demand following the e-commerce boom triggered by the pandemic, pushing UPS to adjust its revenue guidance for the year to $93 billion.

Market Response

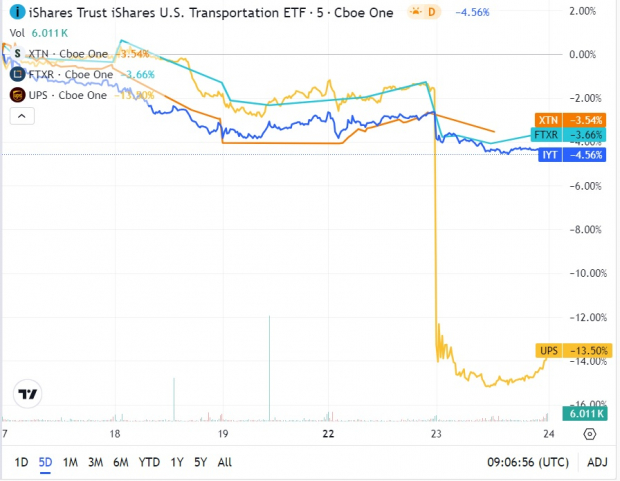

Following its disappointing earnings report, UPS experienced its steepest decline in 25 years, plummeting by 12%. This downward spiral had a ripple effect in the exchange-traded fund (ETF) arena, with notable funds such as iShares U.S. Transportation ETF, First Trust Nasdaq Transportation ETF, and SPDR S&P Transportation ETF shedding between 0.9% and 2.6% on the aforementioned day.

Image Source: Zacks Investment Research

Looking Ahead

Despite the gloomy outlook and recent setbacks, investors should exercise caution before completely shunning transportation ETFs. These funds offer diversified exposure to various industries such as railroads, airlines, and trucking, which can help offset the impact of major component underperformance.

For instance, iShares U.S. Transportation ETF allocates about 27.2% to railroads and nearly 21.5% to airfreight and logistics, while First Trust Nasdaq Transportation ETF leans more towards automobiles and delivery services. On the other hand, SPDR S&P Transportation ETF has significant exposure to cargo ground transportation and passenger airlines.

Despite UPS’s significant weightage in these ETFs, they each hold promise. With a Zacks ETF Rank #2 (Buy) for all three, there is potential for them to outperform the broader market in the near term. However, the transport sector is anticipated to witness an earnings decline of 12.6%, as per the Zacks Earnings Trend report, which may impact these ETFs negatively.

Want key ETF info delivered straight to your inbox? Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.