The financial markets were adorned with a somber tone following the recent earnings reports from two of the illustrious ‘The Magnificent 7’ stocks – Google’s parent company Alphabet (GOOGL) and electric vehicle giant Tesla (TSLA).

Many eyebrows were raised at the market’s tepid response to these financial unveilings, particularly scrutinizing Alphabet’s performance. Some whisper that these reactions might hint at what is forthcoming this week from the remaining four members of the esteemed league – Microsoft (MSFT), scheduled for its sensational debut on Tuesday, July 30th, after the day’s final bell (AMC); Meta Platforms (META) in the spotlight on Wednesday AMC, July 31st; while Amazon (AMZN) and Apple (AAPL) are gearing up for their grand acts on Thursday AMC, August 1st.

The Tesla earnings were like a summer storm, dark and unsettling. In stark contrast, Alphabet’s financial snapshots sparkled with positive light. While Tesla struggled to meet consensus forecasts due to continued margin pressures, Alphabet triumphed by surpassing estimates and showcasing a barrage of positives in its results, notably in search and cloud domains.

But alas, investors fixated on the larger-than-life capital expenditure figure, stirring fears about the ceaselessly rising AI-focused capex without a tangible ROI timeframe. Alphabet’s management stance on this capital expenditure conundrum, highlighting that underinvesting poses a more substantial risk than ramping up, only fueled market anxieties. A substantial leap in search growth attributed to the company’s AI investments could have assuaged these concerns, but the reality was harsher than expected.

As the earnings spotlight shifts to this week’s Meta and Microsoft narratives, all eyes will be trained on the looming capex concerns. Amazon, the cloud space monarch through its Amazon Web Services empire, is under scrutiny for decelerating growth trends in contrast to Microsoft and Alphabet’s escalating trajectories.

Apple’s recent AI ventures have raised a few eyebrows, yet skepticism lingers in the market regarding their success. Closer home, the burning questions surrounding Apple in the near future revolve around evolving iPhone trends in the enigmatic land of China.

Revisiting the tale of Alphabet and Tesla’s financial chronicles, Alphabet delivered an earnings performance that skyrocketed by +28.6% from the corresponding period last year against a backdrop of +15% higher revenues. Tesla, on the other hand, witnessed a dismal downslide of -45.3% in Q2 earnings, albeit with a marginal uptick of +2.3% in revenues.

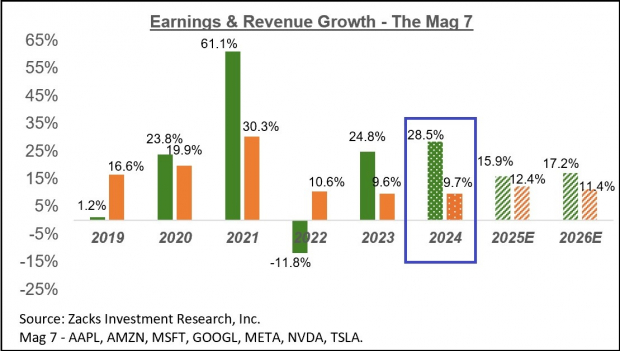

Peek at the vivid chart below, showcasing the current consensus predictions for the ‘Mag 7’ stocks collectively for the present and imminent periods nested within the previous timeline.

Image Source: Zacks Investment Research

These financial warriors are anticipated to haul in +26.8% more earnings compared to the same period last year, riding on +13.7% higher revenue waves.

Glance at the adjacent chart portraying the brigade’s earnings and revenue growth trajectory, narrated annually.

Image Source: Zacks Investment Research

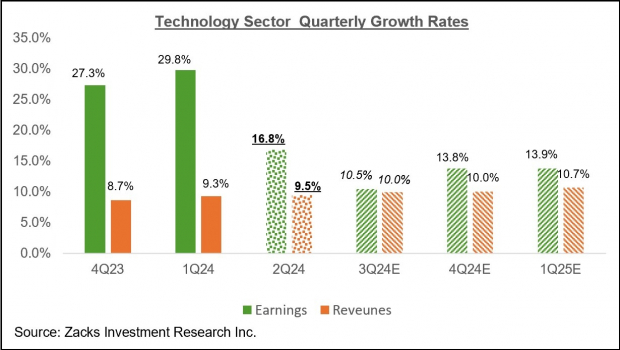

Steering away from the ‘Mag 7’ realm, the Technology sector’s total Q2 earnings are predicted to soar +16.8% from the equivalent period last year, carried by a robust +9.5% revenue surge.

Direct your gaze towards the subsequent chart showcasing the sector’s Q2 earnings and revenue growth forecasts aligned with past performance and future prophecies in the upcoming four cycles.

Image Source: Zacks Investment Research

The panoramic vista divulges the sector’s growth vista on an annual canvas, unveiling opportunities and challenges sprinkled on the path.

Switching gears to the Earnings Season Scorecard and the forthcoming week’s earnings bonanza.

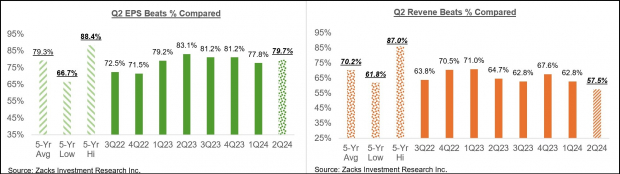

In the wake of the flashing beacons on Friday, July 26th, a total of 207 S&P 500 members have unfurled their Q2 results, comprising 41.4% of the index’s members. Collectively, the earnings of these 207 index constituents have soared +0.6% from the comparable period last year against a backdrop of +4.9% higher revenues, with a striking 79.7% trumping EPS projections and a modest 57.5% eclipsing revenue forecasts.

The Q2 earnings parade is intensifying this week, with over 1000 companies lined up to divulge their financial anecdotes, including the grand debut of 170 S&P 500 members. The stage is set for a riveting showcase of reports from varied sectors, featuring stalwarts like McDonald’s, Proctor & Gamble, Pfizer, Starbucks, Mastercard, Boeing, DuPont, Exxon, Chevron, among others.

Strategize your bird’s eye view to the comparison charts below, threading together the earnings and revenue surpass percentages of these illustrious entities in a historical context.

Image Source: Zacks Investment Research

An intriguing facet of these comparative narratives is the dwindling Q2 revenue exceedance percentage. In a startling revelation, the Q2 revenue outperformance of 57.5% marks a fresh low among this cohort of 207 index members spanning the last 20 quarters.

Dive into the juxtaposed charts below, unwrapping the Q2 earnings and revenue growth tale for these 207 personalities in a historical storyline.

Image Source: Zacks Investment Research

An epic unfolds as we survey the Q2 horizon as a unified tapestry, amalgamating the unveiled results with projections from the forthcoming knights, anticipating a +6.9% earnings crescendo from the same period last year, entwined with a buoyant +5.2% revenue rhythm.

Delve into the captivating chart below, triangulating the year-on-year earnings and revenue trajectory for 2024 Q2 juxtaposed with preceding chapters and forthcoming sagas waiting to be inscribed.

Image Source: Zacks Investment Research

A flicker of hope amidst the storm, the prelude to the Q2 earnings opera witnessed a favorable revisions momentum, with Q2 estimates holding fort with remarkable resilience. The spirited warriors of the S&P 500 index stood tall, retaining Q2 estimates better than their predecessors during the three-month march from the quarter’s genesis to June’s end.

Sage your predictions with an annual view of the earnings horizon, foreseeing a +8.7% uptick in total 2024 S&P 500 earnings, complemented by a +1.7% revenue growth waltz.

Exploring Aggregate Earnings Growth in Financial Markets

The index level aggregate earnings growth for the year has shown a slight decline, settling at a still respectable +8.4% when excluding figures from the finance sector.

An In-Depth Look at Earnings Growth Trends

This current state brings about reflections on historical context. In the ebbs and flows of financial markets, a +8.4% growth in earnings could be perceived as tumultuous waters. Nevertheless, investors find solace in the fact that it remains in positive territory.

Reserved Optimism Amidst Declining Figures

The gradual decrease in earnings growth may seem like a red flag to some, hinting at potential storm clouds on the horizon. However, astute investors recognize that modest fluctuations are part and parcel of the market’s ever-changing landscape.

Unveiling Potential Investment Opportunities

Delving deeper into the numbers, analysts identify a selection of “Whisper” stocks that appear poised to disrupt Wall Street expectations with potential gains of +10-20% upon their earnings announcements.

Identifying Market Outliers for Future Growth

Among the contenders are industry giants like Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Microsoft Corporation (MSFT), Tesla Inc. (TSLA), Alphabet Inc. (GOOGL), and Meta Platforms Inc. (META). These powerhouses exhibit potential for stellar performance, attracting investor attention despite the overall market trends.

Strategic Insights for Investors

As investors navigate through the labyrinth of financial data, analyzing trends and projecting future outcomes, the importance of timely recommendations becomes increasingly apparent. Stay informed, stay prudent, and be ready to seize the opportunities that arise in the ever-evolving world of finance.

To further explore this topic, the detailed Earnings Trends report is available for those keen on a more comprehensive examination of the financial landscape.