Within the industrials sector lies a treasure trove of oversold stocks, providing a golden opportunity to invest in undervalued companies.

One key metric to watch is the Relative Strength Index (RSI), a momentum indicator that gauges a stock’s strength on up days versus down days. When the RSI drops below 30, it signals potential oversold conditions, making it an opportune moment to consider a purchase.

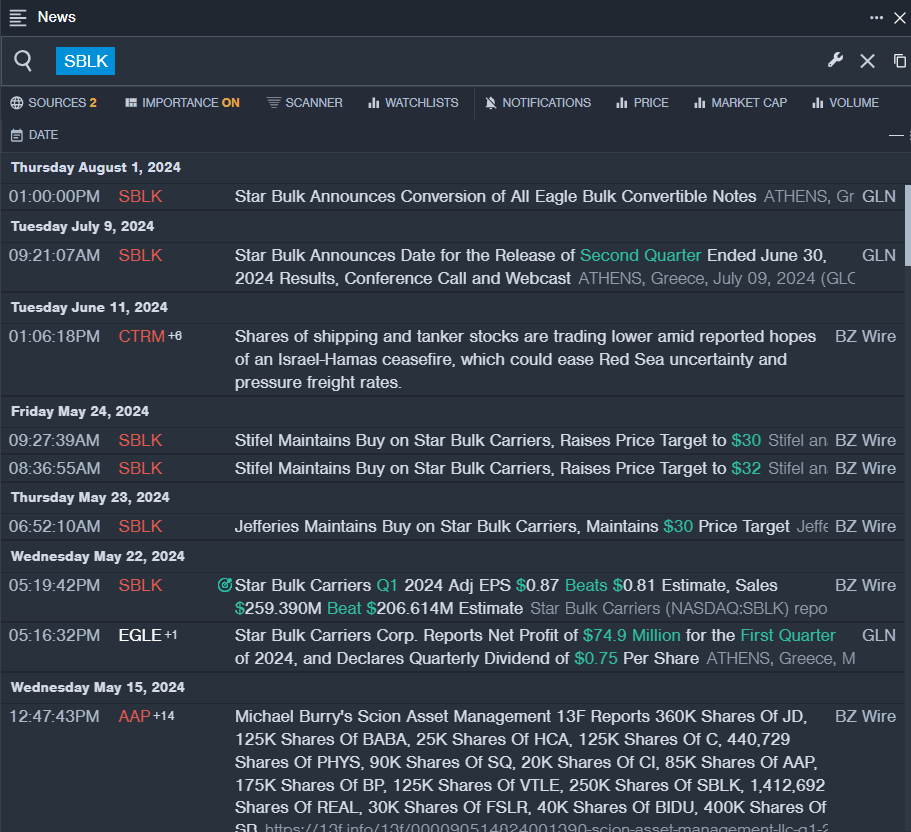

Shining a Light on Star Bulk Carriers Corp (SBLK)

- Star Bulk Carriers Corp is set to unveil its second-quarter results after the closing bell on Wednesday, August 7. The company’s stock has taken a 12% dip over the past month, hitting a 52-week low of $16.86.

- RSI Value: 27.28

- SBLK Price Action: Shares of Star Bulk Carriers saw a 3.6% decline to close at $21.74 on Thursday.

- Real-time news from Benzinga Pro keeps investors informed about the latest developments in SBLK.

Navigating the Challenges Faced by Symbotic Inc (SYM)

- Symbotic Inc recently reported disappointing third-quarter earnings and provided a fourth-quarter revenue forecast that fell short of expectations, leading to a 37% plummet in its stock value over the past five days. The company hit a 52-week low of $24.21.

- RSI Value: 26.59

- SYM Price Action: Symbotic shares experienced an 8.2% decline, closing at $24.61 on Thursday.

- Insights from Benzinga Pro’s charting tool aid in identifying trends in SYM stock.

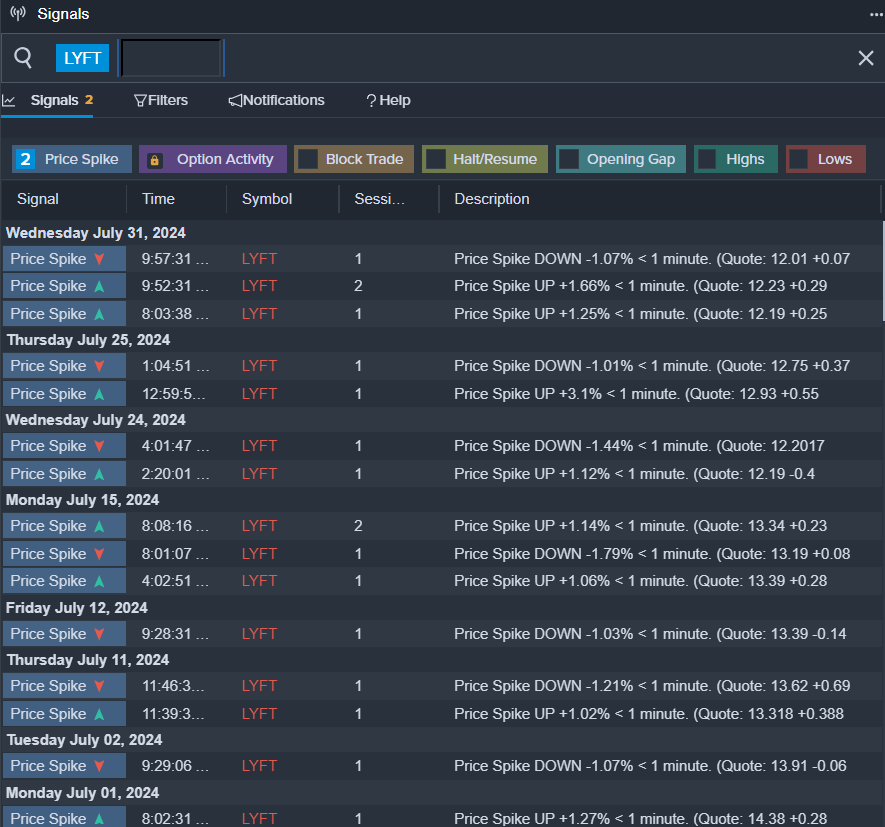

Steering Through the Turbulence with LYFT Inc (LYFT)

- In recent announcements, Lyft disclosed the upcoming departure of President Kristin Sverchek, sparking a 15% decline in its shares over the past month and landing at a 52-week low of $8.85.

- RSI Value: 25.99

- LYFT Price Action: Lyft shares closed at $11.42 after experiencing a 5.2% drop on Thursday.

- Proactive notifications from Benzinga Pro’s signals feature alert traders to potential breakouts in LYFT shares.