The brilliance of Walmart’s outstanding quarterly performance, coupled with the recent positive Retail Sales report for July, has swept away the pessimistic sentiments that loomed just days ago. While a shadow of uncertainty still hovers, a glimmer of hope has pierced through the clouds, with the soft-landing narrative reclaiming its dominance, much to the delight of the market players.

The recent July CPI data has also played a part in allaying investor concerns regarding inflation, reaffirming the Fed’s current focus on labor market dynamics over price stability. The imminent rate cut in September is now a widely accepted notion, with deliberations leaning towards the extent of the cut as the only variable.

Many market pundits had already recognized the shift in the Fed’s stance, attributing greater importance to Walmart’s stellar earnings report as a key barometer for consumer spending patterns and household financial health. The robust results and upgraded guidance from Walmart for the upcoming quarters attest to the economy’s resilience amidst a host of challenges.

Transforming itself beyond a conventional retailer, Walmart’s digital footprint now rivals that of Amazon. The company’s strategic digital investments have been pivotal in attracting affluent consumers to its seamless delivery and pick-up services, resulting in an upsurge in market share. Bolstered by its digital prowess, Walmart’s online platform has become a sought-after advertising space, echoing the high-margin advertising revenues characteristic of Amazon’s operations.

The integration of artificial intelligence in Walmart’s digital initiatives signifies a paradigm shift for the retail behemoth, propelling it towards innovation and customer-centric strategies.

Excitement brews in anticipation of Target’s forthcoming quarterly report on August 21st, with cues from Walmart’s earnings report hinting at favorable trends and stability in non-essential product categories. The divergence in business composition between Walmart and Target underscores the impact of groceries and essentials on revenue streams.

While Walmart boasts a substantial share from these categories, the relative focus of Target on non-essential items has posed challenges amid post-Covid consumer spending patterns. However, hints of improvement in non-grocery segments from Walmart’s earnings call present a glimmer of hope for Target’s upcoming financials.

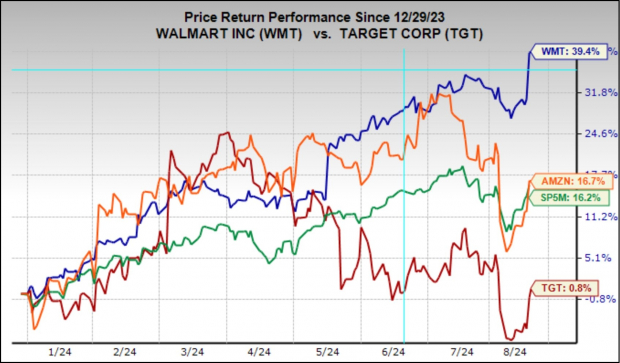

Target’s lackluster performance this year, illustrated below, unveils a stark contrast against the soaring figures of Walmart and Amazon in the market landscape.

Image Source: Zacks Investment Research

Insights gleaned from the Retail sector’s Q2 earnings reflect a nuanced perspective, with 26 key retailers in the S&P 500 index shedding light on the sector’s vitality. Noteworthy disparities in earnings and revenue beats highlight the evolving landscape, illuminating the sector’s trajectory amidst economic fluctuations.

Retail sector players have grappled with surpassing EPS and revenue expectations in Q2, signifying a significant departure from past quarters. The juxtaposition of performance metrics with and without Amazon’s results underscores the transformative impact of ecommerce giants navigating traditional retail terrains.

The juxtaposition below captures the essence of the Q2 earnings and revenue landscape, underscoring the pivotal role played by Amazon alongside its brick-and-mortar and digital counterparts.

Image Source: Zacks Investment Research

The intricate dynamics of consumer spending under the looming specter of inflation and economic deceleration point towards a nuanced narrative of shifting household budgets. While challenges persist, the resilient labor market and rising wages offer a silver lining amidst the economic turbulences.

As we pivot towards the upcoming earnings calls, a deeper dive into prevailing headwinds and future outlooks promises further insights into the market’s trajectory.

Earnings Season Scorecard and This Week’s Earnings Reports

A comprehensive overview of the Q2 results from 464 S&P 500 members illuminates the complex tapestry of earnings momentum, with varying degrees of success in revenue forecasts. The impending wave of results anticipates a riveting narrative, underscoring the dynamic interplay of market forces in shaping the financial landscape.

Analyzing Earnings Reports: The Current Financial Landscape

The Revenue Dilemma Unveiled

One striking feature in the financial saga of these recent fiscal revelations is the dismally low Q2 revenue beats percentage. Hovering at a mere 59.5%, this figure sets a new standard for disappointment, marking the lowest rate encountered by this cohort of index members across the past 20 quarters (equivalent to five years). With revenue victories perpetually on the decline since the inception of the reporting cycle, the outcome seems to resonate through the last echoes of the earnings season.

Exploring the Earnings Landscape

Peering into the universe of Q2 statistics, the collective S&P 500 earnings beacon a prophecy of prosperity – expected to soar by +9.5% compared to the equivalent window from yesteryears, buoyed by +5.4% surge in sales. This golden goose of a growth rate stands as the most radiant gem in the treasury of the last eight quarters, rivaling the zenith reached back in Q1 of 2022, showcasing a fervent rhythm on track to soar to a historical record, as illustrated vividly in the chart below.

Challenges and Triumphs: A Glimpse into the Future

However, the halo of expectations dims slightly when peering ahead into the upcoming period of 2024 Q3, where a +4.2% elevation in S&P 500 earnings from the antecedent year accompanies a +4.6% upsurge in revenues. Alas, estimates seem to be experiencing a gradual deflation, with the current anticipated growth rate of +4.2% witnessing a downturn from the robust +6.9% predicted back in early July, as palpably shown in the chart visualization below.

This downward revision paints a broader stroke, with projections slashed across 14 out of 16 Zacks sectors since the dawn of the quarter. Sectors most profoundly impacted by the red pen of revision include Transportation, Business Services, Energy, Aerospace, and Basic Materials. Yet amidst this tempest, the Tech sector gleams with growing estimates, while the Finance sector seems to maintain a delicate equilibrium, with only slight oscillations from the baseline set forth in early July.

The Road Ahead: Earnings Projections

Painting an annual fresco, the 2024 trajectory for S&P 500 earnings forecasts an ascent of +8.1% accompanied by a +1.7% rise in revenue. Eclipsing the drag imposed by the Energy sector, prophesied to scuttle by -10.8% in 2024, the remaining index exudes a more heartening aura, poised to ascend by +9.6%.

An excision of the Finance sector further embellishes this narrative, elevating the expected revenue growth to +4.1%, with aggregate earnings for the index yearning upwards to +7.7% on an ex-Finance foundation.

Forecasting Future Fortunes

Beyond the numerical tapestry that the aforementioned chart unfurls, a glance into the future unveils a holistic view of earnings data on a rolling four-quarter horizon, crafting a narrative that extends beyond the confines of the fiscal calendar.