CrowdStrike Holdings, Inc. CRWD is scheduled to release second-quarter fiscal 2025 results on Jun 4.

For the second quarter, CrowdStrike projects total revenues between $958.3 million and $961.2 million. The Zacks Consensus Estimate for revenues is pegged at $958.7 million, which indicates growth of 31% from the year-ago quarter’s level.

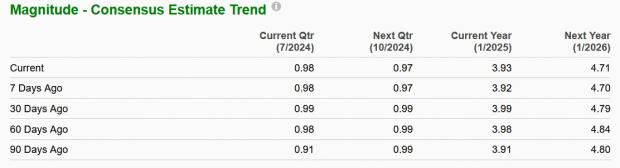

CrowdStrike anticipates non-GAAP earnings between 98 cents and 99 cents per share. The consensus mark for the bottom line has been revised a penny downward to 98 cents per share over the past 30 days and indicates 32.4% year-over-year growth.

Image Source: Zacks Investment Research

The company has consistently demonstrated impressive financial performance, underpinned by its subscription-based revenue model. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 15.8%.

Factors Impacting Upcoming Results

CrowdStrike’s second-quarter results are likely to reflect the benefits of the continued solid demand for its products, given the healthy environment of the global security market. The increasing number of people logging into employers’ networks has triggered a greater need for security and might have spurred the demand for CRWD’s products in the fiscal second quarter. A strong pipeline of deals indicates the same.

Stellar revenue growth in subscriptions might have contributed significantly to the second-quarter top line. Further, the increasing number of net new subscription customers may have acted as a tailwind.

The Zacks Consensus Estimate for Subscription revenues is pegged at $910 million, indicating a year-over-year improvement of 31.9%. Revenues from the Professional Services segment are likely to increase 18.7% year over year to $49.5 million in the fourth quarter.

Moreover, CrowdStrike’s collaboration with Amazon Web Services (“AWS”) is an upside, benefiting the company from its products’ availability on the AWS platform. The expansion in the volume of transactions through Amazon’s AWS Marketplace, growth in co-selling opportunities with AWS salesforce and the uptake of AWS service integrations are likely to have contributed to CRWD’s earnings in the to-be-reported quarter.

However, elevated expenses for enhancing sales and marketing capabilities and increased investments in research and development are likely to have weighed on the company’s fiscal second-quarter bottom line.

Share Performance & Valuation Metrics

Year to date, shares of CrowdStrike have risen 4.8%, underperforming the Zacks Internet – Software industry’s growth of 14.6%. The CRWD stock has also underperformed its peers, including Palo Alto Networks PANW and Fortinet FTNT, which have registered a rise of 18.5% and 27.2%, respectively, YTD.

YTD Price Return Performance

Image Source: Zacks Investment Research

Now, let’s look at the value CrowdStrike offers investors at the current levels. CRWD stock is trading at a premium with a forward 12-month P/S of 14.47X compared with the industry’s 2.57X, reflecting a stretched valuation.

Investment Outlook

Although CrowdStrike has experienced impressive growth since its IPO, recent quarterly reports have shown a deceleration in its growth rate. The company’s revenue growth, while still robust, is not as explosive as in previous years.

CrowdStrike had enjoyed more than 50% year-over-year top-line growth till fiscal 2023. However, the growth rate decelerated in fiscal 2024 to 36%. The current Zacks Consensus Estimate for fiscal 2025 and 2026 suggests that the top-line growth will further decelerate to 30% and 24%, respectively.

This slowdown is partly due to the law of large numbers — as companies grow larger, maintaining high percentage growth rates becomes increasingly difficult. Additionally, heightened competition from established players and new entrants in the cybersecurity space could put further pressure on CrowdStrike’s growth.

Also, CrowdStrike’s near-term prospects might be hurt by softening IT spending as enterprises are postponing their large tech investment plans due to macroeconomic uncertainties and geopolitical issues.

Additionally, the global IT outage incident in July 2024 has highlighted significant vulnerabilities within CrowdStrike’s operational processes, casting a shadow over its reputation. A faulty content update for its Falcon platform had impacted around 8.5 million Microsoft Windows devices and led to widespread system malfunctions across various industries, including banks, airports, hospitals, and government agencies. While CRWD’s swift acknowledgment and rectification efforts were commendable, the scale of the impact has left a lasting impression on clients and investors alike.

Conclusion

Given the challenges CrowdStrike is facing, it might be time for investors to reconsider their position. The company’s slowing sales growth is a serious concern that cannot be ignored. The faulty Falcon update has exposed critical vulnerabilities in the company’s operations, raising questions about its ability to maintain client trust and market dominance. Moreover, this Zacks Rank #5 (Strong Sell) company’s high valuation multiples add another layer of risk.

In light of the reputation damage from the global IT outage and slowing sales growth concerns, it is prudent for investors to stay away from CrowdStrike stock for now. The combination of operational risks and high valuation makes CRWD stock a risky proposition.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.