Wells Fargo & Company just can’t seem to catch a break. The announcement of a formal agreement with the Office of the Comptroller of the Currency (OCC) to address shortcomings in its anti-money laundering (AML) program and sanctions risk management practices sent its stock tumbling down 4%. It’s like watching a marathon runner stumble right before the finish line.

The glaring flaws in the bank’s AML internal controls and risk management procedures are akin to trying to navigate a dense jungle without a map. From issues with suspicious activity reporting to deficiencies in customer due diligence, Wells Fargo found itself in hot water with the authorities. The bank’s struggles were not confined to one area but spread across various facets of its operations like a web of complications.

In a classic case of airing dirty laundry, Wells Fargo first hinted at regulatory woes in its second-quarter SEC filing. The ordeal escalated with talks of an investigation relating to its cash sweep services for new investment advisory clients. It’s like a domino effect – one misstep leading to another.

Despite the dreary outlook, the silver lining is Wells Fargo’s commitment to revamp its AML and sanctions risk management capabilities. Enter the OCC agreement, a beacon of hope in a stormy sea of regulatory requirements. The bank seems determined to right its wrongs and steer its ship back on course.

WFC’s Pledge and Strategic Steps Towards Compliance

To ensure compliance with the OCC’s terms, Wells Fargo must now establish a Compliance Committee. This committee will keep a close eye on the bank’s adherence to the agreement and spearhead targeted actions across critical areas like front-line risk management and customer identification.

The agreement sets clear expectations for the bank to bolster its AML and sanctions risk management procedures. Wells Fargo must seek the OCC’s approval before introducing new offerings, a reminder that regulatory oversight is not to be trifled with.

Regulatory Hurdles and Legal Battles

Wells Fargo’s regulatory woes are a saga that dates back to September 2016 when penalties and sanctions started piling up. From a Federal Reserve-imposed asset cap to class action lawsuits, the bank has been embroiled in legal battles across multiple fronts.

In a recent development, a class action lawsuit alleged that Wells Fargo mishandled its employee health insurance plan, leaving thousands of employees overpaying for prescription medications. These legal battles are akin to sailing through turbulent waters – uncertainty at every turn.

Another lawsuit accused Wells Fargo of complicity in a $300-million Ponzi scheme, leaving investors, primarily senior citizens, high and dry. The allegations paint a grim picture of a financial institution mired in controversy and complicity.

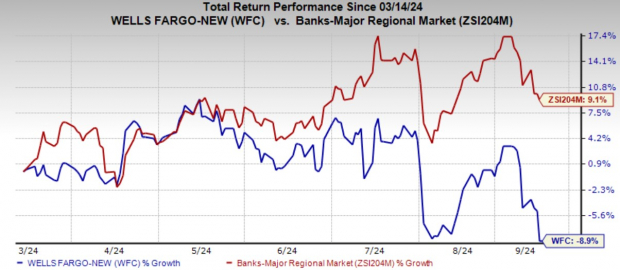

As if legal battles weren’t enough, Wells Fargo’s stock performance took a hit, losing 8.9% in the past six months against industry growth. The roller-coaster ride of the stock market mirrors the bank’s tumultuous journey through litigations and regulatory scrutiny.

Image Source: Zacks Investment Research

Amidst the legal chaos and regulatory storm, Wells Fargo manages to hold a Zacks Rank #3 (Hold), a slight glimmer of hope for investors amidst the stormy clouds.

Legal Turmoil Persists in the Financial Sector

It seems like Wells Fargo is not the only one facing legal troubles in the financial landscape. The Toronto-Dominion Bank faced a $28 million penalty for credit reporting mishaps, highlighting the industry’s regulatory minefield. On the other hand, Robinhood Markets, Inc., drew the ire of authorities for preventing crypto withdrawals, adding to the litany of regulatory issues plaguing the sector.

Like a chessboard with pieces in disarray, the financial sector finds itself navigating a complex regulatory landscape, each move scrutinized under the regulatory microscope.