Opportunities arise as oversold stocks in the financial sector beckon investors to delve into undervalued gems.

Using the Relative Strength Index (RSI) as a guide, investors can gauge a stock’s momentum compared to its price action, providing insights into potential short-term performance. An RSI below 30 typically signals that an asset is oversold, as per market intelligence from Benzinga Pro.

Let’s delve into the top three oversold players in the financial realm boasting RSIs hovering near or below 30.

Resilient Performance Amidst Volatility: Apollo Commercial Real Estate Finance Inc ARI

- On August 6, despite the overall downtrend, Apollo Commercial Real Estate Finance reported robust quarterly earnings. With its stock witnessing a 13% decline over the past month and hitting a 52-week low of $8.76, the company stands resilient.

- RSI Value: 25.60

- ARI Price Action: Closing Friday at $8.89 after a slight dip, the stock continues to weather market fluctuations.

- Tracking real-time updates through Benzinga Pro’s newsfeed ensures investors stay ahead on recent developments in ARI.

Steadfast Amidst Uncertainty: Ready Capital Corp RC

- On September 16, despite analyst caution, Ready Capital Corp maintained its standing. The stock witnessed a 7% dip in the past month, hitting a 52-week low of $7.23.

- RSI Value: 29.84

- RC Price Action: Closing Friday at $7.31, Ready Capital shows resilience in the face of market pressures.

- Empowered with insights from Benzinga Pro’s charting tool, investors can discern critical trends influencing RC’s trajectory.

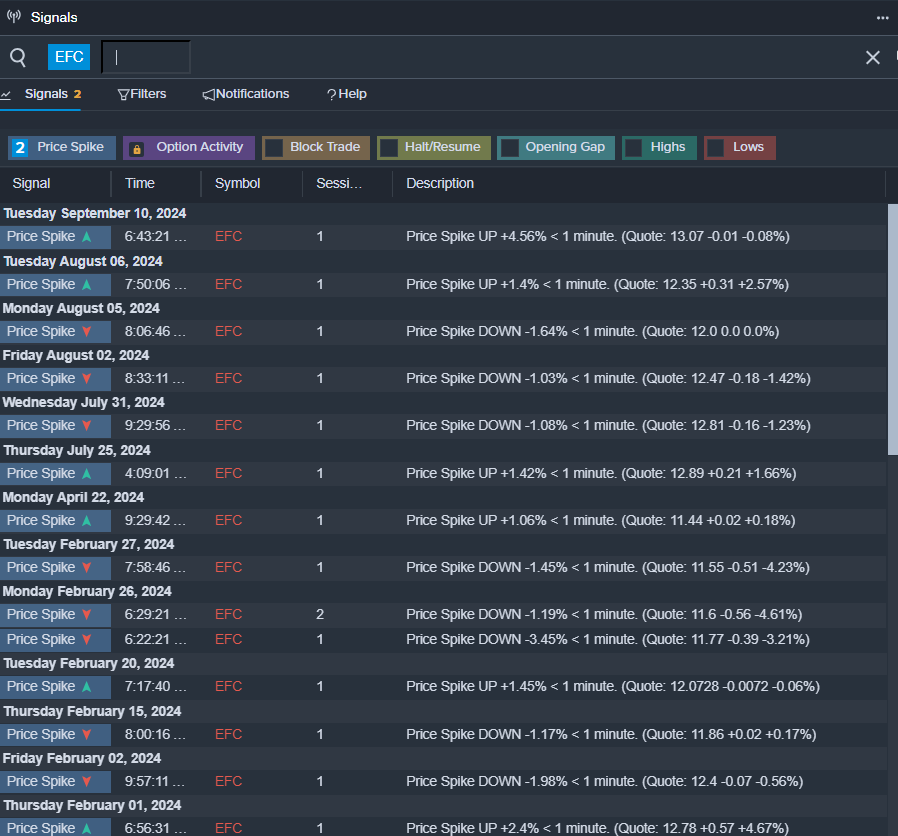

Ripe for Growth: Ellington Financial Inc EFC

- On August 6, Ellington Financial faced headwinds with weaker-than-expected quarterly results. CEO Laurence Penn highlighted diverse portfolio contributions and sequential growth. Despite a 5% slump in the past month and a 52-week low of $10.88, prospects remain promising.

- RSI Value: 29.38

- EFC Price Action: Closing Friday at $12.46 post a marginal decline, Ellington Financial navigates market challenges.

- Empowered with actionable insights from Benzinga Pro’s signals feature, investors can navigate potential breakouts in EFC shares adeptly.

Read Next:

Market News and Data brought to you by Benzinga APIs