The energy sector’s most oversold stocks are currently shining brightly as beacons of opportunity amidst a sea of undervalued companies. These gems may just be ripe for the picking.

Ecopetrol SA – A Diamond in the Rough

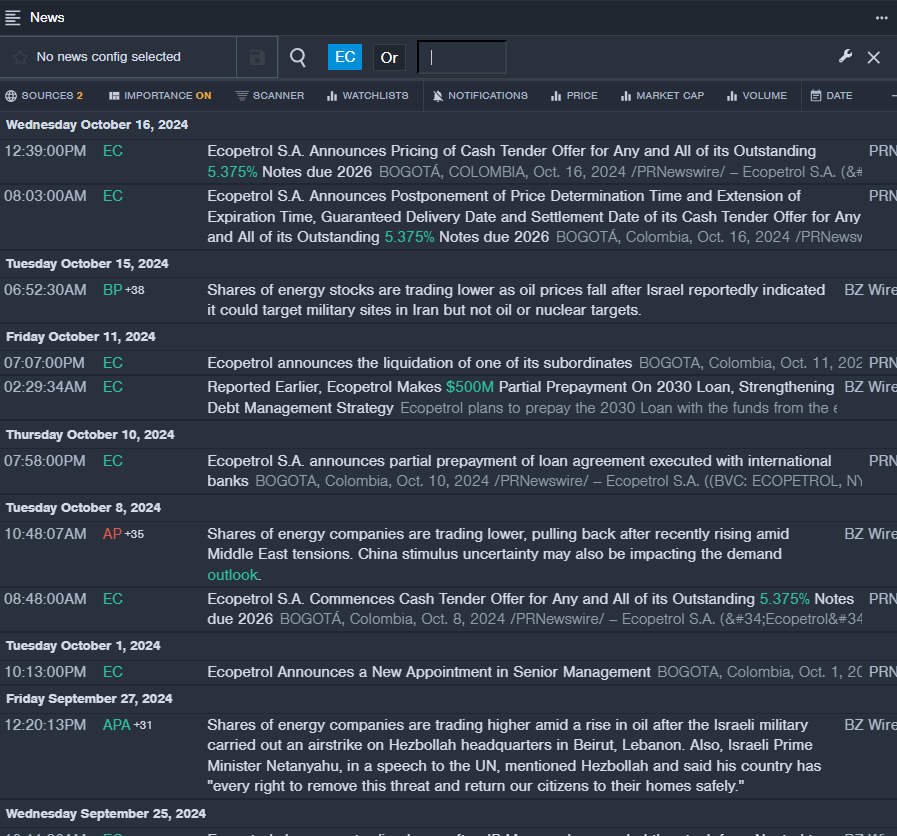

- Amidst the flurry of information on October 16, Ecopetrol SA announced the pricing of a cash tender offer for all its outstanding 5.375% notes due in 2026. The market’s reaction was swift, with the company’s stock plummeting approximately 11% over the past five days, reaching a trough of $8.13.

- RSI Value: 26.20

- EC Price Action: Ecopetrol shares closed at $8.15, slipping 1.1% on Thursday.

- Notably, insights from Benzinga Pro’s real-time newsfeed provided crucial updates on the latest Ecopetrol developments.

Torm PLC – A Potential Gem in the Rough Seas

- In a recent analysis on July 23, Evercore ISI Group analyst Jonathan Chappell expressed bullish sentiment by maintaining an Outperform rating on Torm PLC and raising the price target from $45 to $48. Despite this vote of confidence, the company’s stock faced choppy waters, sliding approximately 17% over the past month to find itself at a 52-week low of $26.10.

- RSI Value: 27.08

- TRMD Price Action: Torm shares concluded at $29.90, marking a 0.7% descent on Thursday.

- Utilizing tools from Benzinga Pro, discerning investors were able to navigate the turbulent trends within Torm’s stock performance.

Read More:

Market News and Data brought to you by Benzinga APIs