Showtime folks!

Alibaba (BABA) has been buzzing like an electrified beehive on Zacks.com’s radar recently. Let’s delve into the nuances that could define this stock’s wild antics in the days ahead.

Behold! Over the past lunar cycle, Alibaba’s celestial journey has netted -6.3%, whereas the Zacks S&P 500 chimera dances to a +2.9% beat. The Zacks Internet – Commerce den, where Alibaba prowls, has slumped by 0.6%. The burning question that sears our minds – where is this comet heading next?

The rumor mill may send ripples across the pond, but the heart of a stock thumps to the tune of its earnings melody. At Zacks, we engage in the age-old pastime of peering into the crystal ball of earnings, for therein lies the soul of valuation.

An Ode to Earnings Projections

Our gaze is unwavering, fixed on the flickering flame of projected earnings. Like a lighthouse beacon guiding ships through the fog, the consensus on earnings forecasts steers our ship’s course. A whisper that earnings are on the rise begets a rise in a stock’s aura. Behold, the symphony of earnings estimates — the maestro orchestrating the capers of a stock’s price.

Alibaba, the enigmatic dragon of the East, is foreseen to unveil earnings of $2.24 per share in the current quarter, a somber -6.7% swan song. In the last moon’s waltz, the Zacks Consensus Estimate pirouetted a nimble +13.7%.

The chimes of destiny toll a consensus earnings forecast of $8.20 for the current fiscal year, painting a -4.9% portrait of year-over-year change. This vision has shimmered -1.4% in the past 30 moons.

The coming year whispers secrets of a $9.20 earnings tale, a +12.2% metamorphosis from yesteryears. The whispers of muses in the moonlight herald a modest +0.3% change this past moon.

With our heralded Zacks Rank, a paragon of virtue and wisdom, we dub Alibaba with the rank of #3 (Hold), a badge that peers into the soul of the stock, predicting its verse of price harmony.

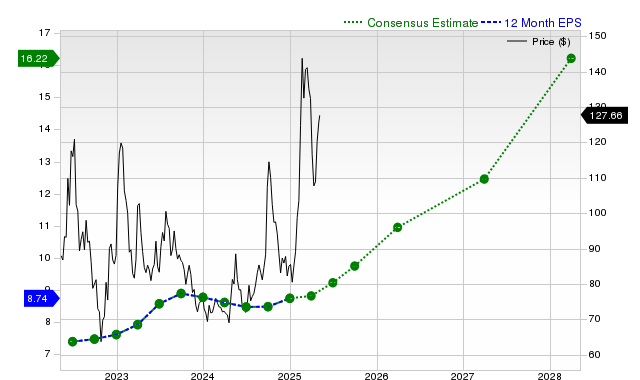

Behold the tapestry of Alibaba’s forward 12-month consensus EPS estimate in the chart below:

12-Month EPS

The Crystal Ball of Revenue Growth

The path to financial nirvana lies in a symphony of earnings, but the serenade falters if revenue, the lifeblood of a company, fails to crescendo. Without the coin’s hum, a stock’s melody falters. Thus, the oracle of revenue growth beckons.

In Alibaba’s enchanted forest, whispers of a $34.95 billion sales magnum opus for the current quarter point to a +8.2% year-over-year dance. The crystal ball chimes with a $138.63 billion and $148.86 billion serenade for the current and next fiscal ballads, boasting +6.2% and +7.4% octaves, respectively.

A Glimpse into Yesteryears and the Element of Surprise

Alibaba’s song in the last dance amounted to $30.73 billion in revenues, a jaunty +1.4% skip year-over-year. Eclipsing the Zacks Consensus Estimate’s whispered $30.59 billion, the +0.46% surprise ushered in a new dawn. The EPS carol of $140 for the same epoch compared fondly with $1.56 a year hence.

Alibaba waltzed with consensus EPS dreams thrice over the past seasons and offered a floral bouquet to the revenue muses twice in the same twilight.

Valuation Balancing Act

No voyage through the harbor of investing is complete without hoisting the flag of valuation. The compass that steers our ship, valuation multiples like P/E, P/S, and P/CF, seek truth in the currency of a stock’s true worth and its fortunes written in the stars.

As a wise owl perched upon the Zacks Style Scores totem, the Zacks Value Style Score dons its robes of A, whispering sweet nothings of discount to Alibaba’s peers. The arcane arts of value metrics unfurl a tapestry, guiding the lost wanderer to the heart of valuation enlightenment.

Alibaba dons the laurel of A, a garland of celebration for trading at the crossroads of the divine discount. Dare to peek into the hinterland of valuation metrics that crowned this king.

The Final Curtain Call

The chronicles weaved herein and other sirens of knowledge on Zacks.com may yet unfurl the map to the treasure trove of Alibaba. And yet, the oracle foretells a song of the #3 Hold, echoing in the halls of market’s timepiece.

Where Will the Comets Soar…

If Jupiter Reigns? If Mars Ascends?

The ley lines may whisper tales.

Since ancient tides ebbed, even after the moons darkened, the market has never bowed to a lower presidential polity. With voters as protagonists, the market stage is aglow, indifferent to the regal hue, red or blue!

Now’s the hour to uncork Zacks’ trove, a free Special Report of 5 cosmic behemoths who dance to tunes both Democratic and Republican…

1. Crafty Apothecary has wielded a +11,000% scepter in yore’s 15 winters.

2. Moonlit Stewards reign supreme in their sector’s twilight.

3. Titans of the Wellspring dream of expanding their bounty by a quarter.

4. Knights of the Azure Skies just have landed an $80 billion legend.

5. Architects of Microcosms sow seeds of grandeur on home shores.

Adventure awaits! Discover the trove FREE >>

Alibaba Group Holding Limited (BABA) : A Glimpse into the Veil