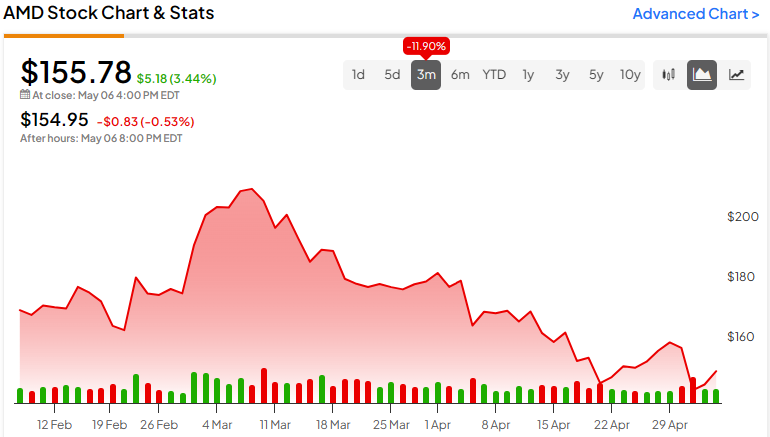

Advanced Micro Devices (NASDAQ:AMD) recently released its first-quarter earnings report, which, on the surface, seemed solid. However, facing tough competition from industry giant Nvidia (NASDAQ:NVDA) in areas like artificial intelligence, investors were left wanting more than just decent numbers. As the generative AI sector faces potential overvaluation, a cautious stance is prudent, leading to a bearish outlook on AMD stock.

The Quest for Excellence Proves Elusive for AMD Stock

While Advanced Micro’s Q1 earnings appeared satisfactory at first glance, a deeper dive reveals a mixed bag. The company managed to meet analyst expectations of 62 cents per share earnings and posted $5.48 billion in revenue against a projected $5.47 billion. Notably, the surge in Data Center revenue by 80% buoyed the top line, driven by AMD’s MI300 AI accelerator competing with Nvidia’s H100 chip at a lower cost, catering to memory-intensive tasks.

However, despite positive statements from CEO Dr. Lisa Su regarding AI driving demand, the market reacted negatively post-earnings. Further analysis unveiled revenue declines in AMD’s Gaming and Embedded unit, overshadowing the elevated Data Center performance. This downturn poses a challenge as Nvidia holds a dominant position in AI, potentially leaving AMD struggling for market share.

Reflections on AMD’s Valuation Amidst Industry Dynamics

If AI’s efficacy falters, Advanced Micro might have to rely on underperforming business units, challenging its stock’s growth trajectory. Analysts forecast revenue around $23.88 billion for Fiscal 2024, but a reality check may see AMD settling at the lower end near $22.71 billion due to AI uncertainties.

Currently trading at 10.4x trailing-year revenue, well above the semiconductor sector average of 4.05x, AMD might face valuation adjustments if the AI sector underperforms. In such a scenario, the stock could trade at a much higher multiple, adding more uncertainty for potential investors.

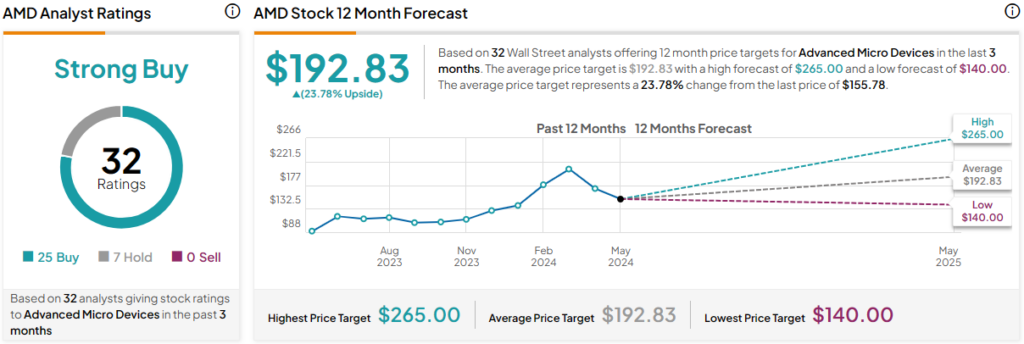

Analysts’ Perspective on AMD Stock

With a Strong Buy consensus rating from Wall Street, based on 25 Buys and seven Holds, AMD stock’s average price target stands at $192.83, suggesting a 23.8% upside potential for investors willing to take the risk.

Evaluating AMD Stock’s Performance Holistically

While Advanced Micro’s Q1 performance appeared decent, the shadow of Nvidia’s dominance in AI looms large, demanding more from AMD. The speculative nature of the AI sector and AMD’s struggles to bolster other divisions following a revenue setback pose challenges for investors, urging caution in assessing AMD stock’s potential.