$200 billion. That’s the revenue Apple (NASDAQ: AAPL) generated last year from iPhone sales.

Apple’s allure as the world’s most valuable company is often credited to iPhone sales. The reality, however, is more intricate than a mere reliance on smartphones.

Exploring Apple’s revenue streams unveils an intriguing narrative, shedding light on a business area typically overshadowed by the iPhone hype.

Image source: Getty Images.

Revenue Diversification: A Shift Towards Services

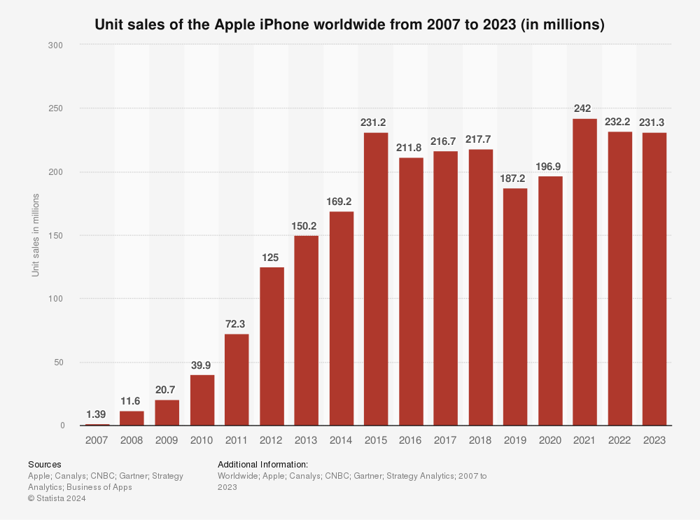

While Apple’s iPhone sales have remained stagnant for nearly a decade, the company’s services segment emerges as the new growth catalyst.

Image source: Getty Images.

Apple’s services, encompassing App Store, iTunes, AppleCare+, advertising, and subscriptions to apps like iCloud+, hold a 75% gross profit margin, outshining its hardware products.

The services unit is now the linchpin of Apple’s financial success, steering the company’s strategic focus towards bolstering services revenue and profitability.

Amidst this service-oriented ethos, Apple’s unexpected $20 billion foray into Apple TV+ production has raised eyebrows among investors.

The $20 Billion Bet on Apple TV+

Estimates suggest Apple’s lavish spending on Apple TV+ surpasses $20 billion, a significant investment to vie with industry giants like Netflix, Amazon, and Disney.

Despite a notable Best Picture accolade in 2022 for Coda, Apple’s lavish productions have failed to catalyze a surge in Apple TV’s viewership, lagging far behind Netflix’s daily viewership.

Reports indicate a shift in Apple’s strategy, pivoting away from extravagant TV+ spending towards AI technologies aimed at elevating services revenue.

With investments in AI gaining precedence, signs suggest Apple may be curtailing its TV+ expenditure, redirecting focus towards fortifying its services and AI ventures.

Apple’s foray into the cutthroat streaming sphere, marked by multi-billion-dollar investments, is now under scrutiny as the company reevaluates resource allocation, pivoting towards AI technologies and service enhancements. This strategic rejig emphasizes Apple’s commitment to fortifying existing service revenue streams and fostering future growth via AI.

An Investor’s Conundrum: Apple’s Balancing Act

Before considering Apple as an investment opportunity, navigating the intricate strategic balance between service expansion, AI ventures, and TV+ spending is crucial for prospective investors.

The Unveiling: Stocks Analysts Swore By, Sans Apple

When the bigwigs swore by Nvidia back in April 15, 2005, the world stayed still. If you had tossed $1,000 on their say-so, you’d have been sitting on a cool $792,725 today. The impact? Gargantuan.

Stock Advisor lays a roadmap for investors, offering a failsafe guide to kickstarting your moolah-making journey. Tips on portfolio construction, handpicked options from the pooling of analysts, and two fresh stock picks monthly are what it offers. The Stock Advisor club? Well, they’ve not just crushed the S&P 500 returns; they’ve quadrupled them since ’02*. Power moves, we say.

While Apple wasn’t in the mix, the 10 stocks that made the grade are setting up to be the dark horses of tomorrow. Keep those eyes peeled, investors!

Wondering whether you’re missing out? Dive into those top 10 stock picks. The clock’s ticking to make your play!

*Stock Advisor returns data stands tall as of August 22, 2024