European Car Registrations

The European Automobile Manufacturers Association recently reported a 3.3% decline in December new car registrations, snapping a 16-month growth trend. While France and Spain saw double-digit increases, Germany recorded a 23% drop. However, overall sales for the full year increased by 13.9% to 10.5 million units, with notable growth in key markets like Spain, Italy, France, and Germany.

STLA and SIXT Deal

Italian-American automaker Stellantis and premium mobility service provider SIXT have cemented a significant deal, allowing SIXT to acquire up to 250,000 Stellantis vehicles for its rental fleet. This strategic partnership focuses on advanced technologies and customer-centric approaches, with the first major deliveries expected in the first quarter of 2024, covering various vehicle classes, including electric vehicles. The collaboration aims to facilitate SIXT’s growth strategy while enhancing customer experience through streamlined processes and improved vehicle availability.

Ford’s Production Shift

U.S. auto giant Ford will reduce the production of its F-150 Lightning in Michigan due to slower-than-expected customer demand for electric vehicles. This move impacts 1,400 workers, with half being transferred to other plants or considering retirement. The decrease in F-150 Lightning production results from the need to align production with customer demand and shifts in the automotive market.

Cummins, PACCAR, and Daimler JV

Leading engine maker Cummins, commercial vehicle manufacturer Daimler Truck AG, and trucking giant PACCAR have selected Mississippi as the future site for their joint venture’s advanced battery cell manufacturing. The investment, estimated at $2-$3 billion, aims to drive economic growth, create over 2,000 manufacturing jobs, and support the adoption of electric vehicles in medium- and heavy-duty commercial transportation. This strategic collaboration represents a concerted effort to develop cutting-edge battery cell technology and reduce carbon emissions.

Allison Transmission Contract

Leading truck transmission manufacturer Allison Transmission has secured an $83.3 million contract to supply upgraded X1100 transmissions for the U.S. Army’s Abrams Main Battle Tank. The contract involves delivering these transmissions throughout 2024, aligning with the performance demands of the Abrams tank. This upgrade program aims to provide significant cost savings for customers while integrating new components with existing customer hardware.

Allison Transmission Holdings, Inc. Announces Significant Contracts and Commitments

In recent news, Allison Transmission Holdings, Inc. confirmed the acquisition of a substantial $83.3 million contract with the U.S. Army. This venture intends to support the Army’s combat vehicle modernization goals entwined with supply contracts for high-performance and reliable transmissions. The contract involves the supply of transmissions designed specifically for the M1 Abrams tank, solidifying Allison’s standing as the most adept tank globally.

Indisputably, Allison’s firm dedication to quality and dependability echoes the U.S. Army’s readiness objectives and the ever-evolving needs of warfighters. The slated deliveries under this contract span from January to December 2024, reinforcing Allison’s enduring rapport with the U.S. Army.

In yet another development, the company disclosed the endorsement of a fresh agreement with the International United Automobile, Aerospace, and Agricultural Implement Workers of America (UAW) Local 933. The agreement covers around 1,600 UAW-represented employees in Indianapolis, IN, extending for a four-year tenure until November 14, 2027. This agreement epitomizes a collaborative strive towards the well-being of employees and the prospective growth of the company.

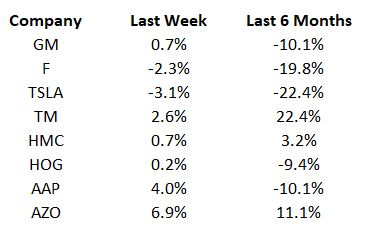

Price Performance

The adjoining table delineates the price movements of several prominent players in the automotive industry over the past week and a six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

The fourth-quarter 2023 earnings season for the auto sector commences today. Keep an eye out for the quarterly results of established players such as Tesla, Autoliv, and Gentex – key contributors to the industry.

To read this article on Zacks.com click here.