Bitcoin, the pioneer of cryptocurrencies, has etched its path through tumultuous market terrains and staggering price fluctuations.

In a spectacular display of volatility, Bitcoin surged by over 1,200 percent from March 2020, hitting a peak of US$69,044 on November 10, 2021, only to tumble to US$15,787 by November 2022 under the weight of economic uncertainties and adverse media scrutiny.

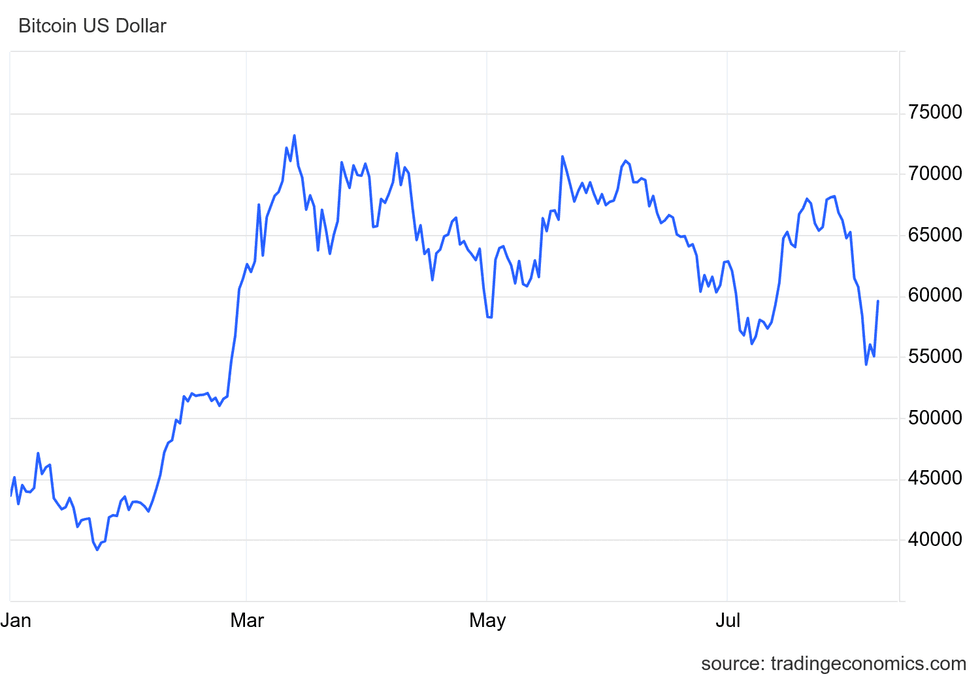

As of 2024, Bitcoin commenced the year just shy of US$45,000 and has since witnessed remarkable growth, culminating in a record high of US$73,115 on March 11, 2024.

What sparks these dramatic price catapults and plummets of the world’s leading cryptocurrency? Delve into Bitcoin’s origin story and its evolution throughout the years.

Genesis: Bitcoin’s Nascent Days

Back in 2009, Bitcoin emerged into the market with a minuscule starting price of US$0.0009, underscoring its astounding journey since inception.

Conceived as a retort to the 2008 financial crisis, the Bitcoin white paper, authored by the mysterious Satoshi Nakamoto, introduced a revolutionary concept for a peer-to-peer electronic cash system. With the ethos of decentralization and transparency, Bitcoin aimed to wrest power from financial institutions and empower the masses, resonating strongly amidst the aftermath of the 2008 financial debacle.

The cypherpunk currency found its footing on January 3, 2009, with the creation of the Genesis Block, embellished with a crucial message that echoed the frustrations of an ailing financial system.

Meteoric Milestones

The seminal Bitcoin transaction occurred on January 12, 2009, as Nakamoto transferred 10 Bitcoins to Hal Finney, heralding an essential juncture in Bitcoin’s narrative.

Bitcoin’s initial valuation breakthrough transpired on October 12, 2009, when 5,050 Bitcoins were traded for US$5.02, marking the birth of a price benchmark for the cryptocurrency in the guise of New Liberty Standard.

A pivotal moment arrived on May 22, 2010, christened as Bitcoin Pizza Day, when Laszlo Hanyecz offered 10,000 Bitcoins for two pizzas, laying a comedic yet significant foundation for Bitcoin’s value at approximately US$0.0025.

Subsequent to a modest rise to US$29.60 in 2011, Bitcoin catapulted to US$1,242 in December 2013, marking a watershed moment in its ascension.

The Shift: Bitcoin’s Rise to Prominence

The advent of 2016 heralded a new epoch for Bitcoin as it surged from US$433 to US$989 within the year, spurred by economic uncertainties and a shift towards Bitcoin as a coveted asset amidst geopolitical tumult.

The stock market turbulence in 2016, coupled with pivotal events like Brexit and Donald Trump’s election, bolstered Bitcoin’s status as a safe-haven asset, propelling its upward trajectory.

Industry endorsements, including notable investments in blockchain technology by major players like IBM and Goldman Sachs, further fortified Bitcoin’s market presence, paving the way for sustained growth.

The Rollercoaster Ride of Bitcoin: A Tale of Triumphs and Tribulations

Bitcoin’s Price Journey Through the Years

Bitcoin, the cryptocurrency that has often been referred to as the “gold standard” of digital assets, has experienced extreme price volatility since its inception. In the early years, Bitcoin saw significant fluctuations, hitting peaks and valleys that left investors on a wild ride.

Immense Peaks and Deep Valleys

In the summer of 2016, Bitcoin surged to a high of US$764, only to sharply drop to the high US$600 range where it hovered for a while. From a low of US$517 on August 1, it once again started its upward climb.

Partnerships and Surging Prices

Partnerships with major players such as Microsoft and Bank of America Merrill Lynch in 2016 resulted in a steady upward trajectory for Bitcoin. Collaborations like Ripple’s pilot trial with 12 banks further bolstered investor confidence, leading to a price surge from US$629 to US$736 by November 2016.

The Rise of Bitcoin in the 2010s

Bitcoin’s popularity continued to soar in 2017, with prices skyrocketing from US$1,035.24 in January to an all-time high of US$18,940.57 in December. The entry of futures contracts on the Chicago Mercantile Exchange marked a turning point for Bitcoin, shifting it from a speculative fad to a legitimate investment.

Bitcoin’s Resilience in the 2020s

Challenges and Triumphs in 2020

As 2020 unfolded, Bitcoin faced a series of challenges, including a significant sell-off triggered by the pandemic in March. Despite this, Bitcoin rebounded and closed the year at an impressive US$29,402.64, marking a 323% year-over-year increase.

The Unstoppable Surge of 2021

2021 showcased Bitcoin’s resilience as it rallied to an all-time high of US$68,649.05 in November. Factors such as increased money printing and growing investor appetite for risk contributed to the monumental growth of Bitcoin in the market.

Inevitable Market Fluctuations and Setbacks

Following its peak in November 2021, Bitcoin’s value began to decline, reflecting market uncertainties in 2022. The industry witnessed significant upheavals with events like Terra’s decline and the fallout affecting other cryptocurrencies.

When Celsius Network declared bankruptcy in July, it further added to the woes of the crypto market, causing Bitcoin’s price to plummet to US$19,047. However, the most significant blow came in November when revelations about Alameda Research’s misuse of customer funds shook the cryptocurrency trading world.

Bitcoin’s journey has been nothing short of a rollercoaster, marked by dizzying highs and heart-wrenching drops. As investors navigate the tumultuous waters of the cryptocurrency market, one thing remains certain – the only constant in the world of Bitcoin is change.

The Resilient Journey of Bitcoin in 2024

Bitcoin’s Path to Redemption

Despite the turmoil in the cryptocurrency sector stemming from the FTX scandal that shook investor confidence, Bitcoin managed to rise above the chaos. By the end of 2022, prices had plummeted below US$17,000, showcasing the resilience that would define its journey throughout 2024.

Bitcoin’s Meteoric Rise in 2023

March 2023 saw Bitcoin rallying to US$28,211 on the back of concerns within the banking system, instigating an upward trend for the cryptocurrency. Even legal challenges and regulatory scrutiny from the SEC against major players like Coinbase and Binance could not deter Bitcoin’s ascent, holding firmly above US$25,000.

BlackRock’s move to file for a Bitcoin exchange-traded fund in June further bolstered Bitcoin’s position, propelling it to breach the US$30,000 mark and hitting highs near US$31,500, maintaining its ground above US$30,000 before a slight dip in July to settle around US$25,150.

Institutional Endorsement Elevates Bitcoin

The latter part of the year marked increased institutional interest in Bitcoin, fueled by prospects of SEC approval for a slew of spot Bitcoin exchange-traded funds. By December, Bitcoin had surged to US$37,885, climbing further to US$42,228 by year-end. The approval of 11 spot Bitcoin ETFs in early 2024 reignited Bitcoin’s upward trajectory, reaching record highs in February and March.

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.

The Impact of the 2024 Bitcoin Halving

Bitcoin’s price performance leading up to the 2024 halving reflected a common trend of surges around halving events. The most recent halving in April, where miner rewards were halved, contributed to Bitcoin’s rally to its all-time high in March 2024. Despite brief fluctuations following the halving, Bitcoin demonstrated resilience amidst changing market dynamics.

Reports linking the price movements to SEC approvals of spot Ether ETFs in May underscored Bitcoin’s interconnectedness with the broader cryptocurrency landscape. Price volatility post-halving was further influenced by market uncertainties and regulatory developments, posing challenges that Bitcoin adeptly navigated.

As Bitcoin evolves from a speculative investment to a “risk-on” asset, its journey in 2024 highlights its adaptive nature amid evolving market trends and increasing institutional involvement. The cryptocurrency’s ability to weather storms and capitalize on emerging opportunities cements its status as a resilient digital asset with profound implications for the financial landscape.

Bitcoin Price Volatility Amid Political Turbulence

Bitcoin’s Rollercoaster Ride

Bitcoin’s price fluctuations have been a whirlwind lately, influenced by a series of events that have shaken up the cryptocurrency market. The aftermath of the assassination attempt on former US presidential candidate Donald Trump sent Bitcoin soaring, only to witness a slight dip following current US President Joe Biden’s exit from the race and nomination of Kamala Harris. Political uncertainty, regulatory concerns, and global market trends have all played a role in the recent market movements.

Market Turmoil Triggered by Economic Events

Bitcoin’s value took a hit amidst a global sell-off event driven by weaker economic data, an unexpected interest rate hike in Japan, and fears of a looming recession. The Asian market panic reverberated globally, causing a significant drop in the price of Bitcoin and other digital assets. However, the market eventually stabilized as investors assessed the long-term repercussions of the economic indicators.

The Impact of Bitcoin Halving

Bitcoin’s halving, a fundamental feature of the cryptocurrency’s protocol, has far-reaching implications. With a finite supply of 21 million Bitcoins, the regular halving event aims to combat inflation by reducing the issuance of new coins. This mechanism supports the value of Bitcoin and influences mining activity and supply dynamics. The recent halving in April 2024 has set the stage for future shifts in the cryptocurrency landscape.

Exploring the World of Cryptocurrency

Blockchain technology, the backbone of cryptocurrencies like Bitcoin, continues to revolutionize various industries such as banking, cybersecurity, and supply chain management. As digital currencies gain traction, more investors are venturing into the crypto space through platforms like Coinbase Global, BlockFi, and Binance. The rise of cryptocurrencies signals a shift in financial paradigms, attracting a younger demographic seeking decentralized financial alternatives.

Bitcoin’s Resilience and Future Outlook

Despite recent price fluctuations, Bitcoin remains a resilient asset with a dedicated investor base. As geopolitical events and market dynamics continue to shape its trajectory, understanding the nuances of cryptocurrency investing becomes essential for both seasoned and novice investors. The evolving landscape of digital assets poses both opportunities and challenges, underscoring the need for strategic decision-making and a comprehensive understanding of the cryptocurrency ecosystem.

The Ever-Evolving World of Bitcoin and Cryptocurrencies

No More Safe Bets: Bitcoin’s Financial Rollercoaster

Bitcoin’s journey to the summit in 2024 comes with its trademark wild swings. The realm of cryptocurrencies remains an arena for the bold, beckoning those unflinching in the face of risk. Fortunes have been forged, with Bitcoin rebounding from its 2022 plummet. Yet, it is also a realm where treasures may effortlessly slip away. For the more risk-averse investor, prudence may guide them towards other investment avenues.

Curious about the current Bitcoin investment landscape? Dive into our piece titled “Is Now a Good Time to Buy Bitcoin?”

The Cryptocurrency Titan: Satoshi Nakomoto

Within the cryptosphere, the enigmatic figure of Satoshi Nakomoto exerts a profound pull. Unveiling investigations into early Bitcoin vaults has unearthed a staggering revelation – Nakamoto is believed to command over 1 million of the nearly 19.5 million Bitcoins circulating across the digital frontier.

Elon Musk’s Crypto Odyssey

A gripping narrative unfolds around tech magnate Elon Musk – a colossus straddling the worlds of Bitcoin and the meme coin Dogecoin. Musk’s Twitter musings and Tesla’s strategic moves have steered the trajectories of these digital assets. While the exact extent of his holdings remains veiled, murmurs suggest a wealth in Bitcoin, Dogecoin, and Ether.

Tesla’s bold foray saw the EV stalwart pocketing US$1.5 billion in Bitcoin during 2021, only to shed 75 percent of this treasure trove the following year. As of February 2024, Tesla’s virtual coffers brimmed with an estimated 9,720 Bitcoin, marking a prominent spot as the third-largest Bitcoin stash among publicly traded entities.

In a poignant revelation on his digital pulpit in January 2024, Musk candidly affirmed, “I still own a bunch of Dogecoin, and SpaceX owns a bunch of Bitcoin.”

This insightful piece is a refreshed iteration of an article that debuted on the Investing News Network in 2021.