Earnings Fuel Stock Surge

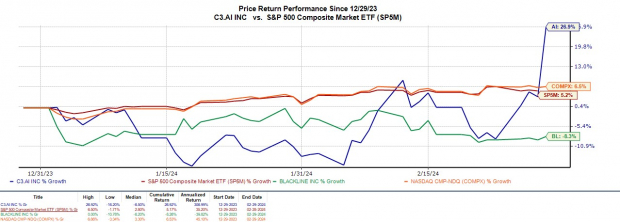

Enterprise AI software player, C3.ai, is riding high on a wave of enthusiasm post its latest earnings release with stocks skyrocketing over 20% today, outpacing many competitors including BlackLine (BL). The company’s robust quarterly results have been a major driving force behind this surge, setting C3.ai’s stock soaring up by a remarkable 27% year-to-date, easily outshining broader market indices and BlackLine’s -8% downturn.

Image Source: Zacks Investment Research

Robust Revenue Growth

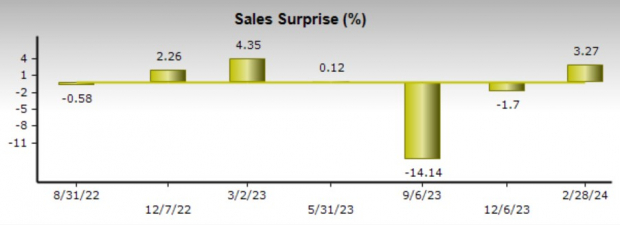

C3.ai, which went public in 2020, witnessed a significant rise in total sales by 18% during its recent fiscal quarter, reaching $78.4 million. The highlight though was the company’s report of an 80% year-over-year growth in customer engagement, a clear sign of soaring interest in its offerings. C3.ai inked 50 agreements during the quarter, a number that more than doubled from the previous year, showcasing growing demand. Notable clients in the list include Boston Scientific (BSX), T-Mobile (TMUS), AbbVie (ABBV), and even the U.S. Department of Defense.

Image Source: Zacks Investment Research

Intriguing Suite of Offerings

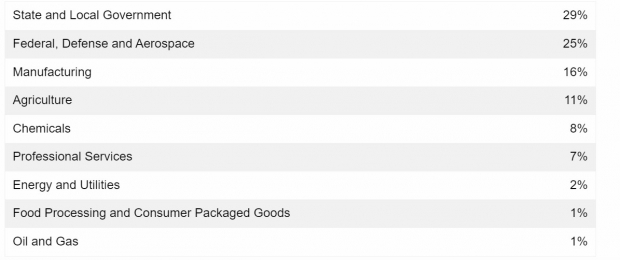

C3.ai’s suite of software solutions is making strong headway in the Enterprise AI landscape, attracting a diverse array of enterprises across industries. With the company positioning itself as a leader in AI-powered predictive maintenance solutions, its suite comprises various elements like C3 AI Application Platform, C3 AI Applications, C3 AI EX Machina (No-Code AI), C3 AI CRM, and C3 AI Data Vision. This comprehensive suite is driving market interest and propelling bookings to new heights.

Image Source: C3.ai Earnings Release

Positive Revenue Outlook

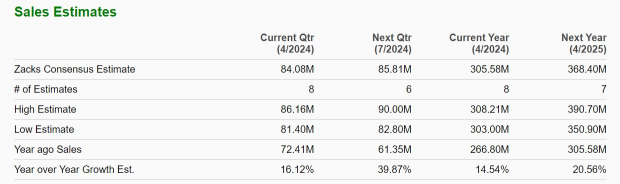

Looking ahead, C3.ai anticipates revenue in the range of $82-$86 million for its upcoming quarter, displaying a 16% growth trajectory. During its full-year fiscal 2024, the company projects total sales to hit approximately $306-$310 million, promising a 14% growth rate. Such positive revenue forecasts are undoubtedly adding to the bullish sentiment surrounding C3.ai.

Image Source: Zacks Investment Research

Looking Ahead

C3.ai has firmly positioned itself as a promising player in the artificial intelligence landscape. With its stock currently holding a Zacks Rank #3 (Hold), the future trajectory will heavily rely on forthcoming earnings estimate revisions. The company’s sustained top-line growth and the potential for profit generation make it an enticing proposition for investors eyeing long-term growth opportunities.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook, unveils 5 exciting stocks with immense growth potential in the AI sector. By 2030, the AI industry is expected to have a massive economic impact akin to that of the internet and iPhone. Automation is paving the way for groundbreaking advancements, freeing individuals to achieve the extraordinary.

Download Free ChatGPT Stock Report Right Now >>