In a surprising twist of fate, Chipotle Mexican Grill’s CEO Brian Niccol is set to depart for the helm of Starbucks. This transition has left investors contemplating which of these two retail restaurant giants is the superior stock option, especially with Niccol’s impending leadership at Starbucks come September.

Chipotle has seen remarkable growth under Niccol, with its stock skyrocketing over +200% in the last five years, a stark contrast to Starbucks’ -2% performance. However, past achievements do not guarantee future success, prompting investors to evaluate the current appeal of each stock.

Image Source: Zacks Investment Research

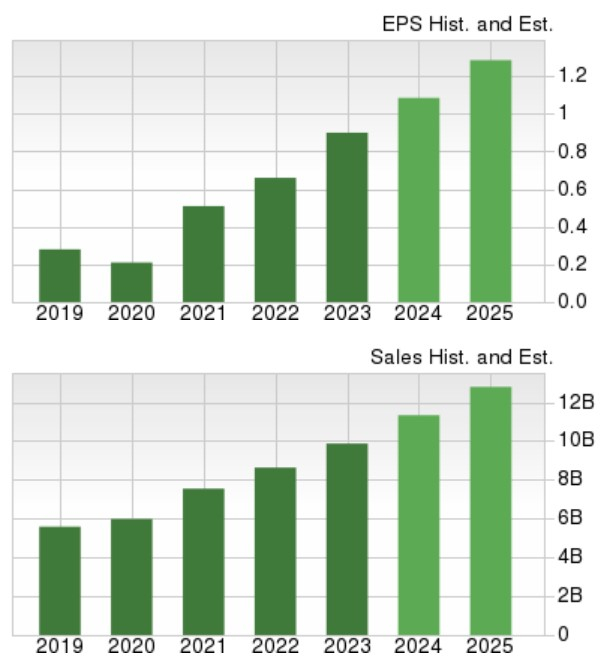

Growth Forecasts

After a groundbreaking 50-1 stock split in June, Chipotle is expected to witness a 20% surge in annual earnings in fiscal 2024, projecting $1.08 per share compared to last year’s EPS of $0.90. Chipotle’s total sales are forecasted to climb by 15% this year and a further 13% in FY25, reaching $12.79 billion.

Image Source: Zacks Investment Research

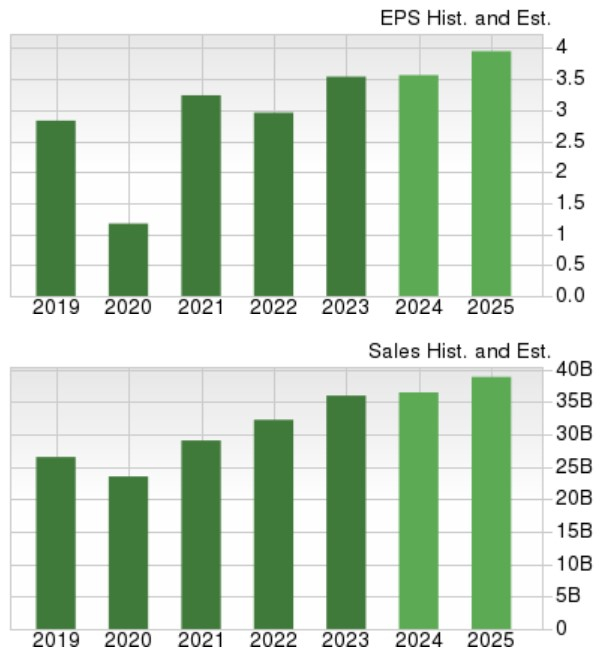

On the flip side, Starbucks is expected to experience nearly flat annual earnings in FY24, with a projected 11% increase in FY25 to $3.94 per share. Total sales for Starbucks are anticipated to rise by 1% in FY24 and a further 6% in the subsequent year, reaching $38.84 billion.

Image Source: Zacks Investment Research

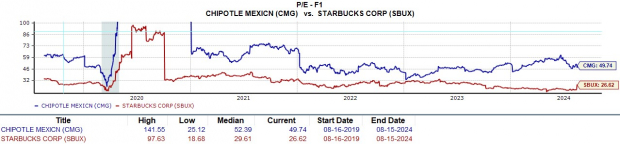

Valuation Assessment

While Chipotle boasts superior growth, Starbucks presents a more appealing valuation. Starbucks trades at 26.6X forward earnings, closely aligned with the S&P 500’s 23.3X. In contrast, Chipotle trades at a premium of 49.7X, signifying a noticeable deviation from the broader market.

Image Source: Zacks Investment Research

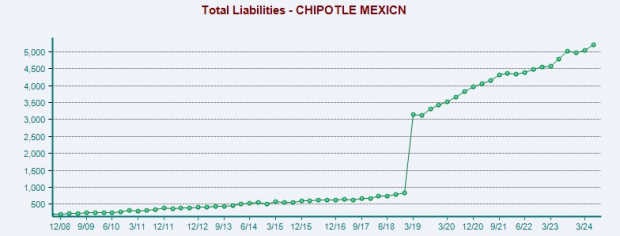

Financial Health Analysis

Financial robustness plays a pivotal role in stock selection. Chipotle showcases a strong balance sheet with $1.49 billion in cash & equivalents, $8.92 billion in total assets, and $5.2 billion in total liabilities.

Image Source: Zacks Investment Research

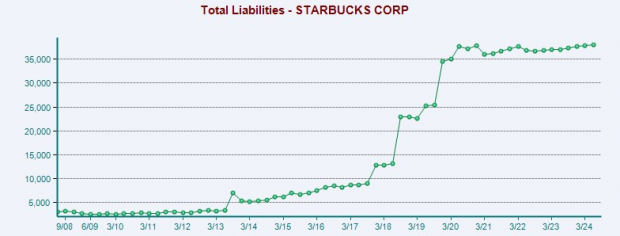

On the other hand, Starbucks possesses $3.39 billion in cash & equivalents but holds $38.04 billion in total liabilities against $30.11 billion in total assets.

Image Source: Zacks Investment Research

Final Considerations

Starbucks faces a critical need for operational restructuring due to concerns about insolvency reflected in the balance sheet. However, there is optimism that Brian Niccol might replicate the success he achieved at Chipotle in steering Starbucks to excellence. Currently, both Starbucks and Chipotle hold a Zacks Rank #3 (Hold), presenting as sound long-term investments despite potential upcoming buying opportunities.