A whirlwind Q3 in the crypto market grappled with price upheavals and shifts in investor sentiments.

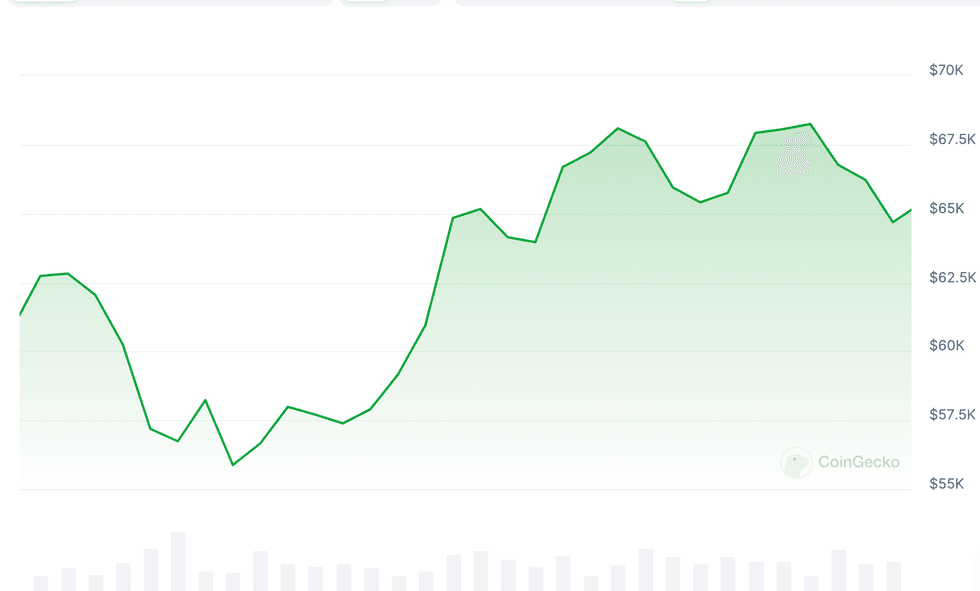

Leading cryptocurrency Bitcoin, often considered a touchstone for the sector, witnessed sharp price corrections at the onset of each month, with July and August experiencing steep declines surpassing 12 percent.

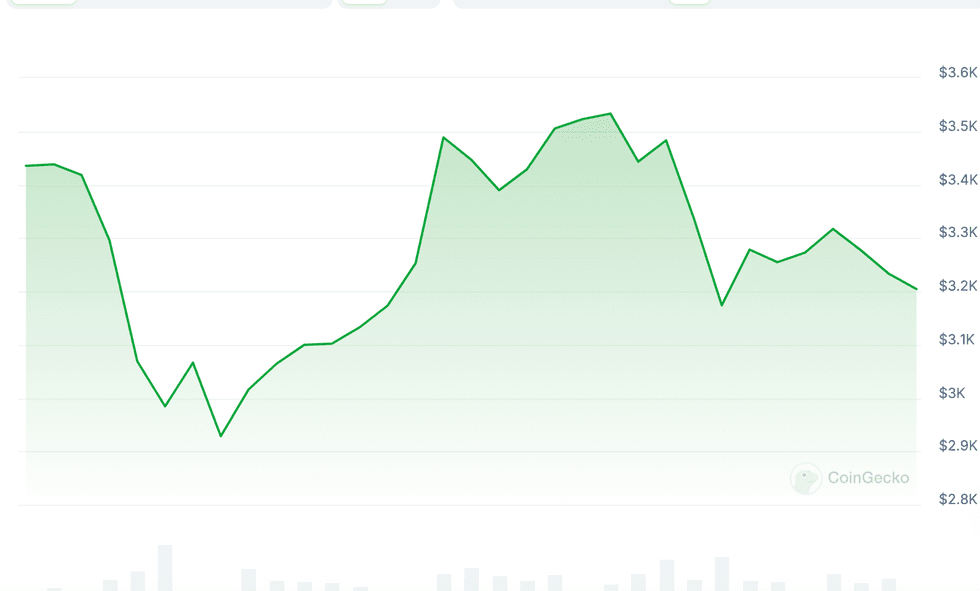

Meanwhile, Ethereum’s performance during Q3 indicated fading user engagement and network activity characterized by reduced daily active addresses compared to prior periods. In contrast, rival blockchains, notably Solana, observed a surge in user engagement, potentially hinting at a changing user preference away from Ethereum.

The Fluctuations of July in the Crypto Space

July unfolded as a dynamic period for the crypto market, rife with shifting trends and price movements. Cryptocurrencies emerged as a significant political catalyst after the withdrawal of incumbent president Joe Biden as the Democratic nominee, propelling Bitcoin’s price upwards. However, the month’s price undulations underscored its sensitivity to external factors, emphasizing the enduring impact of news and events on Bitcoin’s demand and supply dynamics.

Chart courtesy of CoinGecko.

Bitcoin price, July 2024.

Conversely, Ether faced an abrupt 8 percent decline in its valuation right after the launch of highly anticipated Ethereum exchange-traded funds (ETFs) on July 23. Despite this, the ETFs themselves performed admirably, showcasing an impressive daily growth rate throughout the month’s end.

Chart courtesy of CoinGecko.

Ether price, July 2024.

Meanwhile, Solana emerged as a standout performer, propelled by the burgeoning popularity of liquid staking protocols. Surpassing Bitcoin and Ether, Solana outshone other cryptos between July 11 and 21. Attention quickly pivoted to a potential Solana ETF, though analysts deemed this improbable in the immediate future. Surpassing Ethereum, Solana’s decentralized exchanges processed more on-chain volume than Ethereum in July.

Despite some market turbulence, the CoinDesk 20 Index wrapped up the month with a 1.98 percent gain.

A Struggling August for Crypto Markets

August kicked off with turmoil as macroeconomic challenges triggered a wave of sell-offs that reverberated across the economy after the Bank of Japan surprisingly raised interest rates on July 31.

In the US, employment data stoked recession fears and sparked a widespread stock market plunge. By August 5, the crypto sector had shed US$510 billion, pulling Bitcoin below US$50,000, its lowest valuation since February.

While broader markets swiftly rebounded, Bitcoin and Ether’s prices remained subdued as a “death cross” pattern formed in Bitcoin’s price action, historically indicating a potential further decline.

Chart courtesy of CoinGecko.

Crypto sector market cap, August 2024.

The downturn was exacerbated by a surge in short-selling activity. Initially providing some purchasing support post-plunge, institutional investors swiftly scrambled to buy digital assets at lower prices, but this proved to be a brief respite.

As the month progressed, momentum decisively favored sellers, with many likely capitalizing on shorting Bitcoin and other cryptocurrencies, further amplifying downward pressure.

Enthusiasm for Ethereum ETFs also waned as August unfolded.

Cryptocurrency Market Insights: A Look into Q4 2024

September: A Resilient Month for Bitcoin and Ether

September, traditionally bearish for crypto, defied expectations with Bitcoin and Ether breaking through resistance levels. The US Federal Reserve’s interest rate cut on September 18 acted as a catalyst for price surges, while stablecoin valuations, particularly for XRP, experienced a notable uptick following Grayscale’s XRP Token Trust launch on September 12. Rekt Capital’s analysis suggested a potential transition to a bull cycle for Bitcoin heading into Q4, with the month closing up 7.39 percent at just above US$64,540.

BlackRock’s Ethereum ETF Hits Milestone

At the end of Q3, BlackRock’s spot Ethereum ETF exceeded US$1 billion in value for the first time, underscoring the growing interest in digital assets.

Notable Factors to Monitor in Q4

A report by WonderFi highlighted the increasing stability in Bitcoin prices, indicating potential maturation as an asset class. Global liquidity and political developments are poised to impact the crypto market in Q4. Experts like Matt Hougan and Ric Edelman foresee a successful quarter for Solana and Ethereum, echoing positive sentiments expressed by industry analysts.

The forthcoming election stands as a pivotal event in Q4, with potential implications on crypto regulations and policies. Projections from Bernstein Private Wealth Management suggested varying outcomes for Bitcoin prices based on the election results, reflecting the industry’s close attention to regulatory changes.

The debate surrounding regulatory oversight, particularly concerning the SEC’s role in crypto regulation, remains a point of contention within the industry. Calls for a shift in regulatory responsibility to the Commodity Futures Trading Commission have surfaced, underlining the need for clear guidelines in the evolving crypto landscape.

Legislative Developments and Industry Dynamics

Key legislative initiatives like FIT21 and the BRIDGE Digital Assets Act are significant milestones toward regulatory clarity and consumer protection in the crypto space. The House’s upcoming session in November holds the potential for further advancements in crypto-related legislation and oversight.

Key Takeaway for Investors

As the crypto market continues to evolve and attract institutional interest, the final quarter of 2024 emerges as a critical period for industry growth. With shifting regulations, expanding adoption, and the surge in altcoin enthusiasm, investors can anticipate notable developments and innovations in the ever-changing crypto landscape.

Don’t forget to follow us @INN_Technology for real-time updates!