Ford Motor Company (NYSE: F) recently revealed its fourth-quarter sales figures, signaling high-water marks with electric vehicle (EV) sales. The exuberant news was marred, however, by the discovery that this milestone driving billions of dollars in losses. Yet, for investors, this seemingly paradoxical development is actually a reason to rejoice.

Examining the Details

During 2023, Ford’s U.S. sales surged by 7.1% to nearly 2 million vehicles, propelled by robust performance in the F-Series full-size trucks, commercial vehicles, and an unprecedented year with electric vehicles. The F-Series, Ford’s pivotal product, continued to assert its dominance in the market, a feat it has achieved for the 47th consecutive year for best-selling truck and 42nd consecutive year for best-selling vehicle in America. This unflagging triumph, which Ford’s primary competitor, General Motors, divides between its two brands, the Chevrolet Silverado and the GMC Sierra, has significant implications. Most notably, it demonstrates that Ford’s mastery in full-size gasoline-powered trucks can effortlessly transition to EVs, a pivotal component in fortifying the company’s financial foundation.

Discussing EVs

The triumph in EV sales was undeniably momentous. Ford’s EVs notched extraordinary fourth-quarter sales, culminating in a record-breaking full year. The iconic automaker sold almost 26,000 EVs during the last quarter, representing a 24% surge from the third quarter and an 18% increase annually. This surge was predominantly fueled by the F-150 Lightning, which registered a staggering 74% spike in sales year over year in the fourth quarter and a 55% rise throughout the year. In tandem with the Mustang Mach-E and the E-Transit, Ford solidified its position as America’s second-leading EV brand for 2023.

The Bitter Pill

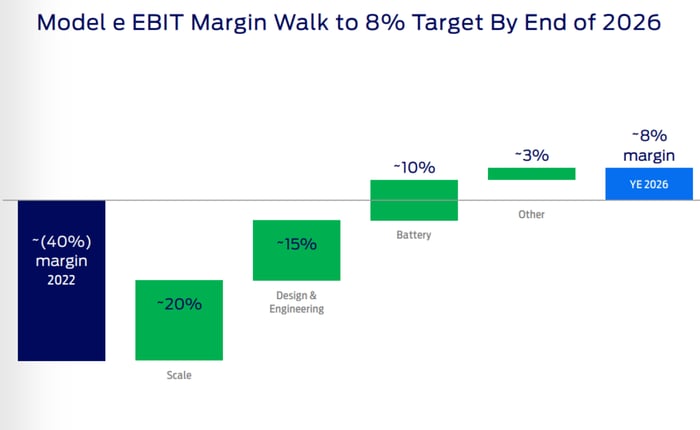

The crux of Ford’s record-breaking EV sales lies in a distressing reality; the company is hemorrhaging cash with every EV it produces. Ford had previously forecasted losses of about $4.5 billion for 2023 in its EV business unit, Model e. Although management is sanguine about steering the unit towards profitability by the end of 2026 by driving down costs and escalating production, in the interim, the achievement of record EV sales translates to diminished full-year earnings. Nevertheless, as the adage goes, the night is darkest before the dawn. Ford’s obligation to garner these quarterly EV records is an essential step towards eventually trimming overheads and pivoting towards profitability, hinting at an imminent dawn after the darkness.

Data source: Ford Motor Company presentation.

Looking Ahead

Despite concluding 2023 with a modest increase in sales, Ford anticipates substantial growth in 2024, propelled by its supremacy in full-size trucks and SUVs. The impending launch of new F-150s, Rangers, Explorers, Expeditions, as well as Lincoln Aviators, Navigators, and Nautilus, underscores the company’s bullish outlook for the forthcoming year. Moreover, notwithstanding the prevailing narrative highlighting Ford’s substantial EV losses, the company’s sustained pursuit of record-breaking EV sales is a pivotal step towards accelerating its journey to profitability.