What a rollercoaster 2023 was for the Nasdaq Composite index. After enduring a drastic 33% plunge in 2022, it remarkably rebounded by more than 43% last year. Remarkably, historical data points to a potentially profitable year following a significant rebound, just like 2023, and yielding substantial double-digit returns.

Admittedly, every economic context is distinct, and there are underlying factors that could dictate the Nasdaq’s performance in 2024. Notably, the initial week of the year revealed a shift in investor behavior, as some opted to offload technology stocks in favor of dividend-yielding assets like utilities and real estate investment trusts (REITs).

Cathie Wood’s Re-Entry

Renowned investor Cathie Wood has once again dived into the realm of Tesla (NASDAQ: TSLA) shares. After a prolonged period of offloading Tesla in 2023, especially as the stock doubled in value, the stalwart Tesla advocate began accumulating shares towards the end of the year, and subsequently embraced an aggressive stance at the outset of 2024.

Wood’s conviction in Tesla’s potential encompasses various aspects, including the anticipated extensive deployment of self-driving robotaxis in the coming years. While this forecast might not garner unanimous support, there are other pivotal catalysts that might propel Tesla’s stock price upwards.

Sustained Growth in EV Sales

The initial exuberance surrounding the growth rate of electric vehicle (EV) sales has somewhat tempered. Despite Tesla achieving a 38% surge in vehicle sales and a 35% production spike in 2023, forecasts hint at an even more subdued growth rate for 2024.

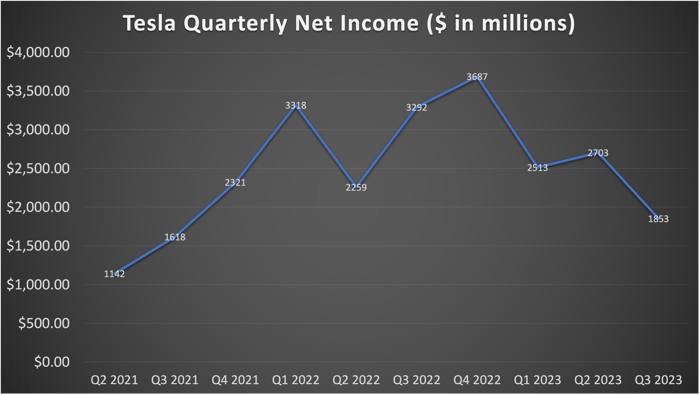

Data source: Tesla. Chart by author.

Despite the growth in vehicle volume, the competitive tussle for market share has impinged on profit margins, resulting in a decline in net income.

Nevertheless, Tesla remains among the select group of global automakers that are lucratively retailing EVs on a large scale. Notably, the company’s revenue from its energy segment burgeoned from approximately $600 million in Q1 2022 to over $1.5 billion in Q3 2023. As the demand for energy storage facilities intensifies among utilities and businesses, this revenue source is poised for further expansion.

The Diverse Stock Landscape

The Nasdaq Composite might continue its upward trajectory in 2024, mirroring historical patterns. However, if the Federal Reserve embarks on an interest rate reduction cycle, dividend-yielding stocks could emerge as the forerunners in 2024. Notably, it’s crucial to underscore that the market is an amalgamation of individual equities and enterprises.

While Tesla remains committed to bolstering its profits and expanding its vehicle production and energy ventures, it is also augmenting its revenue by compelling other automakers to leverage its charging infrastructure, thereby enticing a larger pool of potential EV buyers.

Despite these being overarching long-term growth strategies, Tesla must resuscitate its profit margins through cost reduction or justifiably increasing EV prices to witness an immediate stock upsurge. Investors with a firm belief in Tesla’s long-term trajectory ought to opportunistically leverage any potential pullback in the stock after the substantial gains witnessed in 2023. This mirrors Cathie Wood’s approach as the year unfolds.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of December 18, 2023

Howard Smith has positions in Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.