The past isn’t a crystal ball, but, at times, it can offer valuable insight into the future. An analysis of an index’s historical performance can reveal patterns that may recur in the present and future. This rings true for the Nasdaq Composite, pinning an optimistic prophecy for a substantial upsurge in 2024.

Since its establishment in the early 1970s, the Nasdaq has displayed a consistent trend: following an annual decline, it has registered gains for at least two consecutive years. Particularly, after every annual loss of 10% or more, the Nasdaq has soared by an average of 56% over the subsequent two years. Coupling this with last year’s 43% ascent, if history maintains its course, the index could be poised for another double-digit boost in 2024.

The AI Frontier: Leading Stocks for the Nasdaq Surge

Benefiting from a buoyant Nasdaq entails investing in companies that exert substantial influence on the index’s trajectory – specifically the top 10 most heavily weighted companies – and filtering for entities that currently present compelling growth prospects. This brings attention to two enterprises expected to spearhead the realm of artificial intelligence (AI), within a market projected to surpass $1.3 trillion by 2030. Let’s delve into two groundbreaking AI stocks to consider prior to the anticipated Nasdaq surge.

Image source: Getty Images.

Nvidia: Pioneering AI with Dominance in GPU Market

Nvidia (NASDAQ: NVDA) initially gained prominence in the gaming and graphics sectors, leveraging its graphics processing units (GPUs) to fuel earnings expansion. However, the widespread adoption of GPUs beyond gaming has propelled Nvidia’s sales and share price to new heights.

These potent chips facilitate concurrent task handling by distributing work across multiple processors, significantly accelerating operations. This attribute renders Nvidia’s GPUs indispensable for AI, acting as the cornerstone for the “deep learning” integral to generative AI. Consequently, industries spanning healthcare to automotive are turning to Nvidia chips to fuel their AI initiatives.

In the most recent quarter, Nvidia recorded a record revenue of $18 billion, driven by unprecedented data center revenue, a segment reaping the rewards of the burgeoning AI market. Data center revenue skyrocketed by an impressive 279% to exceed $14 billion. The company not only surpassed operating expenses with an operating income of $10 billion but also exhibited a substantial increase in research and development spending, underscoring Nvidia’s strategic investments to sustain its leadership.

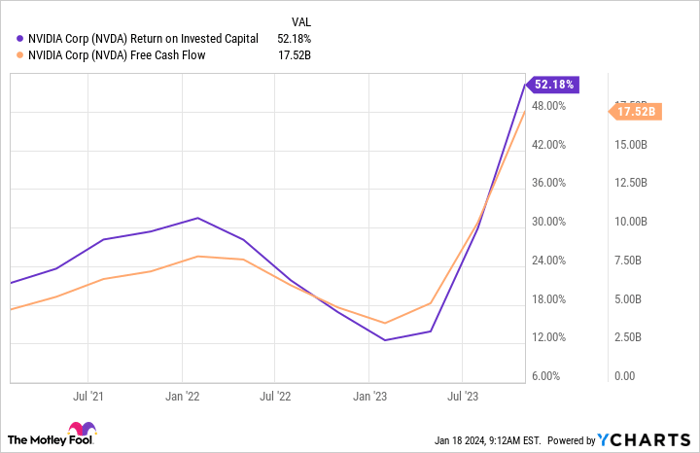

Metrics such as free cash flow and return on invested capital have ascended over the past year, a testament to Nvidia’s astute cash deployment and the fruits reaped from these investments.

NVDA Return on Invested Capital data by YCharts

Nvidia currently commands over 80% of the GPU market. Although competitors have multiplied, the company’s pioneering stance, exceptional product, and an entrenched base of Nvidia GPU enthusiasts make it well-positioned to maintain its dominance.

An illustration emerges from the central processing unit (CPU) domain. While Advanced Micro Devices (AMD) has augmented its laptop CPU market share to 22% over a decade, it has not managed to dislodge leader Intel from its commanding 69% grasp. This scenario portends potential market share gains for AMD in the GPU space without necessarily unsettling Nvidia’s supremacy.

Despite Nvidia’s recent surge, its earnings growth, market leadership, and pivotal role in AI insinuate significant room for further advancement. Moreover, an equity market climate favoring growth bolsters the outlook for Nvidia, rendering it a top-tier stock to consider before the impending Nasdaq hike.

Alphabet: Spearheading AI-Infused Innovation

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is woven into our daily routines courtesy of its ubiquitous search engine, Google. The mainstay of its revenue stems from ad sales targeted at capturing our attention during online information quests. Alphabet’s allure to advertisers is grounded in Google’s entrenched dominance of the search market, which has consistently eclipsed a 90% share. Two compelling factors fortify this market supremacy.

Primarily, human inertia favors steadfast commitment to habit, as most individuals are inclined to perpetuate “Googling” rather than exploring rival search engines. Hence, Alphabet enjoys a robust competitive advantage that indisputably fortifies its market leadership.

Furthermore, Alphabet’s substantial investments in AI to enhance its search capabilities not only consolidate user satisfaction but also fortify advertiser appeal as ad traffic is bolstered by superior user pull.

The company recently unveiled a significant stride in its AI journey with the launch of Gemini, its most expansive and high-performance AI model till date. Gemini’s operational scope spans diverse information formats including text, code, image, and video. With three distinct sizes, Gemini tackles assorted functions like answering complex queries and generating code in prevalent programming languages.

Gemini carries the potential to enrich the Google Search experience and outcomes, thereby fortifying Alphabet’s eminence. Alphabet’s strategic integration of Gemini across its products, like the Pixel smartphone, and its availability to cloud customers underscores its potential to revolutionize the company’s products and services.