Essentials and Beyond

‘Death and taxes’ are part of the trite saying about things that will be with mankind forever. Intuit’s innovative TurboTax software helped it post an impressive streak of double-digit revenue growth that’s seen it expand from under $1 billion in sales in the late 1990s to over $14 billion in FY23.

Intuit utilized the Covid boom to expand its software portfolio into other areas of consumer finance, as well as email marketing, digital-ad services, and more.

Inuit has amassed over 100 million customers across TurboTax, QuickBooks, Credit Karma, and Mailchimp. Inuit’s array of offerings help it benefit from the expansion of multiple key segments of the economy that are unlikely to go out of style anytime soon.

TurboTax is the most recognizable and consumer facing part of its business. But Inuit’s wider consumer unit accounted for only 29% of fiscal 2023 revenues. Credit Karma, which offers personal finance services including credit cards, loans, and insurance, made up 11%.

Meanwhile, its small business and self-employed group made up 56% of fiscal 2023 sales. Intuit’s offerings such as QuickBooks serve small businesses and self-employed people around the world via financial and business-management services, payroll solutions, merchant payment processing, financing for small businesses, and more.

Growth Outlook

Intuit is projected to grow its revenue by 12% in both FY24 and FY25 to bring its streak of double-digit sales expansion to 10 years running. The company is set to jump from $14.37 billion in FY23 to $18.00 billion in FY25.

Inuit is projected to grow its adjusted 2024 earnings by 14%, based on the most recent Zacks estimates. The firm is then expected to add another 15% to the bottom-line next year. INTU’s improving EPS outlook helps it land a Zacks Rank #2 (Buy) and it has crushed our EPS estimates by an average of 16% in the trailing four quarters.

Image Source: Zacks Investment Research

Performance, Technical Levels & Valuation

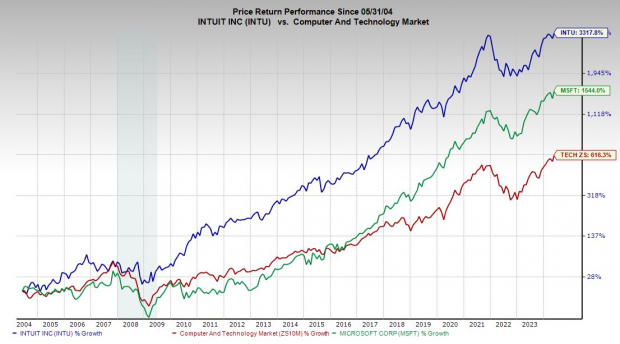

Intuit has blown away the Zacks Tech sector over the past 20 years, up 3,300% vs. 615%. INTU has also doubled fellow tech giant Microsoft (MSFT) during the past two decades. INTU has surged 80% in the past two years to easily outpace Microsoft and more than double Apple (AAPL).

INTU is back above its long-term 21-week moving average and trading above its 21-day and 50-day. The nearby chart showcases that Intuit could be ready to break out to new records if it provides upbeat guidance on May 23.

Image Source: Zacks Investment Research

Intuit is hardly a value stock, trading at 51.7X forward 12-month earnings. But this marks a 40% discount to its 10-year highs despite soaring 740% during the stretch. And Wall Street has been willing to pay up for INTU’s consistent growth for the last 10 years.

Bottom Line

Inuit buys back a ton of stock, with $2.7 billion remaining on the company’s share repurchase plan. Wall Street also loves Inuit, with 24 of the 29 brokerage recommendations Zacks has at “Strong Buys,” alongside zero sells.

Intuit boosted its FY24 dividend by 15%, with it yielding a small 0.5% at the moment. But its dividend is a bonus for a company that is still growing at such an impressive clip and crushing the market and the tech sector.