As July nears its end, investors find themselves fervently embracing small-cap stocks, their optimism spurred by rosy prospects in the realm of interest-rate-sensitive equities. The long-shadowed tide appears to be turning as the market edges closer to the onset of a Federal Reserve rate cut cycle.

The saga of this flaring sentiment unfolds notably in the month of July. Small caps have decisively outplayed their larger counterparts, triumphing especially in the tech domain, which reigned supreme during the nearly two-year bull charge.

A standout in this narrative is the Russell 2000 index, flaunting an impressive nearly 9% surge month-to-date, a stark contrast to the 3.6% retreat observed in the tech-heavy Nasdaq 100 as of the 25th of July.

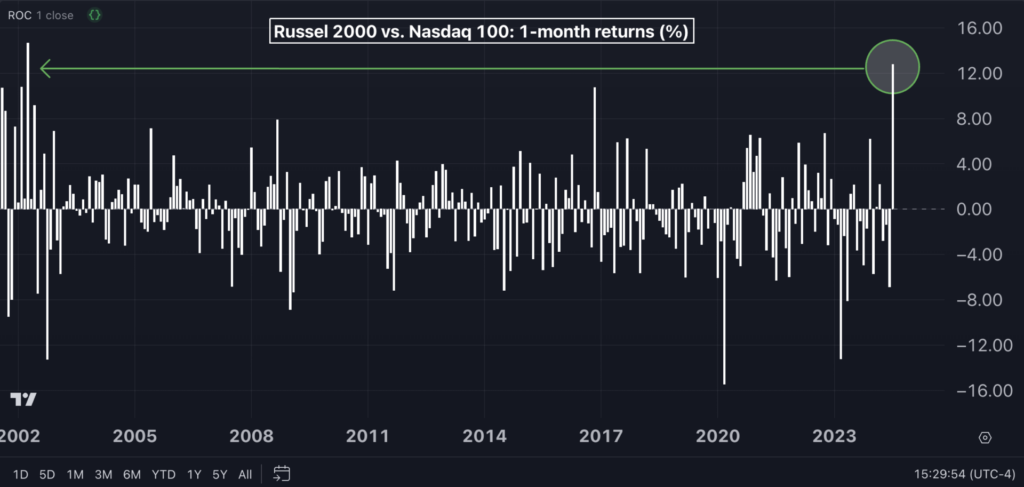

With a performance gap of nearly 13 percentage points favoring the Russell 2000 over tech, this month accounts for the most towering victory in the “long small cap, short tech” maneuver since April 2002, underscored by the vigor and agility animating the current market rotation.

Evolution of the Trade: A Two-Decade Best for the ‘Long Russell 2000, Short Nasdaq 100’

Fund Surge in Small-Cap ETFs

The spirited march of small-cap stocks resonates in the substantial inflows witnessed by key small-cap-focused ETFs.

The iShares Russell 2000 ETF IWM, among the significant ETFs tracking the U.S. small-cap index, tallied over $6 billion in net inflows this month, marking the apex of 2024 to date according to data from Etfdb.com.

Several other small-cap ETFs have also attracted notable investor funds this month:

- iShares Core S&P Small-Cap ETF IJR: $645 million in net inflows

- Avantis U.S. Small Cap Value ETF AVUV: $553.28 million in net inflows

- Invesco S&P SmallCap Momentum ETF XSMO: $350 million in net inflows

- SPDR Portfolio S&P 600 Small Cap ETF SPSM: $188 million in net inflows

Year-to-date, the Vanguard Small-Cap ETF VB and the Pacer US Small Cap Cash Cows 100 ETF CALF have amassed substantial investor capital, clocking $3.1 billion and $2.9 billion, respectively.

Differing Viewpoints

Contrary voices break through the jubilation surrounding the Russell 2000 index and the hefty inflows into small-cap ETFs as several experts counsel prudence.

“Investors and analysts stake their hopes on the Federal Reserve’s tightening cycle coming to a halt, heralding better times for smaller enterprises, particularly those reliant on debt for their operations. We remain skeptical,” opined veteran Wall Street stalwart Ed Yardeni in a recent missive.

Large corporations, especially in the tech sector, bear strengths that smaller players grapple to match, he noted.

For instance, major tech behemoths are cushioned with substantial cash reserves, affording them the luxury of backing hefty capital expenditures and R&D budgets, thereby securing their competitive edge.

A quick look at Alphabet Inc. GOOGL, which closed last quarter with a cash hoard of $111 billion, or Amazon.com Inc. AMZN and Microsoft Corp. MSFT boasting cash reserves of $87 billion and $80 billion, respectively, exemplifies this financial prowess.

Such financial maneuverability opens avenues for strategic acquisitions of smaller firms with novel technology or business verticals. Microsoft’s $10 billion plunge into OpenAI, creators of ChatGPT, last year serves as a testament to this capacity.

Yardeni postulates that the most rapidly expanding, high-potential firms may have already forged alliances with large-cap entities or private equity investors.

“This, naturally, hints at the stragglers being left to wander the S&P 400 and S&P 600 realm—indicating that investors may pivot back to larger-cap options sooner rather than later,” he concluded.