Deciphering Market Signals

Fluctuations in the stock market can sometimes resemble a complex puzzle. Amidst the chaos, there are instances where clarity emerges, and the path ahead becomes unmistakably clear. Today, all eyes are on Apple Inc. (NASDAQ:AAPL), the undoubted alpha of the S&P 500.

It’s intriguing how the movements of Apple serve as a compass for the broader market’s direction. If Apple steps in a certain direction, the market tends to follow suit.

The Chart Speaks Volumes

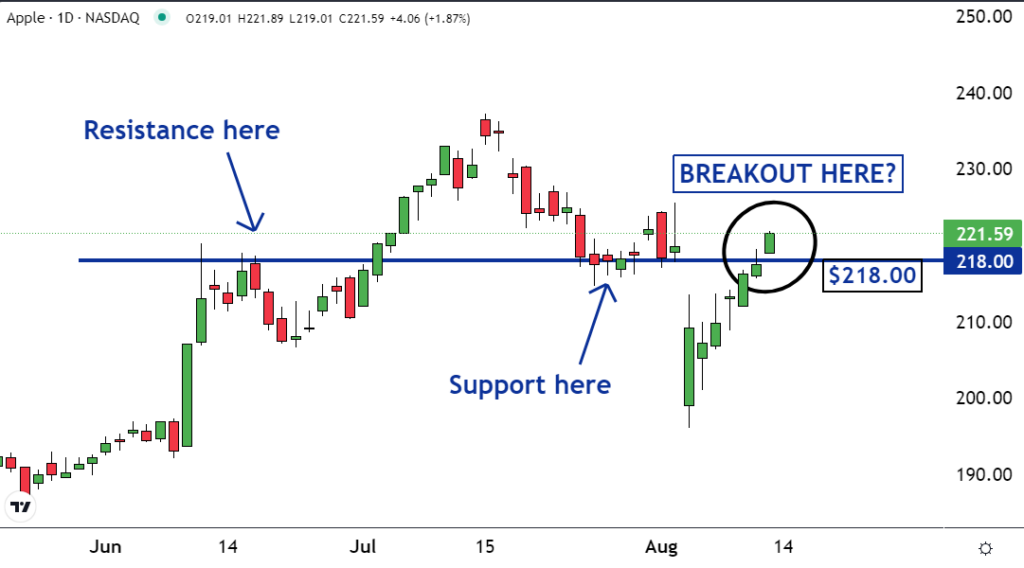

A glance at the chart reveals a significant development – a breakout. The shares of Apple are seen surging, piercing through critical resistance levels.

Breakouts aren’t mere symbolism; they signify a shift in the market dynamics. The breach of resistance indicates that the sellers who once impeded the stock’s rise have now exited, either completing their sales or retracting their orders.

This absence of supply could lay the groundwork for further upward momentum. When fresh buyers enter the scene, they’ll encounter a scarcity of sellers, potentially driving prices upwards as they strive to secure shares, consequently propelling AAPL into a new uptrend.

Support Turned Resistance

The recent resistance observed around the $218 mark was, notably, a support level back in late July. However, in the ever-evolving market dynamics, former support can morph into resistance as a consequence of “buyer’s remorse.”

When the price rebounded to the previous support level, disillusioned buyers who purchased AAPL at that point might have regretted their decisions and opted to sell. This influx of sell orders from remorseful buyers could generate resistance, hindering the stock’s ascent.

Many traders who anchored their positions on AAPL during its support phase might find themselves on the wrong side of the trade as prices dipped below their acquisition levels. Faced with losses, some may be itching to exit their positions.

If Apple manages to hold above this resistance zone, the ripple effect could be substantial. Just like an alpha canine asserts its dominance over a pack, Apple could establish itself as the alpha stock that charts the course for the rest of the market.

Market Forecasts and Insights

As we navigate the intricate web of market dynamics, it’s crucial to anticipate the implications of Apple’s trajectory on the broader financial landscape. The current scenario paints Apple as the lodestar, guiding the market through its ups and downs.

Stay tuned as Apple’s journey unfolds – as the alpha stock, its influence could dictate the market’s path in the days to come.