The recommendations of Wall Street analysts often sway investor decisions, creating ripples that affect a stock’s journey through the market. The question arises – should investors dance to this tune?

Let’s delve into the realm of brokerage recommendations and peer into the looking glass of Wall Street experts to discern their thoughts surrounding ServiceNow (NYSE:NOW).

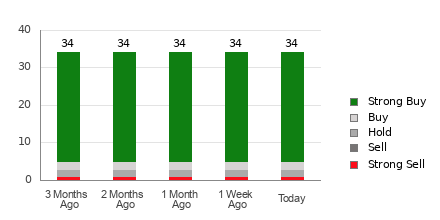

ServiceNow currently boasts an average brokerage recommendation of 1.29, teetering between Strong Buy and Buy, assembled from the insights of 34 brokerage firms. Of these, 29 endorse a Strong Buy, while two advocate for a Buy, representing 85.3% and 5.9% of all recommendations, respectively.

The Fluttering Winds of Brokerage Recommendations for ServiceNow

Despite the siren call to buy, prudence dictates not jumping blindly. Numerous studies unveil the limited impact of brokerage affirmations in steering investors towards stocks with maximum price growth potential.

But why the skepticism? The vested interests of brokerage firms mold a rosy bias, with a glaring ratio of analysts slipping a “Strong Sell” badge for every five “Strong Buy” decorations. This misalignment paints a cloudy picture, nudging investors into murkier waters rather than shedding light on a stock’s future trajectory.

Alas, relying solely on brokerage whispers may not be the wisest choice. Turning to tools like the Zacks Rank, a battle-scarred predictor of stock fortunes, could potentially guide investors towards sunnier shores.

Navigating the Path: ABR versus Zacks Rank

Juggling two universes – ABR and Zacks Rank – both cloaked in a 1-5 attire, but dancing to different tunes.

ABR, a brokerage pinnacle, painted with decimals, whispers tales of analysts’ whims. On the flip side, Zacks Rank, a quantitative machine fueled by earnings estimates, narrates a different saga, etched in whole numbers.

Brokerage mascots, bedecked in optimism, often slip on rose-tinted glasses to bolster their favorites, blurring the lines between fact and fancy. However, the Zacks Rank, tethered to earnings estimate tides, charts a more grounded path, its steps synchronized with stock price musings.

Beyond the veil, earnings estimate revisions, the heartbeat of the Zacks Rank, paint a stable picture for ServiceNow, resting at a steady $13.75 Consensus Estimate. Analysts’ steadfast views whisper of steady earnings horizons, beckoning the stock to march in harmony with broader markets, nesting it at a Zacks Rank #3 (Hold).

Ergo, while the siren call of a Buy-equivalent ABR thrums loudly for ServiceNow, a prudent ear to the winds might advise a second glance.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.