The Numbers Speak: A Deep Dive into Analyst Recommendations

Investors often ponder over Wall Street analysts’ advice when contemplating their next financial move. The buzz around brokerage firms’ ratings could sway a stock’s trajectory, but how reliable are these opinions?

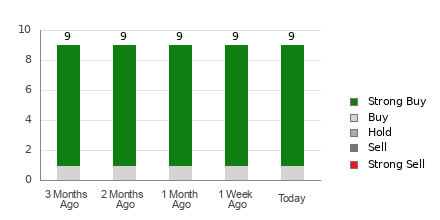

Currently, Vistra Corp. (VST) boasts an Average Brokerage Recommendation (ABR) of 1.11. This scale, ranging from 1 to 5 (Strong Buy to Strong Sell), amalgamates the insights of nine brokerage firms. In layman’s terms, the ABR of 1.11 leans towards a Strong Buy endorsement.

Among the nine guiding voices, a predominant majority chants ‘Strong Buy,’ encompassing 88.9% of the choir, leaving a meager 11.1% in the soothing ‘Buy’ camp.

Insightful Trends in Brokerage Recommendations for VST

While the choir sings in unison for Vistra, it’s wise not to solely anchor your investment decision on this chorus. Studies reveal the questionable efficacy of brokerage recommendations in predicting stocks with robust price potential.

Ever wondered why? Brokerage firms’ entrenched interests often perfume analysts’ ratings with an intoxicatingly positive bias towards stocks they cover. For every “Strong Sell,” there bloom five “Strong Buy” ratings, revealing a misalignment in advisors’ verse with retail investors’ song. Such discordant serenades seldom forecast a stock’s true trajectory, warranting caution.

Our proprietary Zacks Rank emerges as a formidable stalwart in this melody of stock assessments. Backed by an externally audited accolade, this tool categorizes stocks into five leagues, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It unveils a stock’s near-future ovation, resonating through earnings estimate revisions.

Distinction between ABR and Zacks Rank

ABR and Zacks Rank, though clad in the common 1-5 attire, waltz to different tunes.

ABR grooves to brokerage recommendations’ rhythm, shimmering in decimal nuances. Conversely, Zacks Rank leads a quantitative symphony, harmonizing investors’ cavalcade with earnings estimate revisions. This empirical motif underscores analysts’ overzealous optimism bred by brokerage affiliations.

As Zacks Rank pirouettes to the cadence of earnings estimate trends, a harmonious resonance with stock price movements unfolds. It refurbishes its rankings with nimble glee in response to shifting business sonnets, unlike the time-lagged ABR.

To Invest or Not to Invest in VST: That is the Question

Delving into Vistra’s earnings landscape unveils an unflinching Zacks Consensus Estimate of $4.86 for the current year, untouched by tempestuous winds of change.

This steadfast analyst mien towards the company’s earnings voyage, underpins a Zacks Rank #3 (Hold) for Vistra. Such stability hints at a performance in sync with the market’s tempo.

Prudence whispers to tread lightly on the Buy-equivocal ABR path for Vistra.