In a stunning move that cements its bullish outlook on Nvidia Corp, legendary hedge fund Coatue Management LLC, under the guidance of Philippe Laffont, has significantly ramped up its position in the chip giant.

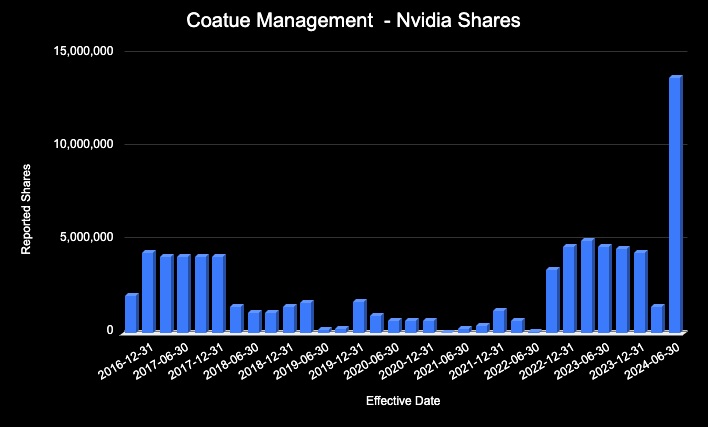

During the second quarter of 2024, Coatue boosted its stake in Nvidia by a staggering 893%, surging from 1.39 million shares at the end of Q1 to a remarkable 13.75 million shares by the close of Q2, showcasing the fund’s unwavering confidence in Nvidia’s future trajectory.

Chart created by author using data from SEC 13F filings

Coatue’s Mega-Buy: Unveiling the Motivation

Coatue’s substantial stock acquisition follows Nvidia’s ongoing dominance in the semiconductor sector, particularly in domains like artificial intelligence and high-performance computing. The decision to amplify its stake nearly tenfold, now valued at around $1.7 billion, stands as a bold testament to Coatue’s conviction in Nvidia’s enduring growth prospects.

From Uncertainty to Supremacy

Interestingly, Coatue had previously trimmed its Nvidia holdings in prior quarters, making a remarkable reversal this time. The notable leap from 1.39 million shares to 13.75 million shares represents one of the most significant strategic shifts for the fund in recent history. The pivotal question now lingers on whether this substantial wager will reap rewards as Nvidia rides the crest of AI and gaming demand.

A Milestone for Coatue

This expansion is not merely ordinary; it marks a historic milestone for Coatue. The 893% surge in ownership underscores the hedge fund’s resolute confidence in Nvidia’s market supremacy. Given Nvidia’s pivotal role in the AI surge, Coatue’s move evidently hinges on expectations of sustained, long-term sector growth.

Nvidia: Jewel in Coatue’s Crown?

With this strategic maneuver, Nvidia now forms a substantial segment of Coatue’s portfolio, comprising 6.61% of the fund’s overall holdings. This represents a substantial rise from a mere 4.91% in the preceding quarter, underscoring how the chipmaker has evolved into a core element of Coatue’s investment approach.

The Path Ahead

While Coatue’s bet on Nvidia is bold, it is underpinned by calculated rationale. Nvidia’s leading stance in burgeoning markets such as AI, data centers, and gaming suggests the stock might witness further upswings in the forthcoming months.

For Coatue, this near-tenfold surge in stake could potentially lay the groundwork for even grander plays on the tech titan’s future.

Read Also: Nvidia’s Rebound Rally Adds Billions To Market Value, Analysts Eye AI Growth: Report

Photo: Shutterstock