As the financial markets set course for the commencement of 2024, most major indices, with the notable exception of the Russell 2000 ($IWM), are positioned near all-time highs. The S&P 500, Dow Jones Industrial Average, and the NASDAQ Composite are all on the brink of record levels, igniting hopes of a prolonged bullish rally.

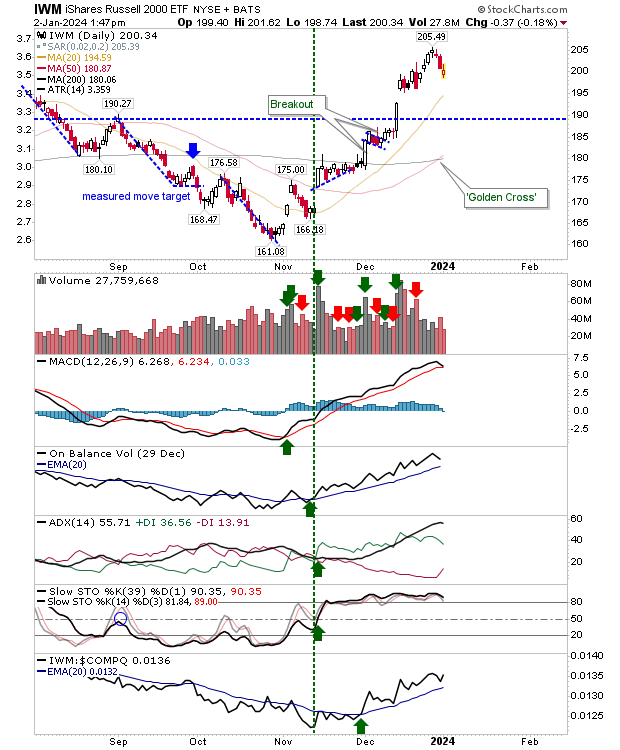

S&P 500-Monthly Chart

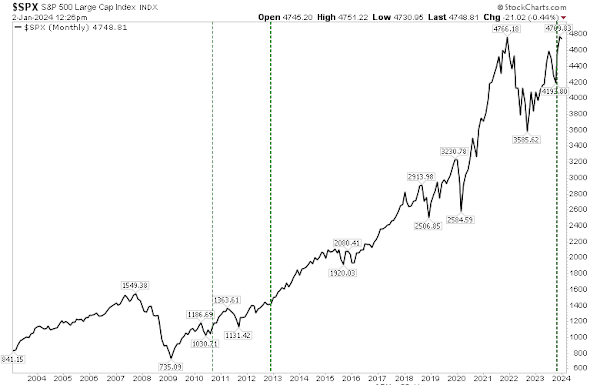

Although concerns of a potential double top pattern, especially evident when observing the monthly charts of the S&P, loom in the background, the imminent clearing of the 2021 high in the coming weeks could alleviate this risk. Notably, the market has seen minimal profit-taking following the October rally. For instance, in the case of the S&P, investors are advised to keep an eye on the 50-day Moving Average as a potential buying opportunity should profit-taking materialize at the onset of 2024.

S&P 500-Daily Chart

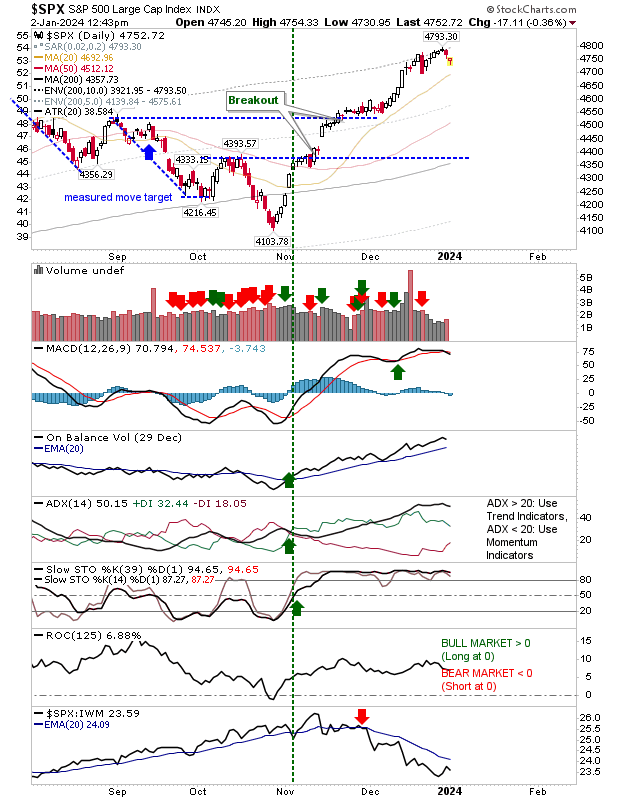

Meanwhile, the NASDAQ has not extended as far as the S&P, indicating there is latent demand should sellers attempt to influence the index. Although the Moving Average Convergence Divergence (MACD) shows a ‘sell’ signal, other technical indicators remain robust, and the selling volume is significantly lower compared to recent buying activity.

NASDAQ Composite-Daily Chart

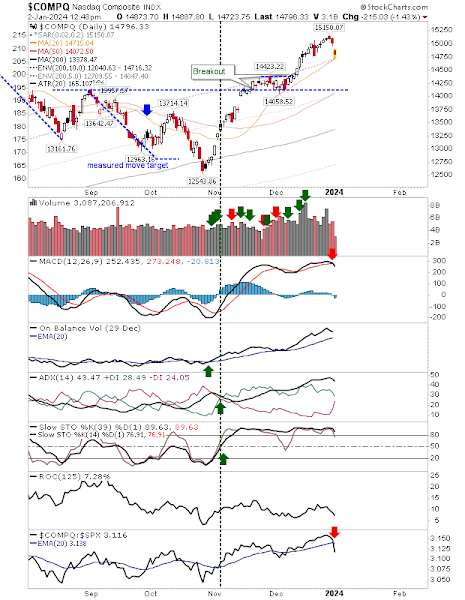

On the other hand, the Russell 2000 ($IWM) is still striving to reach its 2021 highs. Nonetheless, a ‘golden cross’ between the 50-day and 200-day Moving Averages at the end of the previous year signified a trend reversal in favor of the bulls. Similar to the S&P and NASDAQ, the technical indicators for the Russell 2000 remain resilient, and the selling volume has been relatively light.

Looking ahead, the financial markets anticipate the continuation of the bullish trend observed since October. Nevertheless, market participants will be monitoring closely for any signs of profit-taking by so-called ‘weak hands.’ Notably, the Russell 2000 ($IWM) may offer a promising outlook for attracting buyers, given its positioning as a “value” index compared to the S&P and NASDAQ. The forthcoming week promises to reveal how the market dynamics unfold when traders return in force after the seasonal break.