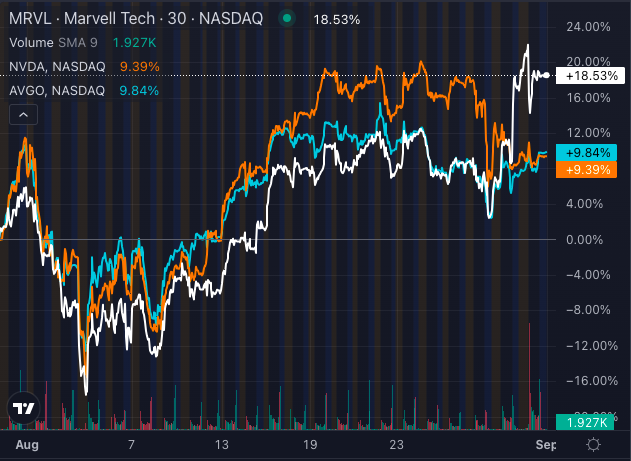

Marvell Technology Inc. MRVL has left heavyweights Nvidia Corp. NVDA and Broadcom Inc. AVGO in the shadows during August 2024.

Marvell’s stock soared an impressive 18.53% last month, outshining Broadcom and Nvidia, who followed with gains of 9.84% and 9.39%, respectively. This stellar performance has captured the attention of investors eyeing growth prospects in the semiconductor sector.

Marvell’s Strategic Edge

Marvell’s success stems from its focus as a fabless chip designer with a firm foothold in wired networking. Holding the second-highest market share in this sector, Marvell caters to various markets, including data centers, automotive, and consumer electronics. Its array of processors, switches, and storage controllers positions it favorably to capture the expanding demand across these industries.

Also Read: Marvell Technology Stock Climbs On Q2, Strong Q3 Guidance

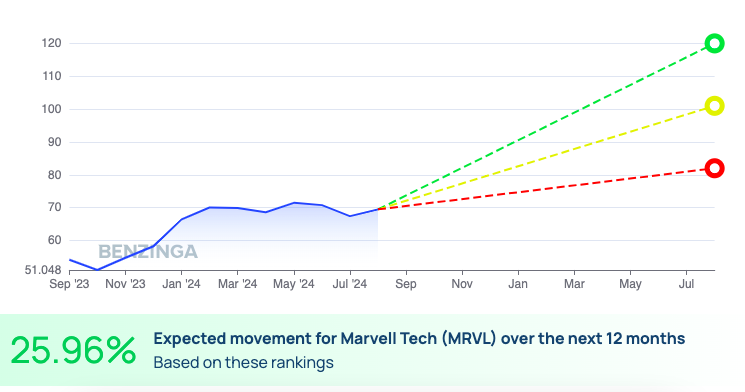

Benzinga Report On Marvell Technology

Analysts maintain a bullish outlook on Marvell, with a price target range of $82.00 to $120.00 and an average target of $101.00 over the next 12 months. This forecast indicates a potential upside of 25.96%, reflecting confidence in the company’s growth trajectory and market positioning.

Also Read: Marvell Technology Posts First Beat-And-Raise In 5 Quarters: Analysts Focus On ‘Solid AI Story’

Broadcom’s Diversification Drive

In contrast, Broadcom, ranked as the sixth-largest semiconductor firm globally, has been diversifying beyond semiconductors into software to broaden its revenue streams. With a massive annual revenue exceeding $30 billion and a broad product line across wireless, networking, and storage markets, Broadcom remains a key player in the semiconductor domain.

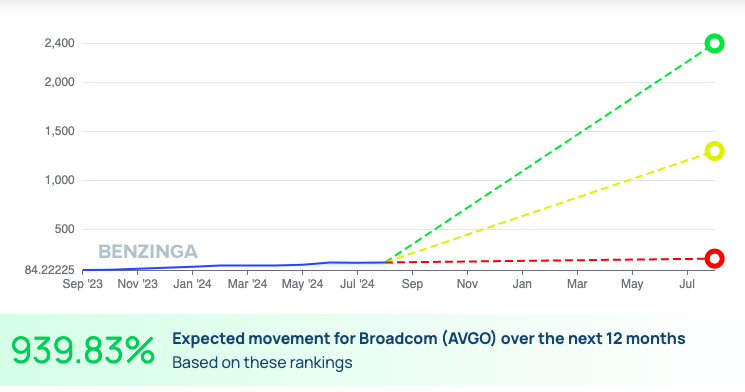

Benzinga Report On Broadcom

Analysts have set Broadcom’s 12-month price target range between $200.00 and $2,400.00, with an average target of $1,300.00, signaling a potential upside of 939.83%. Despite these promising figures, Broadcom’s comparatively modest August performance against Marvell hints at investors’ current preference for focused semiconductor stocks with robust market share and clear strategies.

Nvidia’s AI Expansion

Nvidia, renowned for its GPU market dominance and expanding presence in AI and data center networking, showcased a solid performance in August but fell short of Marvell’s gains.

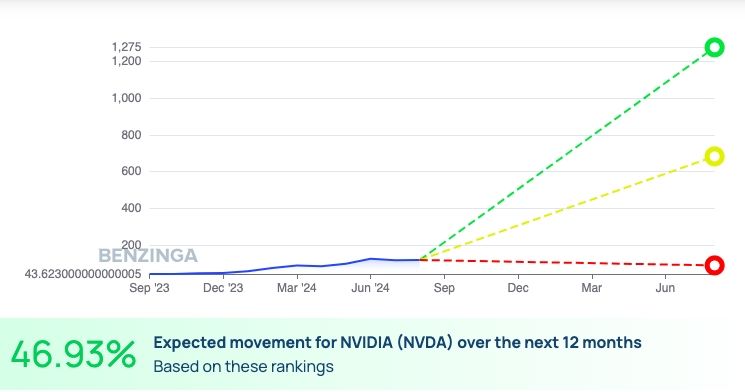

Benzinga Report On Nvidia

Analysts project Nvidia’s 12-month price target between $90.00 and $1,275.00, with an average of $682.50, suggesting an anticipated upside of 46.93%. Nvidia’s enduring growth prospects are underpinned by the escalating adoption of AI technologies.

Despite its strong long-term outlook, investors may exercise caution amid its relatively lower August gain compared to Marvell.

For semiconductor enthusiasts, Marvell’s recent stellar performance is a signal to ponder over stocks with focused market strategies and high growth potential.

While Broadcom and Nvidia stand as stalwarts, Marvell’s nimbleness and robust market positioning make it an enticing option for those seeking to benefit from imminent gains in the semiconductor landscape.

Read Next: