Analyst Downgrades Position

DA Davidson analyst Gil Luria revised Microsoft Corp’s rating and downgraded it to Neutral from Buy while maintaining a price target of $475.

Competition Tightens

Luria highlighted that Microsoft’s AI lead has been substantially eroded by competitors, impacting the rationale behind the current premium valuation.

Shift in Ranking

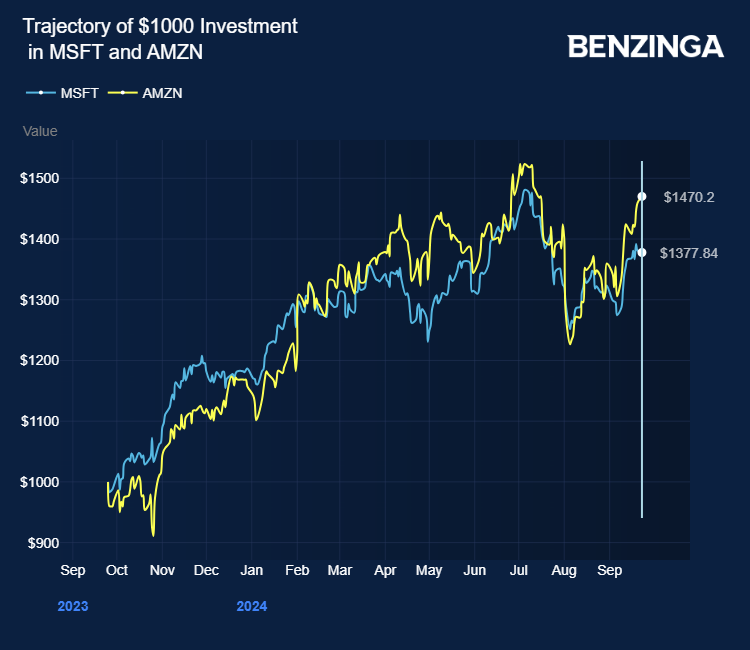

The analyst placed Microsoft fourth within the Magnificent Six, noting a 92% stock price surge since January 2023, contrasting with the S&P500’s 49% increase.

Rise of Competitors

Microsoft’s early adoption of generative AI via OpenAI and swift integration into Azure and GitHub provided a significant advantage over Amazon Web Service and Google Cloud. However, Amazon and Google have made strides to close the gap, shifting the competitive landscape.

Diminished Lead

Microsoft’s advantage in cloud services and code generation has waned, presenting challenges for sustained outperformance.

Technological Gap

The analyst highlighted that AWS and GCP are ahead in deploying custom silicon, granting them a substantial edge over Azure in upcoming developments.

Margin Pressures

Microsoft’s increased capital expenditure for data centers, particularly due to its reliance on Nvidia and pace of investment, is expected to impact operating margins. Luria indicated potential margin erosion necessitating significant measures to offset.

Future Outlook

Luria projected Microsoft’s revenue and EPS for the fiscal first quarter of 2025 amidst these evolving market dynamics.

Stock Performance

MSFT stock was down 0.50% to $433.10 at the last check on Monday.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs