The tech industry has weathered numerous storms, and while the challenges of 2022 impacted many, the artificial intelligence (AI) explosion in 2023 breathed new life into the sector. This AI wave has pushed numerous tech stocks to soaring heights as companies intensify their AI integration to navigate the cutthroat industry.

In this landscape, two standout choices for potential growth in 2024 are Alphabet (GOOGL) and Advanced Micro Devices (AMD). With Alphabet’s stock gaining 58% and AMD shares surging 127% in 2023 – outperforming the Nasdaq Composite’s return of 44.5% – these companies have garnered a “strong buy” rating from Wall Street following robust quarterly results and are poised for further appreciation in the coming year.

The Winning Case for Alphabet Stock

Alphabet has been an enthusiastic adopter of AI, integrating it into various products since 2017. The maturation of AI has paved the way for the company to offer more advanced and innovative products to its consumers. Despite the 6.7% year-to-date surge in GOOGL stock, it remains 3% below its all-time high, presenting an opportunity for growth.

Google Search, with a colossal 92% market share, continues to dominate the search engine industry. Despite regulatory challenges in 2023, Google Search’s revenue surged by 8% to $175 billion. Alphabet’s growth is further driven by its Google Cloud platform, ranking third in the global cloud computing market with a 26% year-over-year revenue increase to $33 billion in 2023. YouTube ad revenue also rose by 7.7% to $31.5 billion for the year.

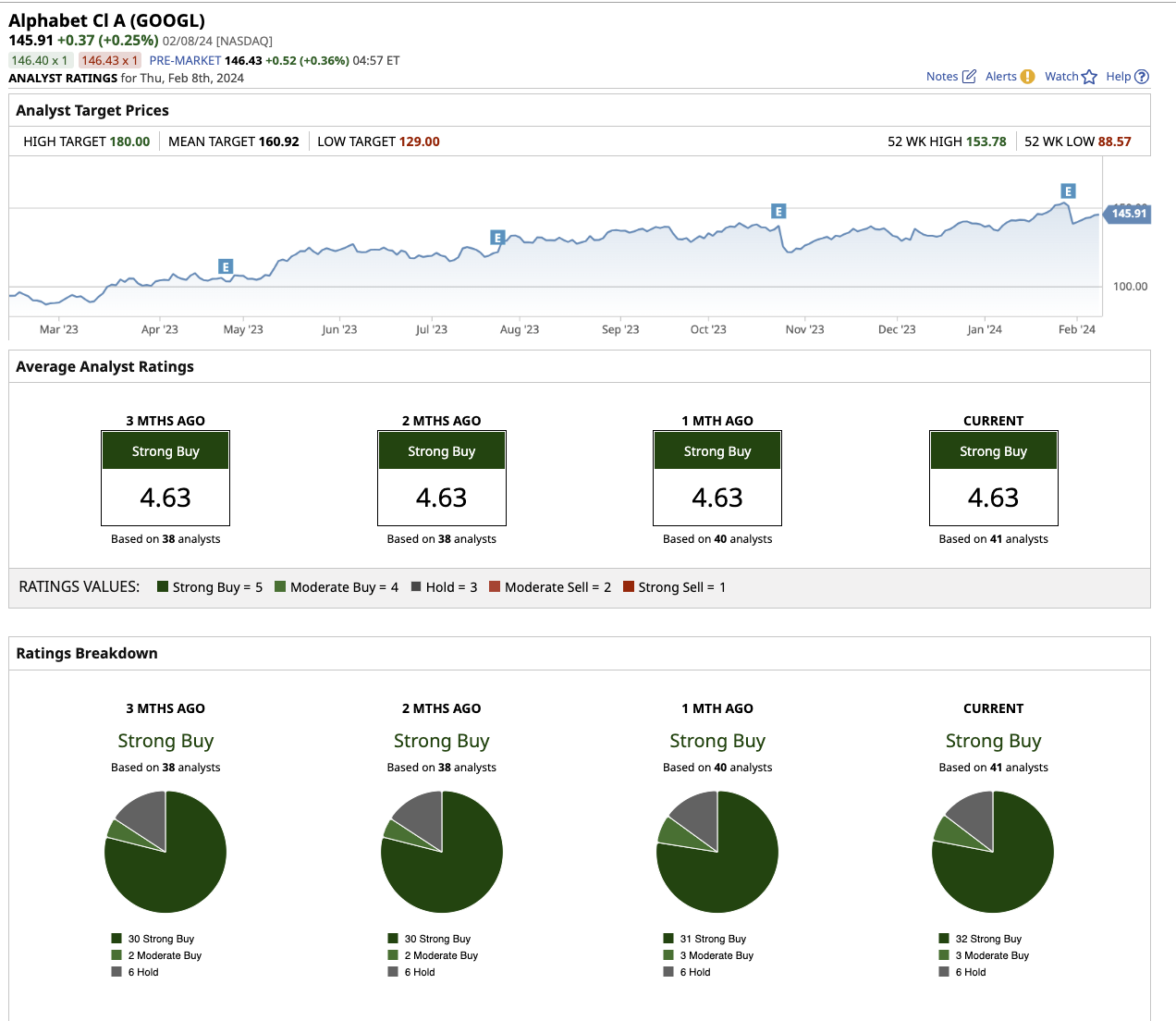

Financially robust, Alphabet ended the fourth quarter with $110.9 billion in cash, cash equivalents, and marketable securities, alongside a long-term debt of $13.2 billion. With a free cash flow of $69.5 billion, the company is well-positioned to capitalize on AI and outpace its smaller industry counterparts, attracting a “strong buy” rating from 32 out of 41 analysts, with a potential 8% upside according to Wall Street’s average price target.

Analysts predict a further 11.4% growth in Alphabet’s revenue and a 16.1% increase in earnings for 2024. With a forward price-to-earnings (PE) ratio of 21x – compared to Amazon’s 40x and Microsoft’s 35x – Alphabet is an attractively priced hyper-growth stock, making it a compelling buy in the current market conditions.

The Case for Advanced Micro Devices Stock

While Nvidia has long reigned supreme in the semiconductor space, AMD has made significant strides, solidifying its market presence. The company’s robust fundamentals and soaring demand for its graphic processors propelled an impressive 17% year-to-date surge in AMD shares, outperforming the S&P 500’s gain of 5.4%.

AMD’s data center segment rebounded strongly, with a 38% year-over-year revenue increase to $2.3 billion in the fourth quarter, driven by rapid customer adoption of AMD Instinct GPUs and 4th Gen AMD EPYC CPUs. The client segment also recorded an impressive 62% sales increase to $1.5 billion.

AMD’s Q4 2023 Earnings Review: Turbulent Waters and Smooth Sailing

In the realm of silicon chips, Advanced Micro Devices, Inc. (AMD) has proven itself a formidable contender. However, the latest quarterly report offers a tale of two segments: robust sales in the CPU department, juxtaposed with a concerning downtrend in the gaming arena.

A Rollercoaster Ride: The Financial Picture

Despite the rocky terrain, AMD reported a total revenue of $6.2 billion in the fourth quarter, reflecting a 10% year-over-year increase. Furthermore, diluted earnings per share (EPS) surged from $0.01 in the prior-year quarter to $0.41, sailing past expectations. Analysts and investors, however, are keeping a watchful eye, considering the somber 17% decline in gaming segment sales year-over-year.

Strategic Maneuvers: Betting on the Future

On the strategic front, AMD’s management remains optimistic about the long-term growth trajectory of the embedded segment, despite the 24% sales slump in Q4. This confidence is substantiated by AMD’s expansion of its AI software ecosystem, having acquired Mipsology and open-source AI software expert Nod.ai. The company is positioning itself for the evolving technological landscape, anticipating the heightened demand for high-performance graphic processors as the AI era unfolds.

Outlook and Investor Sentiment

Wall Street, with its ear to the ground, has resoundingly affixed a “strong buy” rating to AMD. Of the 33 analysts covering the stock, 27 advocate for a “strong buy,” while one suggests a “moderate buy,” and five recommend holding their positions. The average target price, pegged at $184.37, implies a potential upside of 6.8% in the coming 12 months. Those with a grander vision anticipate a surge to $270, marking a remarkable 56% jump from its current valuation.