The battle in the clouds between “Oracle Corp” (ORCL) and “Salesforce Inc” (CRM) is intensifying, propelling both stocks to soaring heights on the wings of AI.

However, the big question lingers: which behemoth is emerging victorious? Let’s delve into the financial metrics, recent strategic maneuvers, and essential insights for savvy investors.

Oracle’s Strategic Leap: Unveils Malaysia’s Mega Cloud

Oracle is flexing its muscles in the cloud arena, boasting a remarkable 20% surge in its stock price over the last month and an incredible +61% year-to-date spike, driven by robust growth in its cloud infrastructure offerings. The latest trump card up Oracle’s sleeve?

A whopping $6.5 billion investment to construct a public cloud hub in Malaysia—outrunning Amazon.com Inc’s $6.2 billion AWS blueprint. Oracle’s bold move aims to tap into the burgeoning appetite for AI, data, and analytics in Malaysia, potentially cementing it as one of the most substantial tech investments in Southeast Asia.

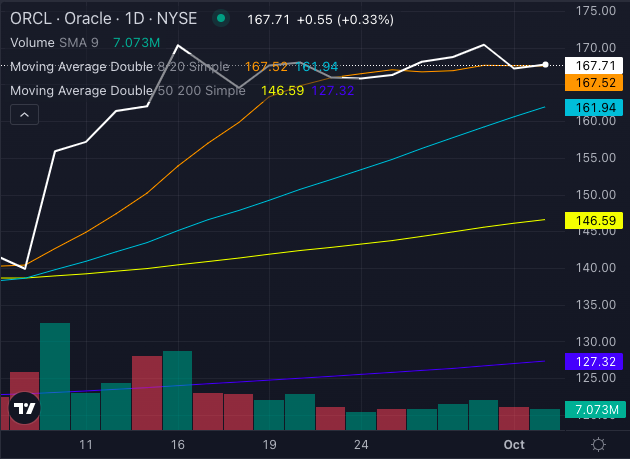

Chart created using Benzinga Pro

Oracle’s stock shines brightly on the charts, exhibiting robust bullish indicators all around. Currently trading at $167.71, the stock is above its eight-day, 20-day, and 50-day moving averages. Nonetheless, a hint of selling pressure suggests caution for those eyeing short-term gains. Despite this, with ambitious revenue goals set at $104 billion by Fiscal Year 2029, Oracle is clearly playing the long game.

Salesforce’s Strategic Move: Unleashing GenAI Power

On the other front, Salesforce is far from idle. The stock has surged by 12.67% in the past month, propelled by the launch of its revolutionary AgentForce platform, acclaimed by analysts as being at the same level as Microsoft Corp’s GenAI.

Piper Sandler even elevated Salesforce to an “Outperform” rating, assigning a price target of $400. AgentForce, tailor-made for sales, marketing, and service workflows, has the potential to elevate Salesforce’s Total Addressable Market (TAM) by a staggering $3.2 trillion.

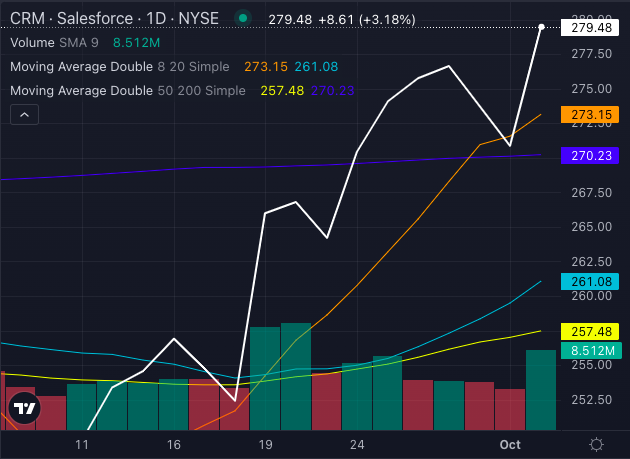

Chart created using Benzinga Pro

Technical signals for Salesforce’s stock are resoundingly bullish, with the stock currently trading at $279.48, comfortably above its eight-day, 20-day, and 50-day moving averages, confirming robust buying pressure.

The Ultimate Showdown

As both Oracle and Salesforce chart out their destinies in a realm dominated by AI and the cloud, opportunities for growth abound. Oracle’s audacious infrastructure endeavors across Asia offer it a global footprint, while Salesforce’s GenAI ambitions position it favorably in the enterprise software landscape.

Investors seeking exposure to the transformative powers of cloud and AI should keep a close watch on both contenders. However, Oracle’s international forays and optimistic long-term trajectory might give it a slight edge over Salesforce’s innovative short-term victories.

So, the burning question remains: who will be crowned the monarch of the cloud realm? Only time will unveil the coronation amid the unfolding AI frenzy.

Read Next:

Photo: Shutterstock