The Current Market Landscape: A Casino-Like Environment and Its Appeal to Young Investors

Consider this declaration: “For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young.” Who made this observation? None other than the legendary Warren Buffett, outlining a striking analogy to our contemporary investment scene.

Reflecting on Buffett’s words, the investing realm has transformed, resembling a pervasive casino within homes, constantly beckoning occupants to test their luck.

Analyzing Income Disparities: A Dive into Historical Data

One crucial aspect contributing to this paradigm shift is the stark contrast in financial scenarios across different generations, underscored by a compelling analysis of income and property prices.

Comparing the median income and average home prices from 1985 to 2022 reveals a profound shift. The disparity has widened significantly, with millennials facing homes that now cost 80% more relative to their parents’ era.

Escalating Costs: A Broader View of Economic Pressures

Besides the housing market, a general trend of diminishing affordability looms large, encompassing various facets of daily expenditure.

An examination of median household income juxtaposed with personal consumption expenditures since 1985 showcases a concerning reality. Expenses have skyrocketed compared to income, painting a dire financial picture for many.

The Millennial Predicament and Its Influence on Investment Behavior

Given the challenging financial landscape, it’s no wonder that younger Americans increasingly view the stock market as a high-stakes casino, seeking a potential bonanza to bridge the growing gap.

Shifting perceptions about the American Dream, coupled with a prevailing sense of economic disillusionment, underscore the shifting attitudes towards wealth creation and financial success.

Navigating the “Game-ification” of Investment Markets

Embracing the trend of gamification, investors are witnessing a shift towards speculative trading practices, epitomized by recent phenomena like the meme stock resurgence and the proliferation of sports betting.

Amidst these developments, opportunities arise to leverage market dynamics influenced by this casino-like approach, providing a unique vantage point for strategic investment decisions.

The Wild World of Altcoins: Navigating the Casino-Like Markets in the Search for Wealth

The Allure of Altcoins for Young Investors

Altcoins, the raciest sector of the crypto universe, where fortunes can materialize overnight and fade just as quickly. Young investors flock to these exotic digital assets, treating them akin to high-stakes bets in a glittering casino where the coins they hold can vault in price extravagantly. The appeal lies in the chance that a modest investment could swell exponentially within a short span.

Navigating the Risks in the Altcoin Casino

Caution is the name of the game in this wild west of finance. The cardinal rule when approaching altcoins is to heed the adage of “risk on” capital – only wager what you are willing to lose without losing sleep at night. Similar to a night at the casino, discipline is key. Remember, the potential upside of these high-flying assets comes hand in hand with steep risks.

The Top Performers: A Glance at the Winners

- OpenPlatform (OPEN) – 6,212%

- POPCAT (POPCAT) – 5,026%

- Catacoin (CAT) – 2,062%

- Solama (SOLAMA) – 1,417%

- DEGEN (DEGEN) – 1,388%

Impressive, to say the least. A surge of over 6,000% is not unheard of, capable of turning a mere $500 investment into a staggering $30,000 in just three months.

Pursuing Altcoin Gains: Chasing Momentum

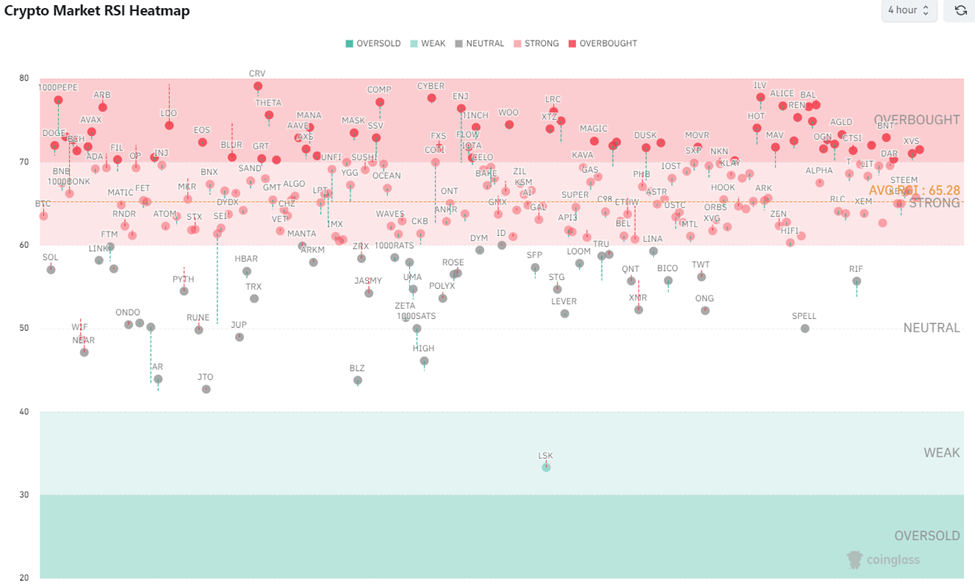

Forget intrinsic value – in the altcoin realm, it’s all about seizing fleeting opportunities for wealth creation. To catch the next big wave, momentum is the name of the game. Riding the surge of a coin on the rise demands precision timing. Various online tools, such as CoinGlass.com’s Relative Strength Indicator Chart, can aid in identifying the altcoins in motion.

Source: CoinGlass.com

Uncovering Opportunities with Stage Analysis

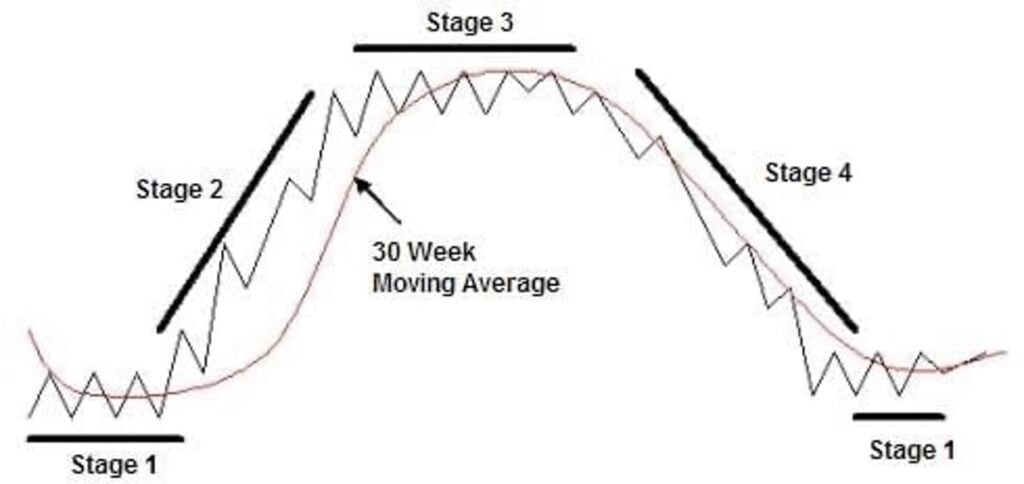

Crypto Trader employs a sophisticated market approach called “stage analysis” to pinpoint altcoins on the verge of significant uptrends. This method categorizes assets into four distinct stages depending on their price action.

It’s a game of timing, identifying when an asset is primed for an upswing in performance. By adopting a discerning approach, investors can position themselves for maximum gains.

Market Sentiments and Financial Landscape

Beyond the altcoin euphoria lies a broader context shaping investor behavior. Younger generations are displaying varying perspectives on capitalism, wealth, and taxation, reflecting evolving societal beliefs. This changing landscape underscores the volatile nature of contemporary investment markets, akin to a fast-paced casino.

As the winds of change blow, investors must navigate through the maze of financial complexities, adapting to the shifting tides in pursuit of potential riches.

May your evening be prosperous,

Jeff Remsburg