The fourth-quarter earnings season is upon us, with significant reports from major U.S. banks like JPMorgan Chase, Bank of America, and Citigroup scheduled to be released tomorrow before the opening bell.

For a holistic evaluation leading up to these earnings announcements, we will employ a novel analytical tool, ProTips, to examine the strengths and weaknesses of these financial powerhouses.

ProTips is an exclusive resource tailored for InvestingPro subscribers, offering accessible insights to unravel complex data on assets, allowing for a swift assessment of risks and revelation of hidden trends.

Catering to both retail investors and professional traders, ProTips simplifies a company’s performance without convoluted calculations, thereby providing a clear understanding of the firm’s standing, especially on the eve of its quarterly earnings reports.

Key Metrics to Monitor in Bank Earnings

Overall, market sentiment is bullish on the banking sector’s resurgence this year, propelled by the burgeoning IPO market and increased bond issuance. Hence, an in-depth look into the results and analysis of these activities can offer valuable insights into stock prospects – discerning potential buys from sells.

In addition to EPS and sales, investors should focus on vital indicators like net interest income and net interest margin, crucial in gauging the earnings from banks’ lending activities.

Robust credit figures could elevate earnings estimates for the remainder of the year, while keeping an eye on the investment banking undertakings of financial enterprises is imperative.

Let’s navigate these metrics with the aid of ProTips:

JPMorgan Chase (JPM)

The forthcoming results, anticipated on Friday, are prognosticated to yield an EPS of $3.61, a decrease from the prior quarter’s $4.33, but a slight uptick from the corresponding period a year earlier.

Revenues are projected to reach $39.72 billion, marginally below the preceding quarter figures, yet marking a 15% surge from the earlier year.

Historical data from InvestingPro reveals that JPMorgan Chase has consistently surpassed expectations for both EPS and revenues over the last 5 quarters.

Insights from ProTips on JPMorgan Chase’s Position

A glimpse at the ProTips for JPMorgan Chase illustrates a predominantly positive outlook.

ProTips underscores the company’s robust earnings quality, with free cash flow exceeding net income, as evidenced in the detailed FCF/Net Income metric page for JPMorgan shares.

Another fortifying point highlighted by ProTips is the marked acceleration in its earnings growth, with a 12-month revenue upswing of 18.1% among its key highlights.

Bank of America (BAC)

The imminent quarterly results for Bank of America are likely to unveil an EPS decline to $0.65, as projected by analysts, compared to $0.90 in the previous quarter and $0.85 a year prior.

Anticipated revenues stand at $23.81 billion, a dip from the preceding quarter’s $25.167 billion and the $24.532 billion recorded in the previous year.

ProTips Perspective on Bank of America’s Standing

The ProTips review for Bank of America presents a mixed scenario.

The bank’s ProTips signify positive momentum in revenue growth, marked by a 5.7% acceleration over the past 12 months.

However, the firm’s total debt has witnessed a successive annual ascent, with a 20.5% surge in the last quarter being notable.

Citigroup (C)

Analysts are forecasting a sharp downturn in earnings for Citigroup, with an anticipated EPS at $0.77 versus $1.52 in the previous quarter and $1.16 a year earlier.

Expected revenues also reflect a decline to $18.771 billion from $20.139 billion in the preceding quarter, albeit showing a slight increase from $18 billion in the corresponding quarter of the prior year.

Insights from ProTips on Citigroup’s Performance

InvestingPro’s ProTips paint a relatively unfavorable picture of Citigroup, with limited bullish ProTips.

On a positive note, the bank’s ProTips signal an upturn in revenue growth, having accelerated by 5.7% over the past 12 months.

Conversely, the company’s total debt has demonstrated a consistent annual upsurge, escalating by 20.5% in the last quarter.

JP Morgan: A Closer Look From Financial ProTips

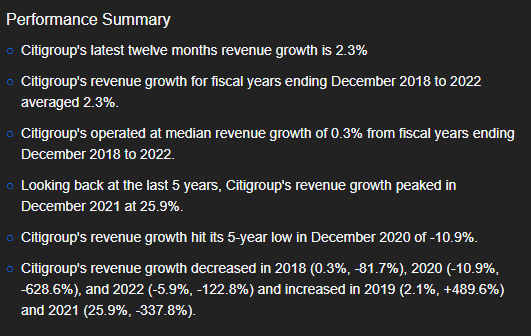

In recent months, JP Morgan’s share price has exhibited significant growth, accompanied by reports of accelerated revenue, albeit at a mild 2.3% increase over the last year.

Revenues

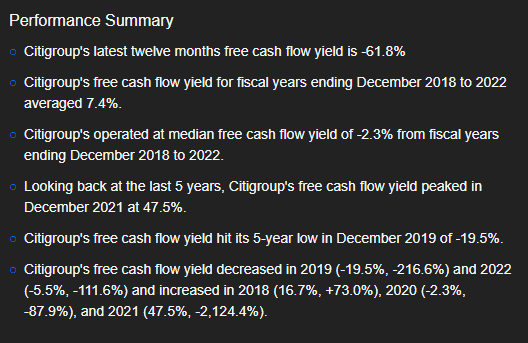

However, the flip side reveals a less rosy picture with ProTips highlighting a valuation suggesting a poor cash flow yield, specifically at -61.8% over the past year according to the Tip’s analysis.

FCF Data

Evaluating Fair Value, Analyst Forecasts, and Financial Health

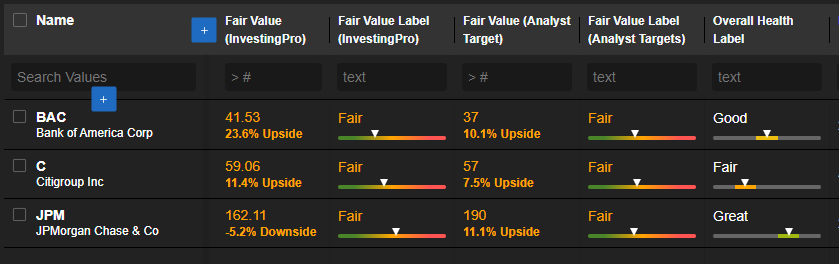

Another angle worth exploring is the culmination of valuation models, analyst predictions, and the financial well-being of JPM, BAC, and C.

The trio of stocks has been grouped into an InvestingPro Watchlist, offering ready access to the crucial details:

Source: InvestingPro

Among the trio, Bank of America stands out as particularly undervalued, by a notable 23.6%.

In terms of growth potential, analysts favor JP Morgan, projecting a robust 11.1% increase over the next 12 months.

Lastly, in the realm of financial strength, JP Morgan clinches the lead with a “very good” rating.

Final Verdict

Focusing on the triad of banks, JP Morgan emerges as the standout contender.

However, there is a dampener to this optimism as InvestingPro indicates that the stock is currently perceived as fairly valued.

Hence, it would be prudent to await the Fair Value update post the announcement of tomorrow’s results before making investment decisions.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.