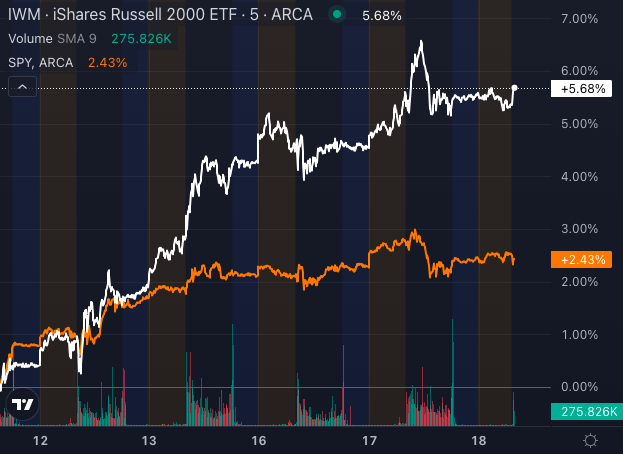

Small-cap stocks are ablaze ahead of the forthcoming Federal Reserve’s potential interest rate cut, reveling in the limelight. In a stark contrast, the Russell 2000 Index blazed a trail, soaring over 5% in recent days, outpacing its larger-cap counterparts in the S&P 500 Index by a considerable margin.

Evidently, the iShares Russell 2000 ETF (IWM), tracking the Russell 2000 Index, outshone the SPDR S&P 500 ETF SPY that traces the S&P 500 index. Noteworthy contributors to the recent small-cap surge include companies like IGM Biosciences Inc (IGMS), Intuitive Machines Inc (LUNR), and Applied Therapeutics Inc (APLT), boasting impressive gains of 59.33%, 38.62%, and 44.90% respectively over the past week.

A wave of enthusiasm is sweeping through investors who firmly believe in the imminent easing by the Federal Reserve. Small-cap enterprises, particularly those entrenched in debt and subject to floating rates, are reaping the rewards.

Small Caps Eyeing Reduced Borrowing Costs

The allure lies in the fact that small-cap firms often hinge on floating-rate debt. As interest rates dwindle, so do their borrowing expenses. This ultimately offers a financial breather and smoother sailing for companies with less stable financial foundations. It’s no surprise that the prospect of interest rate cuts is tantalizing investors with visions of substantial gains from these smaller entities.

Before jumping aboard the small-cap bandwagon, there’s a significant caveat to consider.

Earnings and Economy in the Balance

Despite the optimistic air around cheaper borrowing costs, looming concerns of lackluster earnings and an uncertain U.S. economic panorama are causing a stir in the market. The towering hype encompassing small caps may wane if the economy fails to deliver on expectations.

For investors seeking a slice of the pie, exchange-traded funds such as IWM or the Vanguard Small-Cap ETF (VB) offer diversified exposure to the small-cap realm. These funds mirror small-cap index performances, presenting a prudent way to capitalize on potential upticks without cherry-picking individual stocks.

The burning question remains – how long can this euphoria sustain itself?

Resilient Bullish Trend Seen in Small Cap ETF

The IWM, as a proxy for small-cap stocks, exhibits a robust upward trend, with its share price resting at $219.23, comfortably above the five, 20, 50, and 200-day simple moving averages (SMAs).

Notably, the bullish signals are emphasized by the eight-day SMA of $213.80, the 20-day SMA of $215.07, and the 50-day SMA of $214.41, reflecting the ETF’s steadfast upward trajectory.

While the upbeat trend persists, a slight selling pressure on the IWM hints at potential short-term volatility. The ETF’s elevation well beyond its 200-day SMA of $203.57 further strengthens the positive technical outlook, suggesting continued vitality in the small-cap sector.

Should the Federal Reserve opt for a substantial half-point cut, small caps could shine brightly. Even a modest 25-basis-point reduction might suffice to keep the rally alive – albeit temporarily.

Those keen on diversifying into small-cap companies that could benefit from lower rates might want to observe the SPDR S&P 600 Small Cap ETF (SLY) for broader exposure.

Seize the opportunity to thrive in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile. Secure your tickets today to delve into CEO presentations, engage in 1:1 meetings with investors, and glean insights from esteemed financial experts.

Don’t miss out on the chance to enhance your portfolio and network with industry luminaries!

Read Next:

Augmented with artificial intelligence through Midjourney.