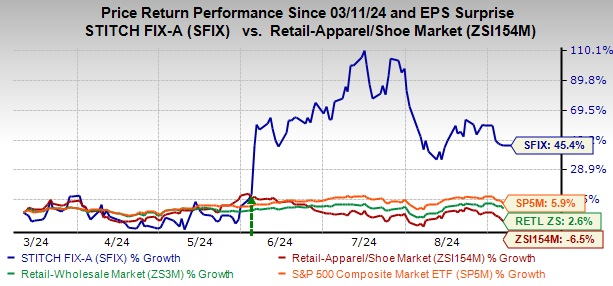

Stitch Fix, Inc. SFIX has seen a remarkable 45.4% surge in its stock price over the past six months, outshining the Zacks Retail-Apparel and Shoes industry’s 6.5% decline by a wide margin. This upward trajectory is a testament to the company’s strategic innovations, including AI-driven inventory management, optimized pricing strategies, enhanced client engagement, and improved cost efficiency.

Stitch Fix’s stellar performance has not only surpassed the broader Retail-Wholesale sector but also outpaced the S&P 500 index, which saw modest growth during the same period. With the stock price closing at $3.46 as of Sept. 6, edging closer to its 52-week high of $5.05 achieved on July 16, 2024, investors are contemplating whether the stock still holds promise for further growth.

Technical analysis paints a favorable picture for Stitch Fix, with the stock trading above both its 100-day and 200-day moving averages. This indicates strong upward momentum and stability in prices, reflecting positive market sentiment and confidence in Stitch Fix’s financial performance and future prospects.

From a valuation standpoint, Stitch Fix presents an enticing opportunity as it trades at a discount compared to historical and industry standards. With a forward 12-month price-to-sales ratio of 0.33, below the five-year median of 0.54 and the industry average of 1.04, the stock offers attractive value proposition for investors looking to gain exposure to the sector. The stock’s Value Score of A further underscores its attractiveness.

Image Source: Zacks Investment Research

Strategic Initiatives Driving Stitch Fix’s Growth

Stitch Fix’s growth trajectory is fueled by its adept use of AI and data analytics, which have become integral to the company’s operations. A standout move has been the adoption of an AI-powered inventory buying tool, responsible for nearly half of all inventory decisions, leading to significant efficiency gains. This strategic embrace of AI underscores Stitch Fix’s commitment to innovation and competitive prowess.

The introduction of Quick Fixes, a feature enabling clients to schedule additional fixes post-checkout, has boosted average order value by 25% within three weeks, demonstrating the company’s agility in addressing client needs. Moreover, a comprehensive review of pricing structure is poised to generate over $20 million in annualized contribution profit by aligning prices with value, thus enhancing profitability.

Stitch Fix’s focus on margin expansion and operational efficiency has borne fruit. The company reported a 280-basis-point year-over-year increase in gross margin, reaching 45.5% in the third quarter of fiscal 2024. This improvement, driven by robust product margins and enhanced transportation leverage, underscores the efficacy of its pricing and inventory management strategies.

Enhancing the client experience remains paramount for Stitch Fix, with efforts directed at delivering more personalized interactions, refining discount tactics, and enhancing onboarding processes. These initiatives have yielded positive outcomes, with higher average order values and improved retention metrics, signaling robust client satisfaction and loyalty.

The launch of Stitch Fix Freestyle has introduced a novel shopping experience, allowing customers to explore and buy curated items based on their style preferences, fit, and size sans the need for a Fix first. This initiative aligns with the company’s broader goal of expanding its customer base and achieving sustainable profitability.

On the operational front, Stitch Fix is realigning its marketing approach to prioritize liquidity preservation and profitability while focusing on high-lifetime-value customers. Operational restructuring, including consolidation of U.S. warehouse locations and the successful divestiture of U.K. operations, is positioning Stitch Fix for enduring growth.

Challenges Faced by Stitch Fix: Declining Active Client Base

Stitch Fix has encountered a significant hurdle in the form of a dwindling active client base over the past eight quarters, which has contributed to a decline in revenue. In the third quarter of fiscal 2024, the number of active clients engaged in ongoing operations dropped to 2,633,000, marking a 20% year-over-year decrease.

As a result, the company witnessed a 15.8% revenue dip in the fiscal third quarter, indicating persistent challenges in client retention and acquisition. This trend suggests underlying issues related to product appeal or intensified market competition, posing a noteworthy challenge for Stitch Fix.

Concluding Thoughts

Despite the setback of a shrinking active client base, investors are drawn to Stitch Fix stock due to its strong resurgence fueled by innovative AI-powered strategies for inventory management and pricing, which have significantly enhanced efficiency, margins, and client engagement.

With a compelling value proposition reflected in its low price-to-sales ratio and strong performance relative to industry benchmarks, combined with robust technical indicators indicating price stability, Stitch Fix emerges as an appealing choice for investors seeking exposure to a data-driven growth story. The company’s focus on operational efficiency and profitability further bolsters its investment appeal. Stitch Fix currently holds a Zacks Rank #3 (Hold).

Top Picks in the Market

Notable alternatives to consider include Boot Barn Holdings, Inc. BOOT, Abercrombie & Fitch Co. ANF, and Steven Madden, Ltd. SHOO.

Boot Barn operates as a lifestyle retail chain specializing in western and work-related footwear, apparel, and accessories. It currently boasts a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Boot Barn’s fiscal 2025 earnings and sales points to growth of 8.9% and 10.7%, respectively, from fiscal 2023 figures. BOOT has delivered a trailing four-quarter average earnings surprise of 7.1%.

Abercrombie is a premium specialty retailer of casual apparel known for its high-quality offerings. It holds a Zacks Rank of 1 currently. ANF surpassed earnings expectations with a 16.8% surprise in the last reported quarter. Forecasts for Abercrombie’s fiscal 2025 earnings and sales signify growth of 61% and 12.6%, respectively, compared to fiscal 2024 levels. ANF boasts a trailing four-quarter average earnings surprise of 28%.

Steven Madden focuses on designing, sourcing, marketing, and retailing fashion-forward footwear under known brands. Its current Zacks Rank is 2 (Buy). Estimates for Steven Madden’s 2024 earnings and sales depict growth of 6.9% and 12.6%, respectively, from the previous year’s actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

© 2024 Benzinga.com. Benzinga does not offer investment advice. All rights reserved.