Critical Levels in S&P E-Mini Market

- Reaching the moving average and the 5,600 round number signifies significant support levels on the daily chart.

- After being away from the moving average for about 30 bars, the market is in a climactic state.

- Bears have successfully pushed the market down to the moving average with consecutive bear bars, suggesting a trading range is more likely than a strong bear selloff.

- Bears are currently selling at yesterday’s close risk, into support, and managing through a deep pullback.

- The recent breakout indicates potential for a second leg down, fueling bearish hopes of a reversal to the June low.

- Market bears anticipate the current selloff as the start of a reversal towards the June low, assuming the year’s high has already occurred.

- Odds are against a direct drop to the June low, requiring bears to establish a series of lower highs within a tight trading range for a clear downside breakout.

- Bears have succeeded in reaching the moving average; their next objective is securing strong closes below it to demonstrate increased strength.

Anticipated Market Trends Today

- The Globex market experienced a selloff to yesterday’s range bottom and has since trended sideways to upwards on the 15-minute chart.

- Bulls are eyeing a double bottom formation with yesterday’s low and the current Globex session low, anticipating a breakout above the neckline and subsequent measured move up.

- Given the daily chart’s support level, bulls are hopeful for an upward breakout and strong reversal today.

- Traders should prepare for a potential sideways market open, with an 80% probability of forming a trading range and only a 20% likelihood of a bullish trend from the outset.

- It is advisable not to rush into trading; waiting for 6-12 bars before positioning oneself is often prudent.

- As it is Friday, traders should pay attention to the weekly chart, preparing for possible surprises towards the end of the session as decisions on the weekly chart close unfold.

- Given the daily support level, odds lean towards a market bounce today.

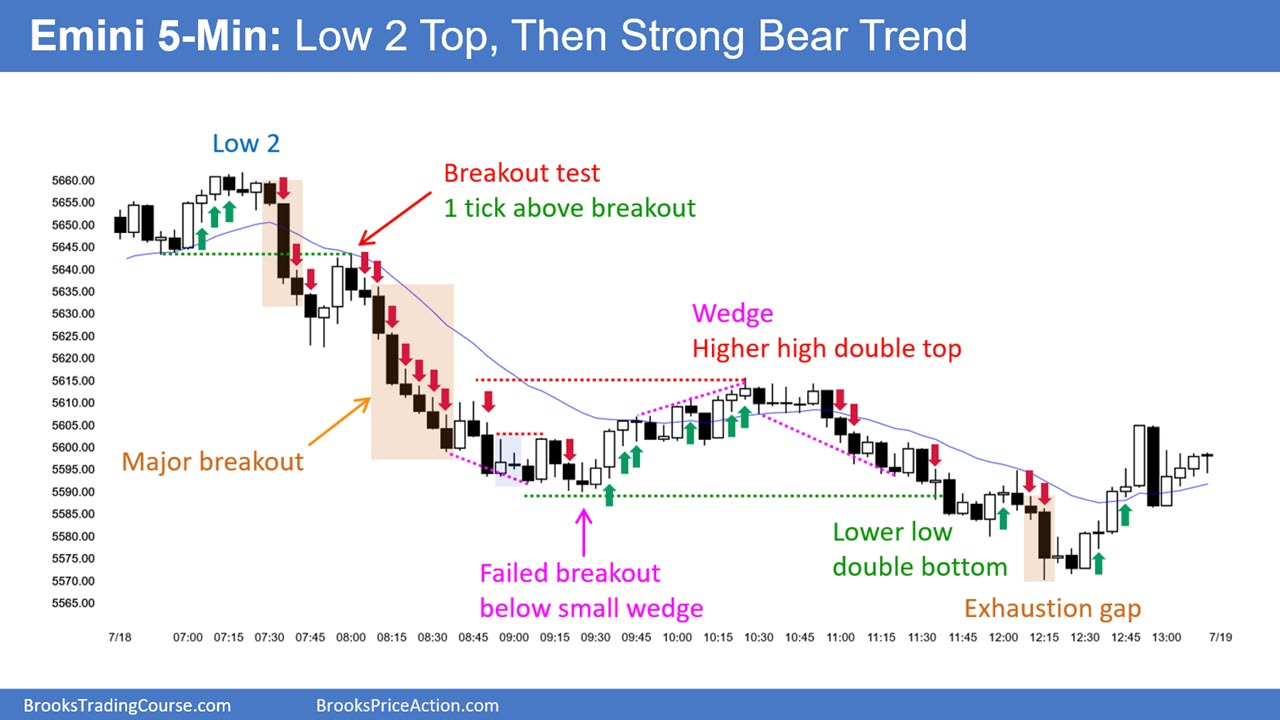

Analysis of Yesterday’s E-Mini Setups

Yesterday’s stop-entry setups provide logical options for traders. Green arrows indicate buy entry bars, while red arrows highlight sell entry bars.

Traders with access to detailed swing trade setups through the Brooks Trading Course and Encyclopedia of Chart Patterns can leverage a vast library of explanations (refer to Online Course/BTC Daily Setups). Encyclopedia members receive updated daily charts.

Most swing setups do not always result in trades; traders often exit when disappointed, aiming for minimal profits or accepting small losses.

If the risk associated with a trade is excessive, waiting for lower-risk trades or exploring alternative markets, like the Micro E-Mini, is advisable.