Artificial intelligence (AI) superstar stock Nvidia (NASDAQ: NVDA) made waves on May 22 by announcing a stock split, propelling its share prices up by a staggering 36%. This meteoric rise has set the stage for other AI companies on Wall Street to ponder their own stock splits, with the understanding that this move alone may not be the sole reason behind Nvidia’s stellar performance.

It is vital to remember that a stock split does not alter the core business or the fundamentals of a stock; it merely divides existing shares into smaller units accompanied by proportionate adjustments in stock prices and financial metrics. Companies opt for stock splits for various reasons, including enhancing share liquidity for employees receiving stocks as part of compensation packages and for investors.

With Nvidia’s stock split finalized on June 10, all eyes are now on other potential candidates in the AI realm. Three astute contributors at Fool.com have singled out Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Super Micro Computer (NASDAQ: SMCI) as the frontrunners likely to embark on this game-changing journey next.

Here’s a breakdown of why these companies could be heading towards the territory of stock splits.

The Unyielding Tech Titan Nearing a Split

Will Healy (Microsoft): As the corporation that reigned as the world’s most valuable in the not-so-distant past, Microsoft’s contemplation of a stock split should not catch anyone off guard. Despite witnessing substantial appreciation in its stock price over recent years, the surprising piece of trivia about Microsoft is its over 21-year dry spell when it comes to stock splits.

During the late 1980s to the early 2000s, the era when Microsoft was the dominant force in PC operating systems, stock splits were a regular occurrence. Microsoft’s shares underwent nine splits during this golden period.

However, the advent of the Dot-Com market crash followed by the emergence of Apple gradually eroded Microsoft’s supremacy. The tide turned, especially after the launch of the iPhone in 2007. From 2000 to 2014, under the leadership of CEO Steve Ballmer, Microsoft’s stock shed a substantial 37% of its value.

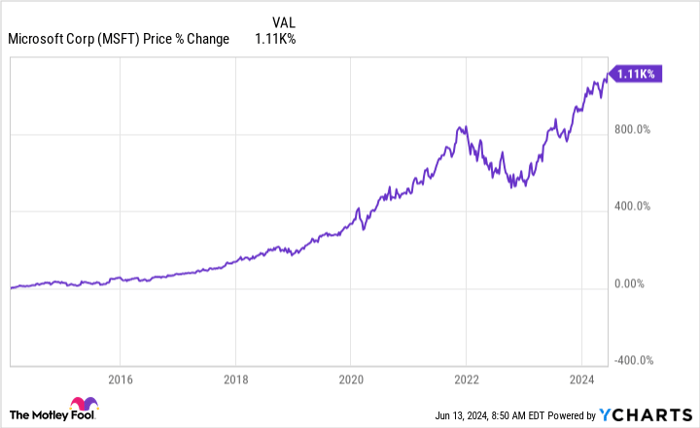

The company’s fortunes took a favorable turn with Satya Nadella assuming the mantle of CEO in 2014. Nadella pivoted Microsoft towards cloud services and later solidified its position as an AI powerhouse. Over Nadella’s tenure of a decade, Microsoft stock skyrocketed by over 1,110%, currently resting at $440 per share.

Given this exceptional growth in stock price, the argument for a split is compelling. Microsoft’s trajectory indicates a continued rise in stock price. In the first three quarters of fiscal 2024 (ending March 31), the company witnessed a 26% year-over-year surge in net income. The projected outlook for the remainder of the fiscal year hints at a double-digit percentage growth in revenue as well.

Another factor nudging Microsoft towards a stock split revolves around its membership in the Dow Jones Industrial Average. As the Dow is price-weighted, Microsoft may find it imperative to split its stock to maintain a balanced influence on the index’s movements. This step is crucial to prevent any outsized impact, potentially signaling the end of its 21-year drought in stock splits.

Meta Platforms Ponders the Stock Split Realm

Jake Lerch (Meta Platforms): It’s safe to say that 2024 has been a flourishing year for the “Magnificent Seven” stocks. Out of the seven, six (besides Tesla) have witnessed double-digit percentage surges year-to-date. Yet, amidst this impressive growth, Meta Platforms stands out as the only intact member of the pack that has never executed a stock split. The time appears ripe for the tech giant to delve into its inaugural split. Here’s why.

To kick things off, the Meta stock is on the pricey side. A single Meta share commands about $504, placing it out of reach for many individual investors. By opting for a 3-for-1 or even a 5-for-1 stock split, Meta could drastically reduce the share price, making it more accessible to retail investors without access to fractional shares, potentially adjusting the price to a more pocket-friendly range of $100 to $175.

A recent analysis by Bank of America put forward another compelling reason for Meta’s contemplation of a stock split: superior performance. The study delved into stock splits dating back to

The Power of Stock Splits: An Analysis of Meta Platforms and Super Micro Computer

The Meta Platforms Conundrum: To Split or Not to Split?

Decades of historical data have shown that stocks tend to outperform the market after a split. However, Meta Platforms has been a notable exception, eschewing stock splits in its 12-year public tenure. While industry giants like Adobe and Microsoft have embraced splits, Meta’s management remains staunchly opposed.

Regardless of its stance on splits, Meta Platforms remains a dominant force in the tech industry, boasting a robust digital advertising business. The company’s impressive Q1 revenue growth of 27% year over year and soaring earnings make it an attractive long-term investment option for savvy investors.

Super Micro Computer: Poised for a Resurgence Through a Stock Split?

Super Micro Computer, also known as Supermicro, has shown immense potential in the AI sector, akin to being the Robin to Nvidia’s Batman. Despite a recent stagnation in share prices, Super Micro Computer’s innovative modular server systems for data centers have garnered attention in the tech sphere.

As AI spending continues to surge, Supermicro stands to benefit, with revenue growth accelerating to an impressive 200% year over year. Analysts project a doubling of annual revenue to over $23 billion by the following year, reflecting the company’s strong growth trajectory in the data center market.

Moreover, earnings per share are expected to grow by an average of 52% annually over the next three to five years, underscoring Super Micro Computer’s solid fundamental outlook. With the stock trading at a forward P/E of 33, there is potential for substantial gains if the company maintains its robust earnings growth.

Despite its remarkable performance post-IPO with shares appreciating over 9,400%, Super Micro Computer has never split its stock. With shares now trading at over $800, a stock split could enhance liquidity, making it more accessible to a broader investor base. The positive attention garnered from a split could reignite investor interest and potentially drive the share price higher, presenting a favorable scenario for all stakeholders.

Investing Wisdom: Looking Beyond Microsoft

While Microsoft remains a stalwart in the tech industry, investors should explore additional opportunities beyond the tech giant. Consideration of the Motley Fool Stock Advisor’s top stock picks, which could produce significant returns in the coming years, is crucial for a diversified investment portfolio.

Reflecting on past successes like Nvidia, which yielded remarkable returns for early investors, underscores the potential for substantial gains in the stock market. The Stock Advisor service’s track record of outperforming the S&P 500 since 2002 further emphasizes the value of expert guidance in navigating the volatile financial landscape.