Beta measures the volatility of a stock compared to the overall market; the S&P 500 being the benchmark with a beta of 1.0.

A beta above 1.0 signals higher volatility than the market, while below 1.0 suggests the opposite. Low-beta stocks are prized for their defensive characteristics,

offering stability when paired with high-beta stocks, thus crafting a more well-rounded risk portfolio. Among the low-beta gems are Interactive Brokers (IBKR), Elevance Health (ELV), and Consolidated Edison (ED). These three stocks not only tame turbulence but also flaunt favorable Zacks Ranks, reflecting faith among analysts.

Let’s unravel the story behind each.

Exemplary Earnings Performance by Elevance Health

Elevance Health, a health benefits champion, assists consumers in leading healthier lives throughout their care journey. Boasting a favorable Zacks Rank #2 (Buy), the company is inching past earnings expectations.

With a recent quarterly report that pleased investors, Elevance Health maintained a growth tempo with earnings up by 12.5% compared to the previous year. While the sales figures slightly missed forecasts, the upward trajectory of earnings is impressive, as illustrated below.

Image Source: Zacks Investment Research

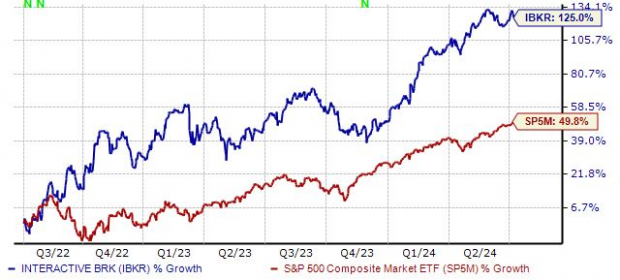

Interactive Brokers: A Force to Reckon With

Interactive Brokers Group, a global electronic market maker and broker, has seized the spotlight by exceeding analyst expectations, securing an enviable Zacks Rank #2 (Buy).

A significant market outperformer for the past two years, Interactive Brokers has sprinted ahead with a robust 125% surge in value, towering over the S&P 500’s 50% gain. The surge in trading activity has markedly contributed to the company’s success, showcased below.

Image Source: Zacks Investment Research

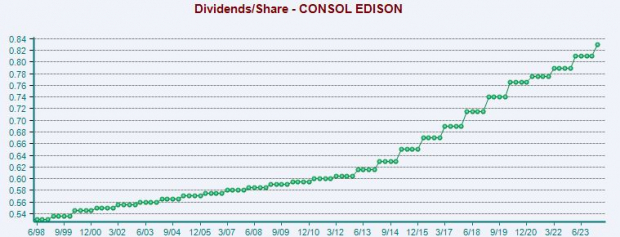

Consolidated Edison: A Steady Shareholder Performer

Consolidated Edison, a Zacks Rank #2 (Buy) entity, is a versatile utility holding company with its hands in regulated and unregulated ventures. Exhibiting a strong track record of surpassing earnings estimates, the company has consistently pleased income-focused investors.

Noteworthy for its hearty 3.8% annual yield, Consolidated Edison’s dividend growth of 2% annually over five years is a cherry on top. The company’s shareholder-friendly stance is unambiguously captured in the illustration below.

Image Source: Zacks Investment Research

Unraveling the Finale

Low-beta stocks, like these three gems, offer a protective shield to portfolios in times of market turmoil. When coupled with high-beta counterparts, they form a balancing act that cushions against extreme market swings.

For the risk-conscious investor, considering Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED could be prudent moves. Armed with robust Zacks Ranks, these stocks not only tame volatility but also present promising investment prospects, as indicated by the analysts.