Investors navigated the week cautiously before optimism surged following US Federal Reserve Chair Jerome Powell’s announcement on Friday, hinting at potential interest rate cuts in the future.

In a speech at Jackson Hole, Powell’s comments set the tone for a positive shift. In response, the cryptocurrency markets experienced a breakthrough after a prolonged period of stagnation. Meanwhile, Waymo unveiled advancements in self-driving technology, marking significant progress in recent months.

Stay up-to-date on the latest tech industry news with the Investing News Network’s weekly roundup.

Market Response to Rate Cut Speculation

At the start of the week, the stock market was shaky, with the S&P 500 and Nasdaq Composite opening lower than the previous week’s close on Monday, August 19. However, both indices secured their eighth consecutive day of gains, alongside the S&P/TSX Composite Index. The Russell 2000 Index saw a 1.1 percent increase on the same day.

On Tuesday, August 20, amidst cautious trading, major indexes remained relatively stable as investors awaited fresh inflation data. Wednesday, August 21, brought U.S. non-farm payroll benchmark revisions and minutes from the Federal Reserve’s July meeting. The Bureau of Labor Statistics reported lower job growth between March 2023 and March 2024 than previously estimated, despite an expanding labor market.

Following the Fed meeting minutes, which revealed considerations for a rate cut due to reduced inflation and increased unemployment, confidence in a rate reduction grew for September. This news drove market indexes upwards, with the Russell 2000 leading with a gain of over 1 percentage point, closing at 2,170.32.

Continued Market Momentum

Thursday, August 22, saw the upward trend persist, with most indices opening above the previous day’s close, except for the S&P/TSX Composite. Economic data indicated a drop in the U.S. manufacturing PMI to 48 in August from 49.6 in July, falling below expectations. In contrast, initial jobless claims rose slightly in the week ending on August 17, increasing by 4,000 to 232,000 from the previous week.

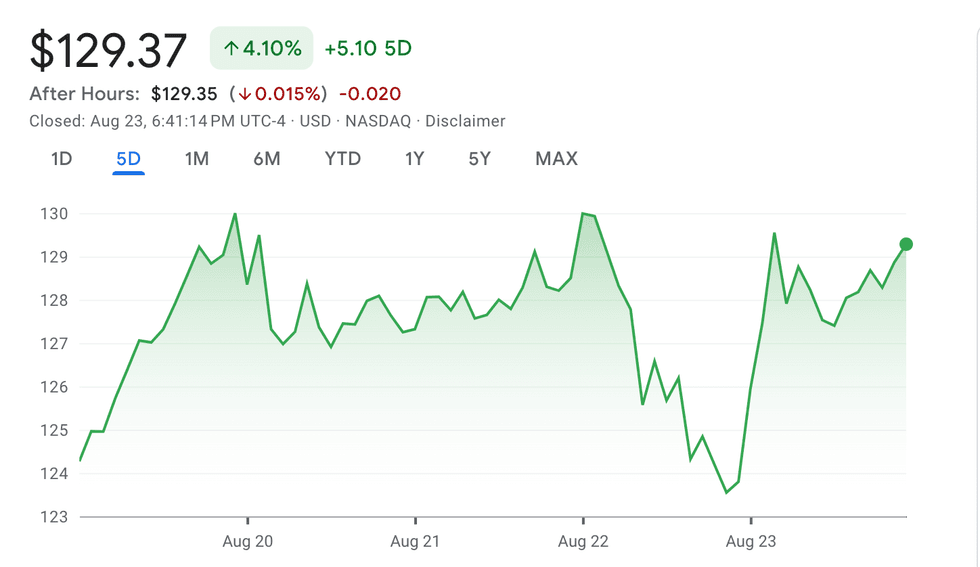

Chart via Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

Market News: Stocks experienced a midday retreat on Thursday, led by the

Market Movement Recap: NVIDIA, Bitcoin, and Democratic Stance on Crypto

1: NVIDIA Shares React to Powell’s Speech in Jackson Hole

After a 4.77 percent drop, NVIDIA (NASDAQ:NVDA) experienced a resurgence in share price following Federal Reserve Chair Powell’s address at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming. Powell hinted at an imminent rate cut, providing hope for investors. This positive sentiment led to a surge in all major stock indexes, with the Russell 2000 showing remarkable performance, reinforcing investor interest in mid-cap stocks—an ongoing trend in response to optimistic Fed data.

By the end of the week, all four major indexes, including the Russell 2000, closed more than 1 percent up, with the latter showing an impressive 3 percent gain.

2: Bitcoin Price Rollercoaster Breaks Through US$60,000

Bitcoin’s market value experienced fluctuations last week, starting with a dip below US$58,000 before exceeding US$61,000. A sharp pullback coincided with a dip in US stock indexes midweek, while volatility continued through to the end of the week. Despite recent data indicating a slight decrease in demand for Bitcoin, the number of institutional investors holding Bitcoin ETFs saw a significant 14 percent increase in Q2 compared to Q1.

Analysts hint at a possible downturn based on market indicators, with the 14 month stochastic indicator suggesting an overbought condition. However, positive economic news on Friday pushed Bitcoin prices above US$64,000 by the evening, with Ether also gaining momentum, trading above US$2,770.

3: Democratic Stance on Crypto Excludes Clear Position From Harris

The Democratic Party’s 2024 Platform, unveiled before the Democratic National Convention, omitted Vice President Kamala Harris’s stance on cryptocurrency and web3 infrastructure. While speculation within the crypto community hints at potential support from Harris for the industry, her official position remains undisclosed, particularly regarding the regulation and taxation of decentralized finance.

Although the platform mentions “Biden’s second term,” it remains uncertain how Harris’s stance will influence the party’s approach to the crypto sector moving forward.

The Rise of AI Giants: A Look at Waymo and AMD

Waymo Unveils 6th Generation Self-Driving Tech

Waymo, a subsidiary of Alphabet (NASDAQ:GOOGL), recently introduced its latest self-driving technology, the 6th Generation Waymo Driver. This new system, unveiled this week, promises increased cost-effectiveness and enhanced capabilities compared to its predecessor.

The 6th Generation Waymo Driver boasts the ability to see up to 500 meters ahead, providing improved navigation in challenging weather conditions. With upgraded camera-radar surround view and advanced sensor technology, Waymo aims to elevate its autonomous driving capabilities.

Waymo CEO Tekedra Mawakana announced via LinkedIn that the company’s robotaxi service, Waymo One, now completes over 100,000 rides per week, reflecting a significant growth from the previously reported 50,000 weekly rides.

Originally launched in 2009, Waymo has expanded its operations to offer services in various states and even partnered with Uber (NYSE:UBER) back in May 2023. During Alphabet’s recent Q2 earnings call, the commitment to invest US$5 billion in Waymo was highlighted, underlining the tech giant’s strategic focus on autonomous driving technologies.

While the new systems are currently in testing phases, further updates are expected as Waymo continues its development journey.

AMD Secures AI Future with ZT Systems Acquisition

Advanced Micro Devices (AMD), a key player in the semiconductor industry, has revealed plans to acquire ZT Systems, a specialist in server and network equipment development. This move, announced earlier this week, signifies AMD’s strategic efforts to strengthen its presence in the data center artificial intelligence (AI) sector.

Dr. Lisa Su, AMD’s Chair and CEO, emphasized the significance of the acquisition, stating, “Our acquisition of ZT Systems is the next major step in our long-term AI strategy.” The deal, valued at US$4.9 billion, will be completed through a combination of cash and stock, potentially reaching up to US$400 million based on post-closing achievements.

In response to the announcement, AMD shares experienced a 4.66 percent increase on Monday, hitting a peak of US$161.57 during Tuesday’s trading session. The company’s stock price closed at US$154.97 on Friday afternoon, marking a 4.46 percent gain for the week.