1. US Government Considers AI Chip Export Caps

A confidential government memo, as reported by Bloomberg on a leisurely Monday afternoon, disclosed a concerning revelation – the contemplation of restricting the sale of cutting-edge Artificial Intelligence (AI) chips from US companies to specific global destinations, all in the name of national security.

Sources within the corridors of power insinuate the focus may be on nations nestled in the Persian Gulf, particularly the United Arab Emirates and Saudi Arabia, both heavyweights in the realm of AI. While the United Arab Emirates’ Mubadala Investment Firm’s significant contributions to Anthropic and Saudi Arabia’s touted US$40 billion investment fund with Andreessen Horowitz have been well-documented.

2. Market Reactions: NVIDIA and AMD

Market tremors were palpable following the news release. NVIDIA, the emblematic tech company, saw its shares plunge by over 4 percent the day after the report surfaced, notwithstanding hitting a market high just the day prior, buoyed by a wave of optimism within the chip industry. AMD, NVIDIA’s perennial contender, suffered a similar fate, with its shares slumping over 4 percent on that brisk Tuesday morning.

3. ASML’s Q3 Results Reveal Fragility

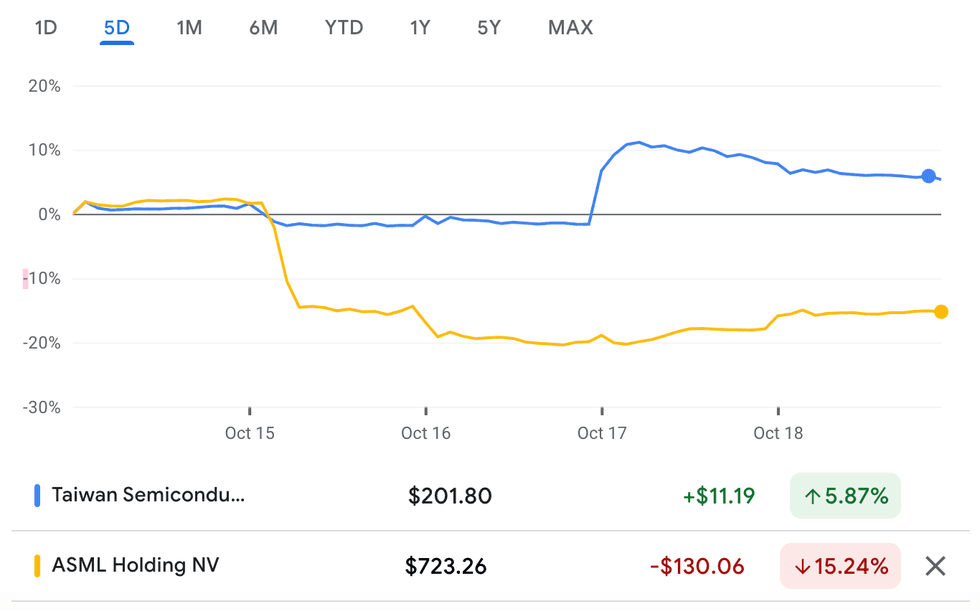

In a tale of woe, ASML prematurely unveiled its lackluster Q3 results on an unfortunate Tuesday, docking anticipated sales figures from 40 billion euros to 35 billion for 2025. The market shuddered as the company missed revenue projections by a wide margin, prompting an eye-watering 16 percent plummet in its share value over the week, obliterating nearly 50 billion euros from its market capitalization.

In a somber press release, ASML’s CEO, Christophe Fouquet, lamented, “While there continue to be robust advancements and potential in AI, the recuperation in other market segments is proceeding at a sluggish pace. The gradual recovery trend is anticipated to persist into 2025, fostering caution among customers.”

ASML’s Industry Impact and Ripple Effect

The shockwave from ASML’s financial woes reverberated across the semiconductor landscape. By serving as a linchpin supplier to some of the planet’s most illustrious chip manufacturers, ASML’s stumble had dire knock-on effects. Notably, shares of its prominent client, TSMC, quivered, facing a 3.3 percent dip early that fateful Tuesday – a couple of days before its third-quarter financial unveiling.

Intel, grappling with a diminishing market pie this year, and Samsung, also bore the brunt of the storm with their share values descending by over two percent each. This tumultuous symphony orchestrated a collective 5.1 percent diminish in the Philadelphia Semiconductor Index. The repercussions resounded through the industry like a thunderclap, leaving many stakeholders reeling from the aftershocks.

Triumphant TSMC Shatters Q3 Revenue Expectations

TSMC Surpasses Revenue Growth Target

TSMC (NYSE:TSM) showcased remarkable resilience in the face of market uncertainty by unveiling Q3 results that outstripped all estimations on Thursday (October 17). The semiconductor giant elevated its revenue growth target to a staggering US$26 billion from the earlier US$22.4 billion to US$23.2 billion range recorded in Q2.

The third-quarter earnings soared by a remarkable 39 percent year-on-year, reaching approximately US$23.5 billion. This notable growth of nearly 13 percent compared to the previous quarter indicated unprecedented momentum. Net income witnessed an impressive surge of 31.2 percent. Boosted by the exceptional revenue report for September preceding the announcement, investors eagerly anticipated the positive news, propelling the company’s stock price above US$200 for the first time in the year.

Optimistic Outlook for TSMC

Chart via Google Finance.

TSMC and ASML performance, October 14 to 18, 2024.

“Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies,” stated Wendell Huang, Senior VP and Chief Financial Officer of TSMC. Moving into the fourth quarter of 2024, the company foresees a continuation of this momentum, bolstered by robust demand for its cutting-edge process technologies,” affirmed the company’s CFO and Senior Vice President, Wendell Huang.

Market Influence on TSMC’s Major Customers

With TSMC’s exceptional report, its two key clients, NVIDIA and Apple, reaped the benefits. Apple’s (NASDAQ:AAPL) share price surged by 1.75 percent at Friday’s market opening, accumulating a 2.66 percent increase for the week. Amidst recent uncertainties, NVIDIA received a positive jolt, opening 2.63 percent higher before the report release on Thursday morning. NVIDIA’s stock soared by 1.11 percent throughout the week.

Big Tech Embraces Nuclear Power

The recent strategic move by Microsoft (NASDAQ:MSFT) to secure energy for its data centers from nuclear power paved the way for Google and Amazon to follow suit. Firming their commitment to greener practices, Google inked an agreement on Monday to procure nuclear energy from several small modular reactors developed by Kairos Power, aligning with their goal of achieving net-zero objectives.

Headlining on Wednesday was Amazon’s announcement signing three agreements with Energy Northwest, X-Energy, and Dominion Energy (NYSE:D) to back the construction of SMRs in Virginia and Washington.

Milestone in Sustainable Energy

Through these strategic collaborations, the tech behemoths are steering towards a sustainable future, merging cutting-edge technologies with eco-friendly practices. The realization of these nuclear power initiatives heralds a transformative era in the energy landscape, underpinning a collective commitment towards a greener tomorrow.