Volatility in Tech Stocks

The tech earnings season dawned with a storm of disappointment for investors, as the shares of the Magnificent Seven companies took a tumble during the trading week. Alphabet Inc.’s stronger-than-expected earnings were overshadowed by a miss in YouTube advertising revenue, leading to the worst week of the year for the tech giant’s stock. Similarly, Tesla Inc. fell short of quarterly earnings forecasts due to thin profit margins from lower vehicle prices and restructuring charges, sinking 12.3% in a single day – the poorest performance since September 2020.

Market Trends

The tech-heavy Nasdaq 100 index endured its second consecutive week in the red, a phenomenon not witnessed since April. Among mega-cap stocks, Ford Motor Company and United Parcel Service Inc. faced significant declines this week, while 3M Company and Bristol-Myers Squibb Company soared with unexpected positive results.

On the brighter side, small-cap stocks continued their winning streak, with the Russell 2000 Index securing its third consecutive week of gains. This success was bolstered by high expectations of upcoming interest rate cuts, fueling optimism among investors.

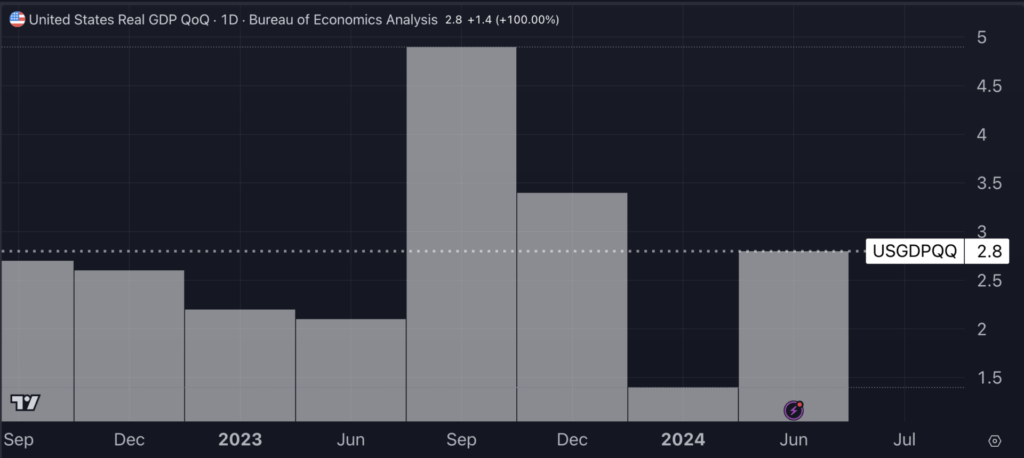

US Economy Stronger Than Expected

The US economy showcased its resilience by growing at an annualized rate of 2.8% in the second quarter, a significant acceleration from the previous quarter’s numbers. This performance exceeded expectations of 2% growth, painting a positive picture of economic strength despite prevailing challenges.

Insights From Historical Data

Reflecting on this tumultuous week, reminiscent of the dot-com bubble burst in the early 2000s, investors are faced with a familiar mix of excitement and trepidation. The resilience of the US economy, reminiscent of the post-recession recovery in the late 2000s, offers a glimmer of hope amid market uncertainties.

Looking Ahead

As the market navigates through turbulent waters, akin to the financial crisis of 2008, it becomes imperative for investors to exercise caution and remain vigilant. Historical patterns suggest that resilience and adaptability are key traits in weathering economic storms, underscoring the importance of a diversified portfolio in mitigating risks.

Amidst all the turbulences and triumphs, investors should remain cautiously optimistic, drawing parallels from historical economic upheavals to make informed decisions in an ever-evolving market landscape.