Stocks like Nvidia have received accolades for the past 18 months, but every party meets its end on Wall Street. It’s time to switch gears and seek out the next big thing.

Three intrepid minds from Motley Fool embarked on a quest to unearth precisely that.

Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) emerged as stealthy contenders. These firms boast promising growth prospects and remain at an early enough stage to shower investors with riches in the forthcoming years.

Consider hitching your wagon to these three burgeoning tech stars for the next half-decade.

Palantir Ascends: A Remarkable Journey

Jake Lerch (Palantir Technologies): There is one name that stands out when discussing tech stocks on the rise: Palantir Technologies.

Palantir is hitting all the right notes. The recent news of Palantir’s inclusion in the S&P 500 sent its shares soaring by 14%. The company’s stock has doubled this year and is poised to be the index’s second-best performer upon its official entry on Sept. 23, just behind Nvidia.

The remarkable financials of Palantir tell a similar tale. Revenue surged by 27% in the last quarter, hitting $678 million. Its net income also jumped by 87% to reach $134 million.

PLTR Revenue (Quarterly) data by YCharts

Moreover, Palantir’s customer base and free cash flow are on a rapid ascent. With over 27 deals exceeding $10 million, the demand for its AI-powered platform continues to spike.

Mark my words, 2024 could be the year Palantir overshadows its past obscurity and becomes a household name. There’s still a window of opportunity for investors, as the stock has yet to reclaim its all-time high of $45 from 2021. Given the company’s stellar performance, this could be a golden era to invest in Palantir.

Affirm’s Apple Deal: A Leap Forward

Justin Pope (Affirm): Affirm, a buy now, pay later company, shines as a clear long-term victor. Utilizing algorithms, the company disburses funds per transaction, aiding borrowers in avoiding mounting debts. With a customer base of 18.7 million, Affirm operates without late fees, banking on user reliability.

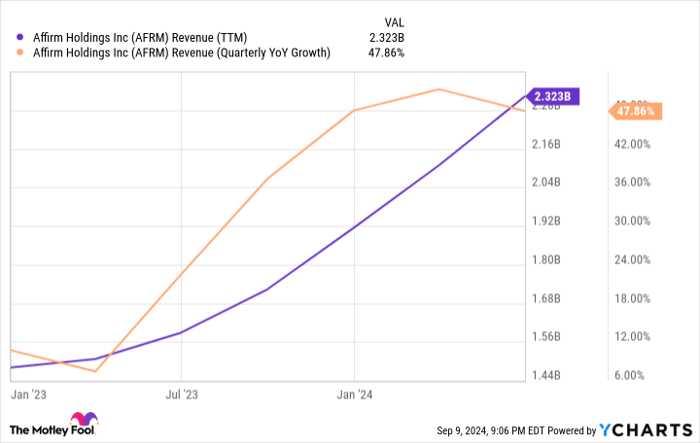

Its consumer-centric model, raking in revenue from interest and merchant fees, has attracted 300,000+ merchants, including powerhouse allies like Amazon and Shopify. This boost has propelled Affirm’s revenue growth to nearly 50% in recent times:

AFRM Revenue (TTM) data by YCharts

Now, Affirm is stepping up its game. With Apple choosing Affirm over its buy now, pay later offering and integrating it into Apple Pay, the potential market exposure to 153 million iOS users in the U.S. is vast.

The Apple partnership, combined with Affirm’s existing robust growth, hints at significant strides in the next five years. Although the stock has plunged 77% from its 2021 peak, its recent turn to operational profit signals a path to overall profitability in the near future.

Given its resplendent growth and financial strengthening, Affirm might soon be viewed through a different lens on Wall Street, marking it as a rising star with substantial investment allure.

A Second Shot at Glory: MercadoLibre’s Stealthy Rise

Will Healy (MercadoLibre): Many investors overlooked the e-commerce juggernaut Amazon as it metamorphosed from a book-centric entity to a tech behemoth fueled by e-commerce and cloud services.

The Rise of MercadoLibre in the E-Commerce Landscape

The Latin American E-Commerce Giant

While many investors were fixated on the growth of northern e-commerce behemoths, the exponential rise of the southern powerhouse, MercadoLibre, went under the radar. This e-commerce titan’s reach spans from Tijuana to Tierra del Fuego, akin to the colossal Amazon. Initially rooted in online selling, MercadoLibre navigated the unique business terrain of Latin America, compelling it to diversify into other sectors.

Innovative Solutions in a Cash-Based Society

Lacking the digital financial infrastructure of the U.S., Latin America leans heavily on cash transactions, where millions have no access to traditional banking methods. To bridge this gap, MercadoLibre birthed Mercado Pago, crafting digital financial tools to endorse online commerce. So triumphant was the concept that MercadoLibre extended its services to non-patrons of its main e-commerce platform, thriving in an arid financial landscape.

Shipping the Unshippable

The logistical hurdles of fulfillment and shipping in Latin America pushed MercadoLibre to establish Mercado Envios, a division dedicated to order fulfillment and product shipping. By doing so, they ushered in same-day and next-day delivery in regions previously devoid of such luxuries, setting a new benchmark in the industry.

Unveiling Financial Triumphs

Despite being a mere fraction of Amazon’s colossal $1.9 trillion market value, MercadoLibre’s $100 billion market cap positions it for swift growth. The first half of 2024 witnessed an astounding 39% surge in revenue, totaling $9.4 billion. Keeping a keen eye on expenditure, the company pocketed $875 million in net income for the same period, marking an 89% surge from the previous year.

Investor Interest & Stock Performance

The glow of success radiated brightly, attracting more investors to MercadoLibre’s stock, catapulting it over 40% higher in the last year to near-record peaks.

Steadfast Performer: A Stock Worth A Look

As the price-to-earnings ratio stands at 73, some may raise an eyebrow. However, with significant profit escalation, the price/earnings-to-growth ratio hovers just below 0.9, marking MercadoLibre as a reasonably priced choice for investors eyeing a slice of the pie while it retains its modest market cap stature.

An Unquestionable Climb

As the dawn breaks on Latin America’s e-commerce skyline, MercadoLibre emerges as an undeniable force to be reckoned with, setting new standards and breaking barriers in a realm where others falter. The vitality and agility of this e-commerce leviathan show no signs of ebbing, captivating investors with its relentless growth trajectory. The journey continues for MercadoLibre, poised to redefine the digital landscape of the southern hemisphere.