You can’t recap 2023 in the stock market without talking about the “Magnificent Seven,” Earth’s most powerful technology companies: Tesla (NASDAQ: TSLA), Nvidia, Apple, Amazon, Meta Platforms, Microsoft, and Alphabet. These stocks have soared between 50% and 250% this year, carrying the broader markets to a great year of gains.

It’s hard to bet against such strong momentum, but investors should pay attention to which companies can continue the rally and which are poised to take a step back.

2023 was more about hype than results

Investors tend to look ahead, which means hype around a company’s future potential can directly affect the stock. It seems that that’s happened with Tesla. For instance, CEO Elon Musk is very vocal as the owner of social media platform X (formerly Twitter). There has been a lot of publicity around some of Tesla’s emerging business products, such as the Cybertruck, the Tesla Bot, and advancements in artificial intelligence (AI).

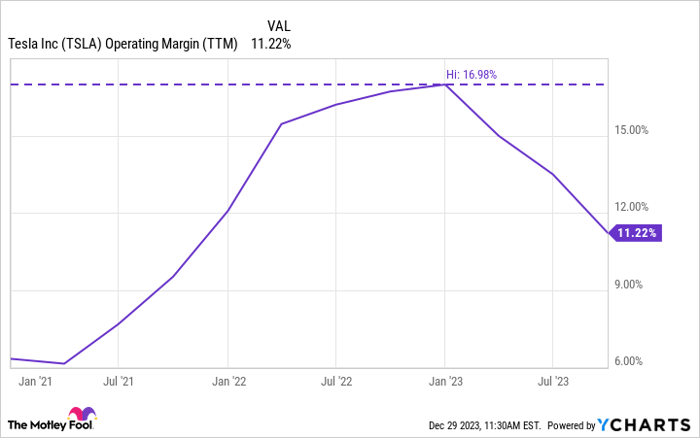

But Tesla’s business currently depends on selling its existing electric vehicles, namely the Models S, 3, X, and Y. Tesla has resorted to aggressive price cuts to boost its unit sales, directly affecting profit margins. Peaking at 17% in January, operating margins have fallen almost 6 percentage points in under a year.

TSLA Operating Margin (TTM) data by YCharts

There’s a counterargument to this. Tesla is using price cuts as an offensive measure to grow its market share and lowering costs by maximizing factory efficiency (more units made equals less cost per unit). In other words, short-term pain for long-term gain. But whether it works remains to be seen.

Expectations have gone down…

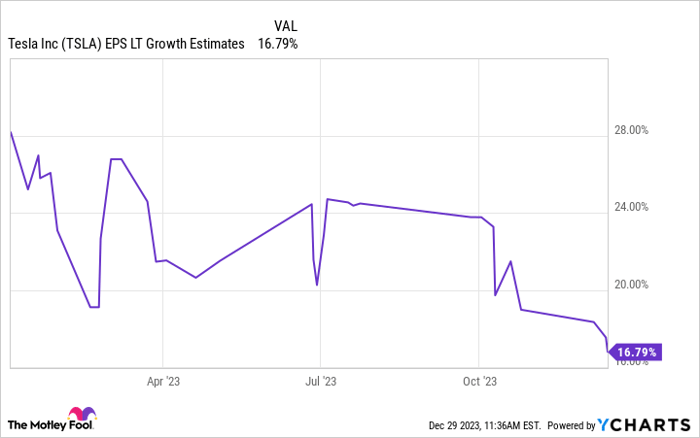

Investors will want to see an eventual pivot whereby the operating margin stops declining. At that point, the boost in volume should begin boosting Tesla’s bottom line. For now, analysts are lowering their expectations for Tesla. Expected earnings growth for the long term has fallen from an average of 24% annually to under 17%.

TSLA EPS LT Growth Estimates data by YCharts

Again, it’s not that it will stay like this (although it could), but nobody knows how much Tesla will cut prices and how many more units it must make and sell for the financials to show signs of improvement. In other words, there is a risk in Tesla stock that wasn’t there before the price cuts.

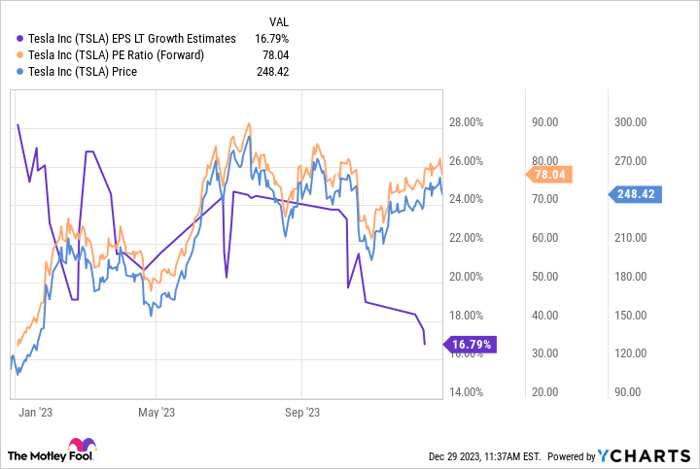

…While the stock has gone up

Risks typically send stocks lower, but Tesla has soared 120% in 2023. The lack of accompanying earnings growth means that Tesla stock has become far more expensive than it once was. Shares trade at a forward P/E of 78 today as operating margins continue to fall.

Using the below analyst estimates, the stock’s current PEG ratio is over four, signaling it is very expensive for its expected earnings growth. Decreasing margins and potentially slowing earnings growth make the stock’s triple-digit gains feel like fighting gravity — a battle gravity should eventually win.

TSLA EPS LT Growth Estimates data by YCharts

The bottom line is that investors should think twice about chasing Tesla stock at these prices. The stock is a prime candidate to revert lower if the broader market gets shaky in 2024. That all could change if Tesla can show evidence its strategy is working, but there isn’t enough cushion in the stocks’ valuation to justify that leap of faith.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.