As the Q4 earnings season unfolds, all eyes are on the financial sector, with major players such as JP Morgan (JPM), Bank of America (BAC), Ally Financial (ALLY), and Synchrony Financial (SYF) set to report quarterly results. Amidst this fervent environment, the consumer lending stocks, Ally and Synchrony, have emerged as beacons of promise within the financial sector.

Both Ally and Synchrony are currently near their 52-week highs and are scheduled to announce their Q4 earnings on January 19 and 23, respectively. With these impending reports looming, investors are contemplating whether it is an opportune moment to invest in Ally or Synchrony stock, anticipating a surge to higher highs.

Recent Performance Overview

Ally, an auto industry-focused financial services provider, and Synchrony, offering credit products through various national and regional retailers, have exhibited robust stock performance over the last year. Ally’s stock soared by 36%, surpassing the S&P 500’s 24% increase, while Synchrony’s 17% rise has also been commendable. Notably, Synchrony reached a 52-week high of over $38 per share, whereas Ally is on the verge of surpassing its previous peak of $35.78 per share observed last February.

Image Source: Zacks Investment Research

Q4 Previews & Outlook

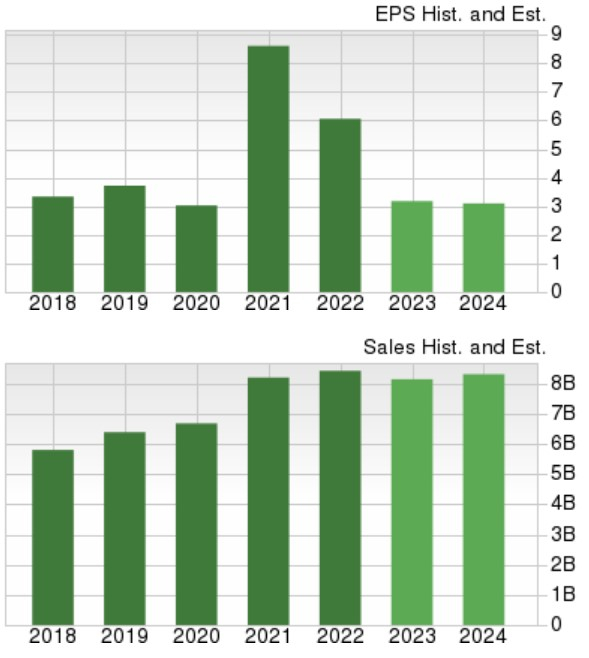

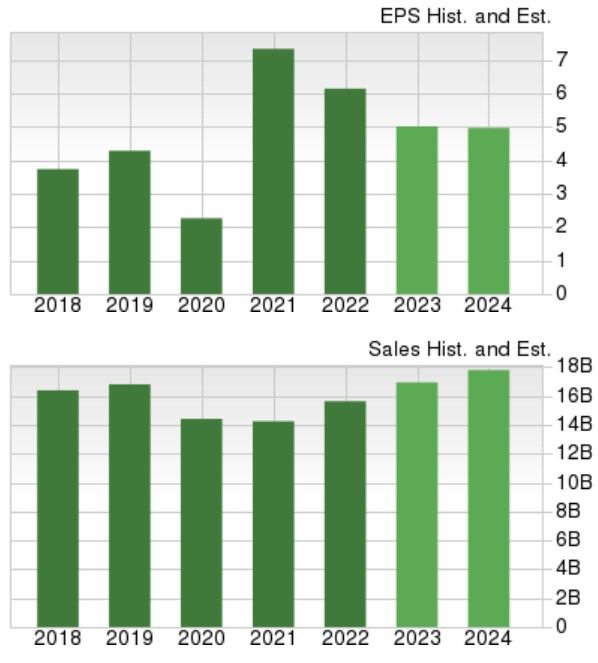

Both companies are facing challenging comparative quarters for their Q4 earnings. Ally’s Q4 earnings estimates stand at $0.51 per share, a notable decline from $1.08 per share in Q4 2022, with Q4 sales projected to decrease by 9% to $2 billion. While Ally’s annual earnings for FY23 are expected at $3.12 per share, marking a considerable drop from $6.06 per share in 2022, there is a forecasted rebound in FY24 with an expected 14% increase to $3.57 per share. Similarly, Synchrony’s Q4 earnings are anticipated to dip by 22% to $0.98 per share, compared to $1.26 per share in the corresponding quarter, although Q4 sales are projected to rise by 8% year-over-year to $4.45 billion. Synchrony is poised for an annual earnings decrease in FY23 by 16% to $5.13 per share, with a projected rebound in FY24 resulting in a 7% increase to $5.51 per share. Total sales are expected to witness an 8% rise in FY23 and a further 7% increase this year to $18.17 billion.

Strong Value

Despite potential post-pandemic challenges in their bottom-line figures, both stocks have surged due to their reasonable valuations. Ally’s stock is currently trading at an attractive 10.8X forward earnings multiple, while Synchrony’s shares are priced at just 7.3X. Additionally, Ally offers a generous 3.5% annual dividend yield, outperforming the S&P 500’s 1.4% average, and Synchrony provides a commendable 2.67% yield.

Takeaway

Currently ranked as Zacks Rank #3 (Hold), both Ally Financial and Synchrony Financial’s stocks present a complex investment decision. While the potential for higher highs largely hinges on their Q4 results, holding positions in these consumer finance leaders may continue to yield returns at their current levels.

Source: Zacks Investment Research