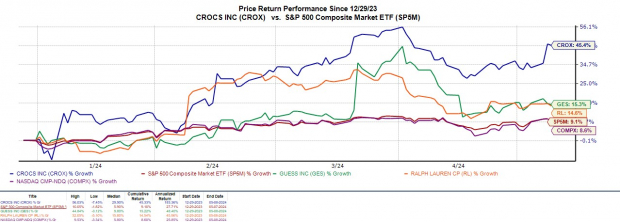

Crocs CROX stock has dominated this week’s earnings reports, surpassing Q1 expectations with flying colors. The footwear and apparel giant has witnessed its stock price surge over +40% this year, outshining the wider market and key competitors like Guess GES and Ralph Lauren RL.

Let’s delve into whether buying or holding Crocs stock post its stellar Q1 performance is a wise investment decision.

Image Source: Zacks Investment Research

Impressive Q1 Results

Crocs demonstrated robust brand growth as Q1 sales surged by 6% year over year to $938.63 million, sailing past estimates of $883.85 million by 6%. The company’s profitability also soared, with earnings of $3.02 per share marking a 16% increase from the previous year quarter and surpassing EPS estimates of $2.25 by 34%.

Notably, Crocs has outperformed both revenue and earnings expectations for 16 consecutive quarters, boasting an average earnings surprise of 17% in its last four quarterly reports.

Image Source: Zacks Investment Research

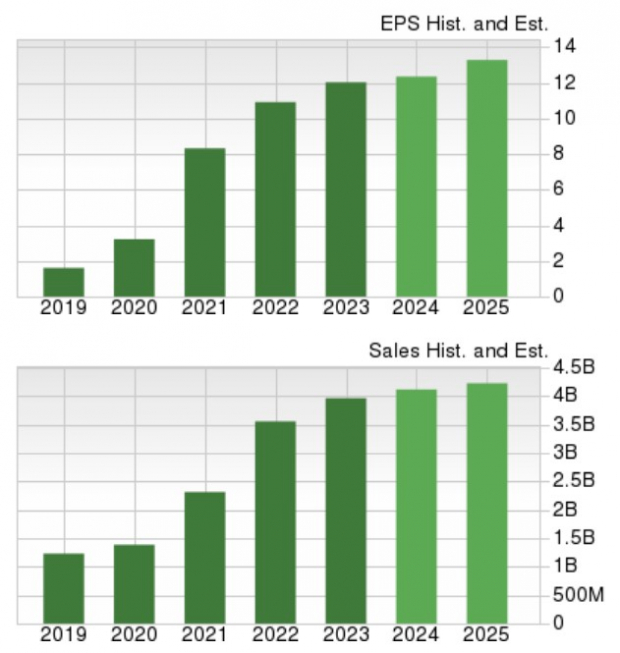

Growth Trajectory & Future Outlook

As per Zacks estimates, Crocs is expected to witness a 3% rise in annual earnings in fiscal 2024, with a further projected expansion of 9% in FY25 to $13.56 per share. Total sales are forecasted to grow by 4% this year and are anticipated to climb 6% in FY25 to $4.37 billion.

Image Source: Zacks Investment Research

Attractive Valuation

Despite the remarkable YTD rally in Crocs stock, CROX continues to trade at just 10.9X forward earnings, representing a slight discount to the Zacks Textile-Apparel Industry average of 12.5X and falling slightly above the P/E valuations of peers like Ralph Lauren at 14.8X and Guess at 9.1X.

Image Source: Zacks Investment Research

Final Thoughts

Presently, Crocs stock holds a Zacks Rank #3 (Hold). With the company’s promising growth trajectory and appealing valuation, maintaining CROX in your portfolio could prove beneficial. However, given the rapid ascent in the stock price this year, investors may want to watch for potential dips as better buying opportunities might arise post the impressive initial performance in 2024.