Salesforce’s Robust Q2 Results

Salesforce is on a triumphant trajectory, surpassing Q2 expectations. The company reported sales of $9.32 billion, an 8% increase from the previous year. Their Q2 EPS stood at $2.56, soaring 21% from the comparative quarter.

The highlight was Salesforce’s operational cash flow, reaching $892 million and free cash flow ascending to $755 million, marking a significant 20% surge. These figures signal financial vibrancy within the company.

AI Breakthroughs

Salesforce’s strategic focus on artificial intelligence has yielded substantial rewards. The company shared that bookings for its AI products doubled quarter-over-quarter, signing 1,500 AI deals in Q2 with prominent brands like Alliant Energy.

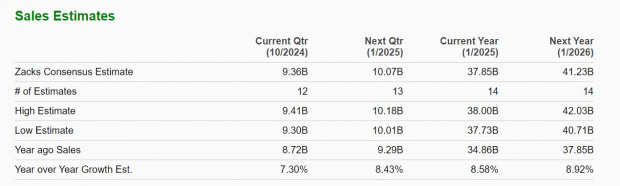

Guidance & Future Growth

For the fiscal year 2025, Salesforce projects sales in the range of $37.7 billion-$38 billion, aligned with an expected 8% growth. Looking forward to FY26, Salesforce anticipates a further 9% revenue expansion to $41.23 billion.

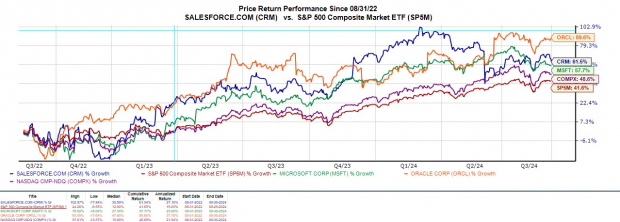

Positive Outlook on Stock Performance & Valuation

Despite challenges from competitors like Microsoft and Oracle, Salesforce’s stock performance has shown resilience. Trading at 25.9X forward earnings, Salesforce stands at a promising position. Its stock valuation remains below Microsoft and above Oracle.

Key Takeaways

Salesforce’s current Zacks Rank of #3 (Hold) may signal caution, but prospects remain bright. The company’s optimistic profit guidance following the Q2 results is a strong indicator for potential investors. Considering Salesforce’s robust growth trajectory, concerns about heightened competition from Microsoft and Oracle appear overstated.